SkyWest Airlines 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operating leases and therefore are not reflected as liabilities in the Company’s consolidated balance sheets. Although some of the

Company’s aircraft lease arrangements are variable interest entities as defined by FASB Interpretation No. 46, Consolidation of

Variable Interest Entities, or FIN 46, management believes none require consolidation in the Company’s financial statements.

The lease agreements do not contain any guarantees of the debt underlying the lease or fixed price purchase options or residual

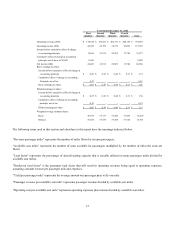

value guarantees. At December 31, 2003, the Company has 134 aircraft under lease with remaining terms ranging from one to 16

years. Future minimum lease payments due under all long-term operating leases were approximately $1.7 billion at December 31,

2003. At a 7.0% discount factor, the present value of these lease obligations would have been equal to approximately $1.1 billion

at December 31, 2003.

As part of the Company’s leveraged lease agreements, the Company typically agrees to indemnify the equity/owner participant

against liabilities that may arise due to changes in benefits from tax ownership of the respective leased aircraft.

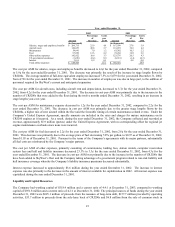

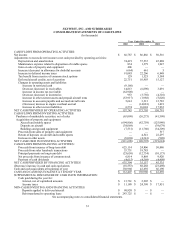

The Company’s total long-term debt at December 31, 2003 was $493.7 million, of which $485.4 million related to the acquisition

of EMB120 and CRJ200 aircraft and $8.3 million related to the construction of the Company’s new corporate office building.

Certain amounts related to the EMB120s are supported by continuing subsidy payments through the export support program of

the Federative Republic of Brazil. The subsidy payments reduced the stated interest rates to an average effective rate of

approximately 4.0% on $9.5 million of the Company’s long-term debt at December 31, 2003. The continuing subsidy payments

are at risk to the Company if the Federative Republic of Brazil does not meet its obligations under the export support program.

While the Company has no reason to believe, based on information currently available, that the Company will not continue to

receive these subsidy payments from the Federative Republic of Brazil in the future, there can be no assurance that such a default

will not occur. On the remaining long-term debt related to the EMB120 aircraft of $18.2 million, the lender has assumed the risk

of the subsidy payments and the average effective rate on this debt was approximately 3.8% at December 31, 2003. The average

effective rate on the debt related to the CRJ200 aircraft of $457.7 million was 3.8% at December 31, 2003, and is not subject to

subsidy payments.

Off Balance Sheet Arrangements

The Company typically enters into third party long-term operating leases with regards to aircraft purchases. As a result, these

long-term leases are not included in the Company’s consolidated balance sheet. These obligations are summarized in the table set

forth in the preceding section of this Report entitled “Significant Commitments and Obligations” and described in further detail in

that section.

Seasonality

The Company’s results of operations for any interim period are not necessarily indicative of those for the entire year, since the

airline industry is subject to seasonal fluctuations and general economic conditions. SkyWest’s operations are somewhat

favorably affected by increased travel on its prorate routes, historically occurring in the summer months, and are unfavorably

affected by decreased business travel during the months from November through January and by inclement weather which

occasionally results in cancelled flights, principally during the winter months.

New Accounting Standard:

In January 2003, the FASB issued Interpretation No. 46, or (FIN 46), Consolidation of Variable Interest Entities, which requires

the consolidation of variable interest entities. It is management’s belief that the majority of the Company’s leased aircraft is

owned and leased through trusts whose sole purpose is to purchase, finance and lease these aircraft to the Company; therefore,

they meet the criteria of a variable interest entity. However, since these are single owner trusts in which the Company does not

participate, the Company is not at risk for losses and is not considered the primary beneficiary. As a result, based on the current

rules, the Company is not required to consolidate any of these lessors or any other entities in applying FIN 46. Management

believes that the Company’s maximum exposure under these leases is the remaining lease payments, which are reflected in the

future minimum lease payments table in Note 4 to the Company’s Consolidated Financial Statements as of December 31, 2003.

As discussed in Note 1 to the Company’s Consolidated Financial Statements as of December 31, 2003, the Company entered into

an agreement with United on September 10, 2003, whereby the Company is reimbursed based on block hours, departures and

certain pass-through costs, plus an amount per aircraft. This arrangement is designed to reimburse the Company for certain

25