SkyWest Airlines 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

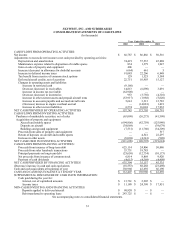

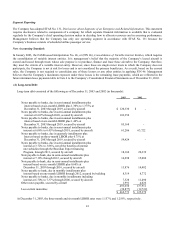

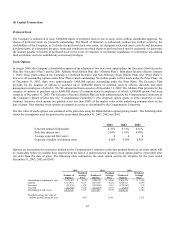

The aggregate amounts of principal maturities of long-term debt as of December 31, 2003 were as follows (in thousands):

Year ending December 31,

2004 $ 30,877

2005 30,859

2006 28,170

2007 29,015

2008 29,981

Thereafter 344,748

$ 493,650

The Company’s total long-term debt at December 31, 2003 was $493.7 million, of which $485.4 million related to the acquisition

of EMB120 and CRJ200 aircraft and $8.3 million related to the construction of the Company’s new corporate office building.

Certain amounts related to the EMB120s are supported by continuing subsidy payments through the export support program of

the Federative Republic of Brazil. The subsidy payments reduced the stated interest rates to an average effective rate of

approximately 4.0% on $9.5 million of the Company’s long-term debt at December 31, 2003. The continuing subsidy payments

are at risk to the Company if the Federative Republic of Brazil does not meet its obligations under the export support program.

While the Company has no reason to believe, based on information currently available, that the Company will not continue to

receive these subsidy payments from the Federative Republic of Brazil in the future, there can be no assurance that such a default

will not occur. On the remaining long-term debt related to the EMB120 aircraft of $18.2 million, the lender has assumed the risk

of the subsidy payments and the average effective rate on this debt was approximately 3.8% at December 31, 2003. The average

effective rate on the debt related to the CRJ200 aircraft of $457.7 million was 3.8% at December 31, 2003, and is not subject to

subsidy payments.

As of December 31, 2003, the Company had available $10,000,000 in an unsecured bank line of credit through January 31, 2005,

with interest payable at the bank’s base rate less one-quarter percent, which was a net rate of 4.0%. The line of credit provides for

a total of $10,000,000 available for borrowings or letters of credit with the same institution. The Company had $7,346,615 of

letters of credit and no borrowings outstanding under this line of credit as of December 31, 2003. Additionally, the Company had

$1,431,416 of letters of credit outstanding with another bank at December 31, 2003.

Certain of the Company’s long-term debt arrangements contain limitations on, among other things, the sale or lease of assets and

ratio of long-term debt to tangible net worth. As of December 31, 2003, the Company was in compliance with all debt covenants

contained in its long-term debt agreements.

(3) Income Taxes

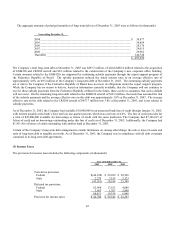

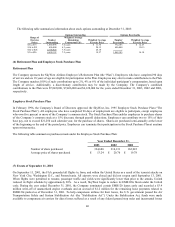

The provision for income taxes includes the following components (in thousands):

Year ended December 31,

2003 2002 2001

Current tax provision:

Federal $ (46,230) $ 29,029 $ 20,226

State 2,279 7,155 5,123

(43,951) 36,184 25,349

Deferred tax provision:

Federal 82,968 17,651 4,088

State 3,683 1,707 2,860

86,651 19,358 6,948

Provision for income taxes $ 42,700 $ 55,542 $ 32,297

42