SkyWest Airlines 2003 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the book value of an asset may not be recoverable. The Company uses an estimate of future undiscounted net cash flows of the

related asset or group of assets over the remaining life in measuring whether the assets are recoverable. The Company records an

impairment charge if the net book value of the assets being assessed exceeds future undiscounted net cash flows of such assets

and the net book value of such assets exceed their fair value. The Company assesses the impairment of long-lived assets at the

lowest level for which there are identifiable cash flows that are independent of other groups of assets. During 2001, the Company

recorded a $3.4 million write-off of unamortized engine overhauls as a result of United reducing its flight schedule after the

September 11, 2001 terrorist attacks.

Capitalized Interest

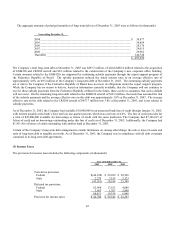

Interest is capitalized on aircraft purchase deposits and long-term construction projects and is depreciated over the estimated

useful life of the asset. During the years ended December 31, 2003, 2002 and 2001, the Company capitalized interest costs of

approximately $5,084,000, $7,041,000, and $5,185,000, respectively.

Maintenance

The Company operates under an FAA-approved continuous inspection and maintenance program. The Company’s historical

maintenance accounting policy for engine overhaul costs has included a combination of accruing for overhaul costs on a per-

flight-hour basis at rates estimated to be sufficient to cover the overhauls (the accrual method) and capitalizing the cost of engine

overhauls and expensing the capitalized cost over the estimated useful life of the overhaul (the deferral method). Through

December 31, 2001, the Company used the deferral method of accounting for EMB120 engines and was using the accrual method

for CRJ200 engines. As discussed below, during the quarter ended March 31, 2002, the Company elected to change its method of

accounting for CRJ200 engine overhauls to expensing overhaul maintenance events as incurred (the direct-expense method). The

costs of maintenance for airframe and avionics components, landing gear and normal recurring maintenance are expensed as

incurred. For leased aircraft, the Company is subject to lease return provisions that require a minimum portion of the “life” of an

overhaul be remaining on the engine at the lease return date. For EMB120 engine overhauls related to leased aircraft to be

returned, the Company adjusts the estimated useful lives of the final engine overhauls based on the respective lease return dates.

Effective August 1, 2001, the Company and GE Engine Services, Inc. (“GE”) executed a sixteen-year engine services agreement

(the “Services Agreement") covering the scheduled and unscheduled repair of CRJ200 engines. Under the terms of the Services

Agreement, the Company agreed to pay GE a fixed rate per-engine-hour, payable monthly, and GE assumed the responsibility to

overhaul the Company’s CRJ200 engines as required during the term of the Services Agreement, subject to certain exclusions.

The Company accounted for all CRJ200 engine overhaul costs through December 31, 2001 under the accrual method using an

estimated hourly accrual rate through August 1, 2001, and then for the period from August 1, 2001 through December 31, 2001,

using the fixed rate per-engine-hour pursuant to the Services Agreement.

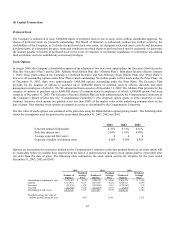

In response to changing market conditions, the Company and one of its major partners agreed to modify the method of

reimbursement for CRJ200 engine overhaul costs under their contract flying arrangement beginning in 2002 from reimbursement

based on contract flights to reimbursement based on actual engine overhaul costs at the maintenance event. In April 2002, the

Company and GE signed a letter agreement (the “Letter Agreement”) amending the Services Agreement in response to the change

with the Company’s major partner. Pursuant to the Letter Agreement, payments under the Services Agreement were modified

from the per-engine-hour basis, payable monthly, to a time and materials basis, payable at the maintenance event. The revised

payment schedule extended through December 31, 2002, at which time monthly payments were to resume on the fixed rate per-

engine-hour, as adjusted for the difference in the actual payments made under the Letter Agreement during 2002 as compared to

the payments that would have been made under the Services Agreement during 2002. As discussed below, on March 14, 2003, the

Services Agreement was further amended.

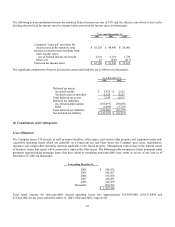

Due to the change in the Company’s contractual arrangement with one of its major partners and based on the Letter Agreement,

the Company elected to change from the accrual method to the direct-expense method for CRJ200 engine overhaul costs effective

January 1, 2002. The Company believes the direct-expense method is preferable in the circumstances because the maintenance

liability is not recorded until the maintenance services are performed, the direct-expense method eliminates significant estimates

and judgments inherent under the accrual method, and it is the predominant method used in the airline industry. Accordingly,

effective January 1, 2002, the Company reversed its engine overhaul accrual that totaled $14,081,000 by recording a cumulative

effect of change in accounting principle of $8,589,000 (net of income taxes of $5,492,000).

36