SkyWest Airlines 2003 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the execution of the United Express Agreement, United’s bankruptcy filing could still lead to many other unforeseen expenses,

risks and uncertainties. Although United has reported that it intends to emerge from its ongoing Chapter 11 bankruptcy, on or

before July 30, 2004, it could still file for liquidation under Chapter 7 of the United States Bankruptcy Code, or liquidate some or

all of its assets through one or more transactions with third parties. Such events, individually or singly, could jeopardize the

Company’s United Express operations, leave the Company unable to efficiently utilize the additional aircraft which the Company

is currently obligated to purchase, or result in other outcomes which could have a material adverse effect on the operations,

activities and financial condition of the Company.

The Company’s operations and financial condition are dependent upon the terms of its relationships with its major

partners

Substantially all of the Company’s revenues are derived from flight operations conducted under its agreements with Delta and

United. Any material change in the Company’s contractual relationships with its major partners would impact the Company’s

operations and financial condition. The Company’s major partners currently face significant economic, operational, financial and

competitive challenges. United’s bankruptcy filing and associated reorganization effort represents only one of those challenges.

As the Company’s major partners struggle to address such challenges, they have required, and will likely continue to require, the

Company’s participation in efforts to reduce costs and improve the financial position of the Company’s partners. In particular,

these challenges could translate into lower departure rates on the contract flying portion of the Company’s business. Management

believes these developments will impact many aspects of the Company’s operations and financial performance. In particular, the

Company anticipates that its financial performance, including its margins, will be less predictable than in prior periods and will be

negatively impacted as the industry experiences significant restructuring. In addition, the Company’s contract flying

arrangements with Delta and United contain termination provisions that could adversely impact the Company’s revenues. The

Company’s rights under the United Express Agreement expire incrementally between 2012 and 2016; however, United can

terminate the agreement without notice if the Company does not perform at certain levels. The Company’s Delta Connection

agreement expires in 2008; however, Delta can terminate the agreement without cause upon 180 days notice. The agreement with

Continental can be terminated by either party upon 90 days notice.

Maintenance costs will likely increase as the age of the fleet increases

Because the average age of SkyWest’s CRJ200s is approximately 2.2 years, SkyWest’s aircraft require less maintenance now than

they will in the future. The Company has incurred lower maintenance expenses because most of the parts on SkyWest’s aircraft

are under multi-year warranties and a limited number of heavy airframe and engine checks have occurred. The Company’s

maintenance costs will increase significantly, both on an absolute basis and as a percentage of its operating expenses, as

SkyWest’s fleet ages and these warranties expire.

The Company has a significant amount of contractual obligations

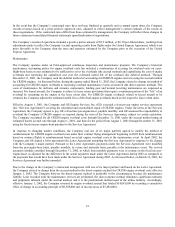

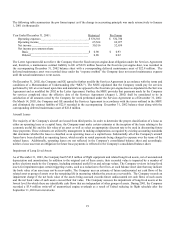

As of December 31, 2003, the Company had $493.7 million in long-term debt obligations. Substantially all of the long-term debt

was incurred in connection with the acquisition of EMB120 and CRJ200 aircraft. The Company also has significant long-term

lease obligations primarily relating to its aircraft fleet. These leases are classified as operating leases and therefore are not

reflected as liabilities in the Company’s consolidated balance sheets. At December 31, 2003, the Company had 134 aircraft under

lease with remaining terms ranging from one to 16 years. Future minimum lease payments due under all long-term operating

leases were approximately $1.7 billion at December 31, 2003. At a 7% discount factor, the present value of these lease

obligations was equal to approximately $1.1 billion at December 31, 2003.

As of December 31, 2003, the Company had commitments of approximately $750 million to purchase 30 CRJ700 aircraft and

related flight equipment. The Company currently anticipates that it will take delivery of these aircraft from January 2004 through

May 2005. The Company’s high level of fixed obligations could impact its ability to obtain additional financing to support

additional expansion plans or divert cash flows from operations and expansion plans to service the fixed obligations.

Terrorist activities or warnings have dramatically impacted, and will likely continue to impact, the Company

The terrorist attacks of September 11, 2001 and their aftermath have negatively impacted the airline industry in general and the

Company’s operations in particular. The primary effects experienced by the airline industry included a substantial loss of

9