SkyWest Airlines 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

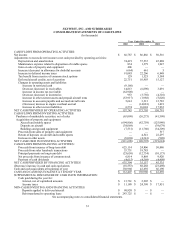

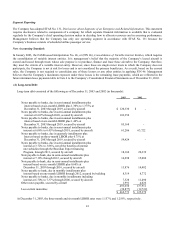

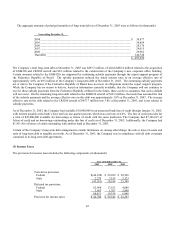

2003

2002

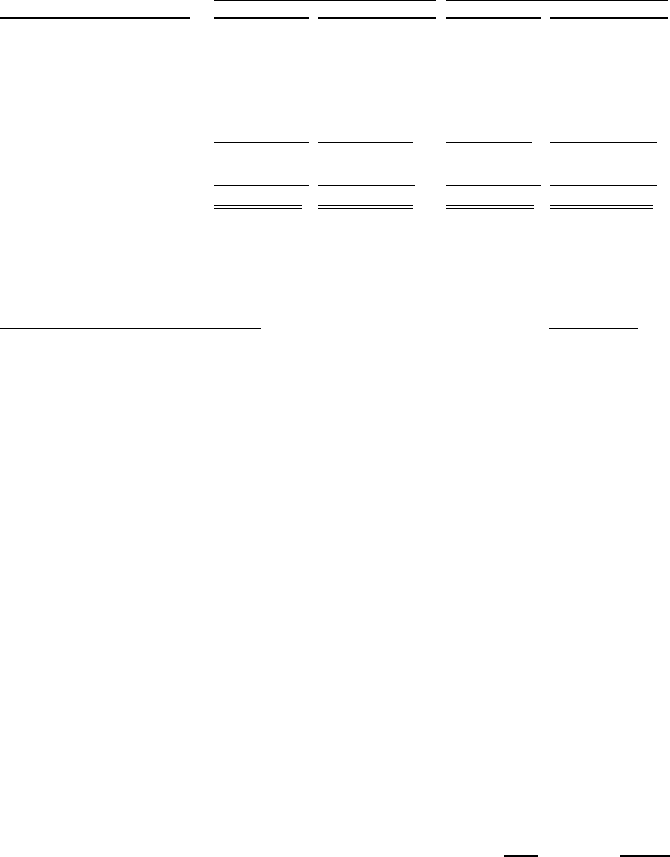

Investment Types Cost Market Value Cost Market Value

Commercial paper $ 15,318 $ 15,318 $ 10,019 $ 10,019

Bond funds 262,790 262,345 232,891 230,858

Corporate notes 59,984 60,117 35,597 35,439

Asset backed securities 20,395 20,390 18,288 18,148

Other 584 657 - -

359,071 358,827 296,795 294,464

Unrealized depreciation (244) - (2,331) -

Total $ 358,827 $ 358,827 $ 294,464 $ 294,464

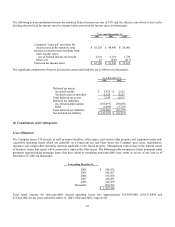

Marketable securities had the following maturities as of December 31, 2003 (in thousands):

Maturities

Amount

Year 2004 $ 197,111

Years 2005 through 2008 83,338

Years 2009 through 2013 21,384

Thereafter 56,994

The Company has classified all marketable securities as short-term since it has the intent to maintain a liquid portfolio and the

ability to redeem the securities within one year.

Inventories

Inventories include expendable parts, fuel and supplies and are valued at cost (FIFO basis) less an allowance for obsolescence

based on historical results and management’s expectations of future operations. Expendable inventory parts are charged to

expense as used. An allowance for obsolescence is provided over the remaining estimated useful life of the related aircraft, plus

allowances for spare parts currently identified as excess to reduce the carrying costs to net realizable value. These allowances are

based on management estimates, which are subject to change.

Property and Equipment

Property and equipment are stated at cost and depreciated over their useful lives to their estimated residual values using the

straight-line method as follows:

Depreciable Residual

Assets Life Value

Aircraft 14-18 years 25-30%

Rotable spares 5 years 0%

Ground equipment 5-7 years 0%

Office equipment 5-7 years 0%

Leasehold improvements 15 years 0%

Buildings 20-39.5 years 0%

Impairment of Long Lived Assets

As of December 31, 2003, the Company had $742.8 million of flight equipment and related long-lived assets, net of accumulated

depreciation and amortization. In addition to the original cost of these assets, their recorded value is impacted by a number of

policy elections made by the Company, including estimated useful lives and salvage values. The Company reviews its long-lived

assets for impairment upon certain triggering events, such as a reduction to fleet lives, at each balance sheet date that may indicate

35