SkyWest Airlines 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(5) Capital Transactions

Preferred Stock

The Company is authorized to issue 5,000,000 shares of preferred stock in one or more series without shareholder approval. No

shares of preferred stock are presently outstanding. The Board of Directors is authorized, without any further action by the

stockholders of the Company, to (i) divide the preferred stock into series; (ii) designate each such series; (iii) fix and determine

dividend rights; (iv) determine the price, terms and conditions on which shares of preferred stock may be redeemed; (v) determine

the amount payable to holders of preferred stock in the event of voluntary or involuntary liquidation; (vi) determine any sinking

fund provisions; and (vii) establish any conversion privileges.

Stock Options

In August 2000, the Company’s shareholders approved the adoption of two new stock option plans: the Executive Stock Incentive

Plan (the “Executive Plan”) and the 2001 Allshare Stock Option Plan (the “Allshare Plan”). Both plans became effective January

1, 2001. These plans replaced the Company’s Combined Incentive and Non-Statutory Stock Option Plans (the “Prior Plans”);

however, all outstanding options under Prior Plans remain outstanding. No further grants will be made under the Prior Plans. As

of December 31, 2003, there were approximately 1,468,000 options outstanding under the Prior Plans. The Executive Plan

provides for the issuance of options to purchase up to 4,000,000 shares of common stock to officers, directors and other

management employees of which 1,736,794 options had been issued as of December 31, 2003. The Allshare Plan provides for the

issuance of options to purchase up to 4,000,000 shares of common stock to employees of which 1,500,000 options had been

issued as of December 31, 2003. The Executive Plan and Allshare Plan are both administered by the Compensation Committee of

the Company’s Board of Directors (the “Compensation Committee”) who designate option grants as either incentive or non-

statutory. Incentive stock options are granted at not less than 100% of the market value of the underlying common stock on the

date of grant. Non-statutory stock options are granted at a price as determined by the Compensation Committee.

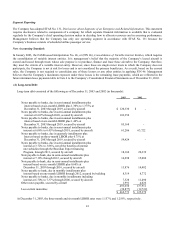

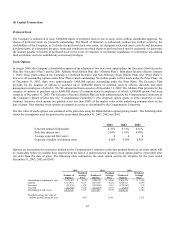

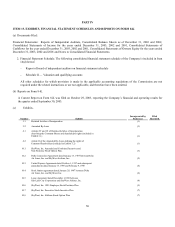

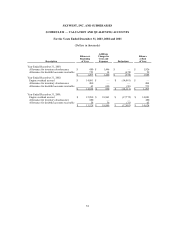

The fair value of stock options was estimated at the grant date using the Black-Scholes option pricing model. The following table

shows the assumptions used for grants in the years ended December 31, 2003, 2002 and 2001.

2003 2002 2001

Expected annual dividend rate 0.76% 0.31% 0.31%

Risk-free interest rate 2.56% 3.91% 4.49%

Average expected life (years) 4 4 4

Expected volatility of common stock 0.603 0.584 0.585

Options are exercisable for a period as defined by the Compensation Committee at the date granted; however, no stock option will

be exercisable before six months have elapsed from the date it is granted and no incentive stock option shall be exercisable after

ten years from the date of grant. The following table summarizes the stock option activity for all plans for the years ended

December 31, 2003, 2002 and 2001:

2003

2002

2001

Number of

Options

Weighted

Average

Price

Number of

Options

Weighted

Average

Price

Number of

Options

Weighted

Average

Price

Outstanding at beginning of year 3,679,925 $ 21.70 3,028,534 $ 18.66 2,864,434 $ 12.39

Granted 1,116,915 10.57 1,073,968 26.24 1,045,911 25.95

Exercised (24,396) 11.97 (389,260) 11.15 (874,550) 7.72

Canceled (82,322) 21.20 (33,317) 22.54 (7,261) 11.97

Outstanding at end of year 4,690,122 19.27 3,679,925 21.70 3,028,534 18.66

Weighted average fair value of

options granted during the year 4.85 12.46 12.51

45