SkyWest Airlines 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

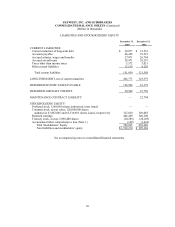

connection with the exercise of stock options under the Company’s stock option plans and the Company’s Employee Stock

Purchase Plan. During the year ended December 31, 2003, the Company invested $732.9 million in flight equipment, $63.1

million in marketable securities, $8.1 million in other assets and $7.5 million in buildings and ground equipment. The Company

made principal payments on long-term debt of $25.7 million and paid $4.6 million in cash dividends. These factors resulted in a

$18.6 million decrease in cash and cash equivalents during the year ended December 31, 2003.

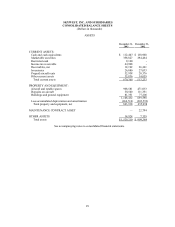

The Company’s position in marketable securities, consisting primarily of bonds, bond funds and commercial paper, increased to

$358.8 million at December 31, 2003, compared to $294.5 million at December 31, 2002. The increase in marketable securities

was due primarily to the Company’s successful completion of aircraft financing transactions wherein the Company entered into

long-term, third-party, US leveraged lease transactions or long-term debt transactions and reduced its net investment in previous

aircraft acquisitions. At December 31, 2003, the Company’s total capital mix was 60.5% equity and 39.5% debt, compared to

83.6% equity and 16.4% debt at December 31, 2002. The change in the total capital mix during 2003 reflected the Company’s

incurrence of approximately $372.8 million of debt financing related to CRJ200s acquired by the Company during 2003. The

financing agreements associated with the new CRJ200s permit the Company to refinance the debt into long-term lease agreements

with third-party lessors. Accordingly the interim financing has been classified as long-term debt in the accompanying financial

statements.

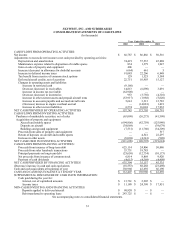

The Company expended approximately $67.2 million for aircraft related capital expenditures during the year ended December 31,

2003. These expenditures consisted primarily of $20.5 million for rotable spares, $18.6 million for engine overhauls, $12.5

million for aircraft improvements, and $15.6 million for buildings, ground equipment and other assets.

The Company has available $10.0 million in an unsecured bank line of credit through January 31, 2005, with interest payable at

the bank’s base rate less one-quarter percent, which was a net rate of 3.75% at December 31, 2003. The Company believes that in

the absence of unusual circumstances, the working capital available to the Company will be sufficient to meet its present

requirements, including expansion, capital expenditures, lease payments and debt service requirements for at least the next 12

months.

During the fourth quarter of 2003, the Company classified $9.2 million of cash as restricted cash on the consolidated balance

sheets as required by the Company’s workers compensation policy.

Significant Commitments and Obligations

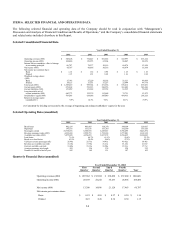

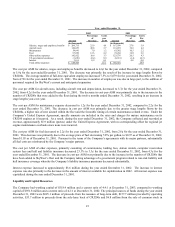

The following table summarizes SkyWest’s commitments and obligations as of December 31, 2003, for each of the next five

years and thereafter (in thousands):

Total

2004

2005

2006

2007

2008

Thereafter

Firm aircraft commitments $ 750,000 $ 375,000 $ 375,000 $ — $ — $ — $ —

Operating lease payments for aircraft and

facility obligations 1,705,526 148,932 146,267 155,568 148,091 146,369 960,299

Principal maturities on long-term debt(1) 493,650 30,877 30,859 28,170 29,015 29,981 344,748

Total commitments and obligations $ 2,949,176 $ 554,809 $ 552,126 $ 183,738 $ 177,106 $ 176,350 $ 1,305,047

(1) Principal maturities on long-term debt exclude interest payments.

On September 15, 2003, the Company announced the completion of a firm order for 30, 70-seat CRJ700s for its United Express

operations. The Company presently anticipates that it will begin taking delivery of these aircraft in January 2004 and continue

through May 2005. The Company’s firm aircraft orders, as of December 31, 2003, consisted of orders for 30, 70-seat CRJ700s

scheduled for delivery through May 2005. Gross committed expenditures for these aircraft and related equipment, including

estimated amounts for contractual price escalations will be approximately $375 million through 2004 and $375 million through

2005. The contract also includes options for another 80 aircraft that can be delivered in either 70 or 90-seat configurations. The

Company presently anticipates that delivery dates for these aircraft could start in June 2005 and continue through September

2008; however, actual delivery dates remain subject to final determination as agreed upon by the Company and United.

The Company has significant long-term lease obligations primarily relating to its aircraft fleet. These leases are classified as

24