SkyWest Airlines 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

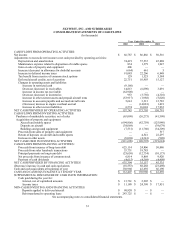

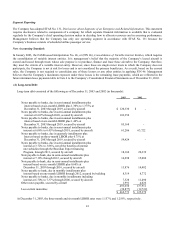

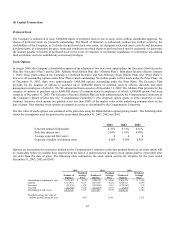

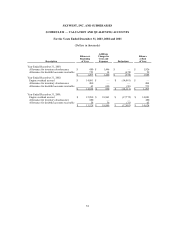

The following is a reconciliation between the statutory Federal income tax rate of 35% and the effective rate which is derived by

dividing the provision for income taxes by income before provision for income taxes (in thousands):

Year ended December 31,

2003 2002 2001

Computed “expected” provision for

income taxes at the statutory rates $ 38,320 $ 49,845 $ 28,985

Increase in income taxes resulting from:

State income taxes,

net of Federal income tax benefit 4,338 6,133 3,729

Other, net 42 (436) (417)

Provision for income taxes $ 42,700 $ 55,542 $ 32,297

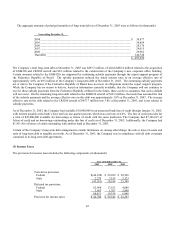

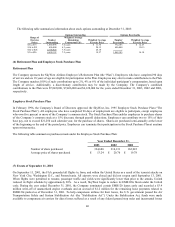

The significant components of the net deferred tax assets and liabilities are as follows (in thousands):

As of December 31,

2003 2002

Deferred tax assets:

Accrued benefits $ 2,936 $ 2,555

Accrued reserves and other 4,318 4,257

Total deferred tax assets 7,254 6,812

Deferred tax liabilities:

Accelerated depreciation (153,097) (59,650)

Other (1,809) (3,729)

Total deferred tax liabilities (154,906) (63,379)

Net deferred tax liability $ (147,652) $ (56,567)

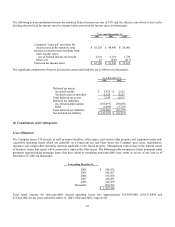

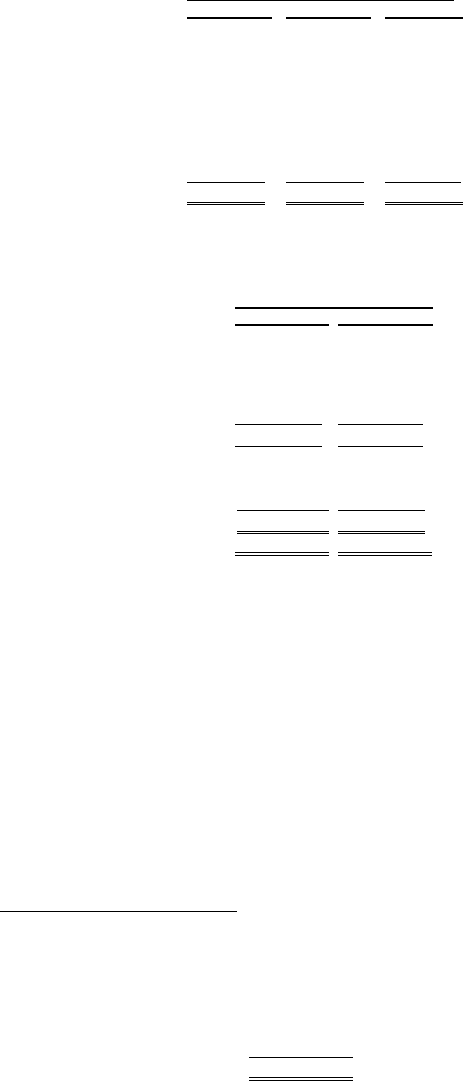

(4) Commitments and Contingencies

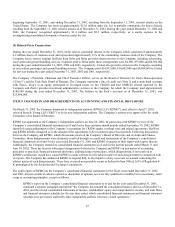

Lease Obligations

The Company leases 134 aircraft, as well as airport facilities, office space, and various other property and equipment under non-

cancelable operating leases which are generally on a long-term net rent basis where the Company pays taxes, maintenance,

insurance and certain other operating expenses applicable to the leased property. Management expects that, in the normal course

of business, leases that expire will be renewed or replaced by other leases. The following table summarizes future minimum rental

payments required under operating leases that have initial or remaining non-cancelable lease terms in excess of one year as of

December 31, 2003 (in thousands):

Year ending December 31,

2004 $ 148,932

2005 146,267

2006 155,568

2007 148,091

2008 146,369

Thereafter 960,299

$ 1,705,526

Total rental expense for non-cancelable aircraft operating leases was approximately $124,936,000, $103,318,000 and

$72,841,000, for the years ended December 31, 2003, 2002 and 2001, respectively.

43