SkyWest Airlines 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

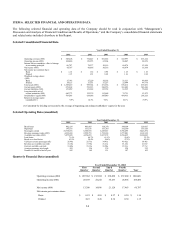

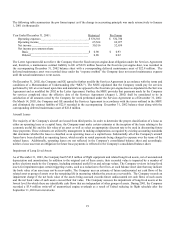

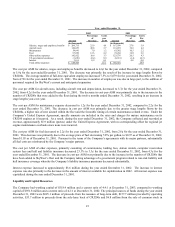

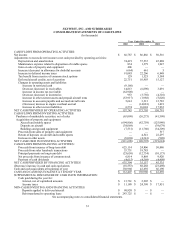

Year ended December 31,

2002

2001

Amount

Percentage

of

Revenue

Cents

per

ASM

Amount

Percentage

of

Revenue

Cents

Per

ASM

(in thousands) (in thousands)

Salaries, wages and employee benefits $ 200,715 25.9 4.6 $ 167,590 27.8 5.9

Aircraft costs 160,853 20.8 3.7 118,072 19.6 4.2

Maintenance 54,041 7.0 1.2 63,242 10.5 2.2

Fuel 97,899 12.6 2.2 72,202 12.0 2.6

Other airline expenses 142,822 18.4 3.3 123,376 20.5 4.3

US government assistance (1,438) (0.2) 0.0 (8,181) (1.4) (0.3)

Interest 3,611 0.5 0.1 - 0.0 0.0

Total airline expenses $ 658,503 15.1 $ 536,301 18.9

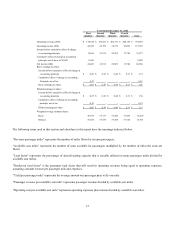

The cost per ASM for salaries, wages and employee benefits decreased to 4.6¢ for the year ended December 31, 2002, compared

to 5.9¢ for the year ended December 31, 2001. The decrease was primarily the result of the increase in stage lengths flown by

CRJ200s. The average number of full-time equivalent employees increased 7.5% to 5,079 for the year ended December 31, 2002,

from 4,726 for the year ended December 31, 2001. The increase in number of employees was due in large part, to the addition of

personnel required for SkyWest’s current and anticipated expansion.

The cost per ASM for aircraft costs, including aircraft rent and depreciation, decreased to 3.7¢ for the year ended December 31,

2002, from 4.2¢ for the year ended December 31, 2001. The decrease in cost–per-ASM was primarily due to the increase in the

number of CRJ200s that were added to the fleet during the twelve months ended December 31, 2002, resulting in an increase in

stage lengths year-over-year.

The cost per ASM for maintenance expense decreased to 1.2¢ for the year ended December 31, 2002, compared to 2.2¢ for the

year ended December 31, 2001. The decrease in cost per ASM was primarily due to the greater stage lengths flown by the

CRJ200s, a higher mix of new aircraft within the fleet and the favorable timing of certain maintenance-related events. Under the

Company’s United Express Agreement, specific amounts are included in the rates and charges for mature maintenance on its

CRJ200 engines as it incurred. As a result, during the year ended December 31, 2002, the Company collected and recorded as

revenue, approximately $5.9 million (pretax) under the United Express Agreement, with no corresponding offset for regional jet

engine maintenance overhauls since none were incurred.

The cost per ASM for fuel decreased to 2.2¢ for the year ended December 31, 2002, from 2.6¢ for the year ended December 31,

2001. This decrease was primarily due to the average price of fuel decreasing 5.8% per gallon, to $0.97 as of December 31, 2002,

from $1.03 as of December 31, 2001. Pursuant to the terms of the Company’s agreements with its major partners, substantially

all fuel costs are reimbursed by the Company’s major partners.

The cost per ASM of other expenses, primarily consisting of commissions, landing fees, station rentals, computer reservation

system fees and hull and liability insurance decreased 23.3% to 3.3¢ for the year ended December 31, 2002, from 4.3¢ for the

year ended December 31, 2001. The decrease in cost per ASM was primarily due to the increase in the number of CRJ200s that

have been added to SkyWest’s fleet and the Company taking advantage of a government program related to war-risk liability and

hull insurance coverage whereby the Company’s liability insurance premiums decreased substantially.

Interest expense increased to approximately $3.6 million during the year ended December 31, 2002. The increase in interest

expense was due primarily to the decrease in the amount of interest available for capitalization in 2002. All interest expense was

capitalized during the year ended December 31, 2001.

Liquidity and Capital Resources

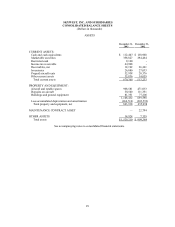

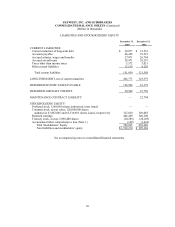

The Company had working capital of $518.4 million and a current ratio of 4.4:1 at December 31, 2003, compared to working

capital of $391.8 million and a current ratio of 4.2:1 at December 31, 2002. The principal sources of funds during the year ended

December 31, 2003 were $625.1 million of proceeds from the issuance of long-term debt, $157.7 million provided by operating

activities, $33.7 million in proceeds from the sale-lease back of CRJ200s and $6.8 million from the sale of common stock in

23