SkyWest Airlines 2003 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

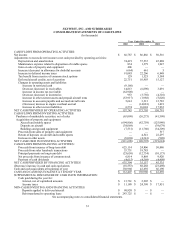

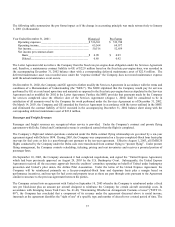

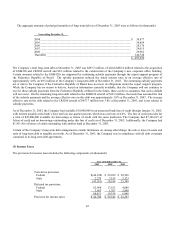

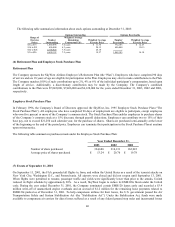

The following table summarizes the pro forma impact as if the change in accounting principle was made retroactively to January

1, 2001 (in thousands):

Year Ended December 31, 2001: Historical Pro Forma

Operating expenses $ 536,301 $ 532,788

Operating income 65,564 69,077

Net income 50,516 52,659

Net income per common share:

Basic $ 0.90 $ 0.93

Diluted

0.88 0.92

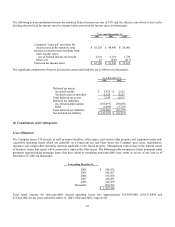

The Letter Agreement did not relieve the Company from the fixed rate per-engine-hour obligation under the Services Agreement

and, therefore, a maintenance contract liability to GE of $22.8 million based on the fixed rate per-engine-hour, was recorded in

the accompanying December 31, 2002 balance sheet with a corresponding deferred maintenance asset of $22.8 million. The

deferred maintenance asset was recorded since under the “expense method” the Company does not record maintenance expense

until the actual maintenance event occurs.

On December 31, 2002, the Company and GE agreed to further modify the Services Agreement in accordance with the terms and

conditions of a Memorandum of Understanding (the “MOU”). The MOU stipulated that the Company would pay for services

performed by GE at a rate based upon time and materials as opposed to the fixed rate per-engine-hour as stipulated in the Services

Agreement and as modified for 2002 in the Letter Agreement. Further, the MOU provides that payments made by the Company

for services completed since the effective date of the Services Agreement (August 1, 2002) shall be considered to be in

satisfaction of all amounts owed by the Company for work performed under the Services Agreement as of December 31, 2002.

On March 14, 2003, the Company and GE amended the Services Agreement in accordance with the terms outlined in the MOU

and eliminated the contract liability of $22.8 recorded in the accompanying December 31, 2002 balance sheet along with the

corresponding deferred maintenance asset of $22.8 million.

Passenger and Freight Revenues

Passenger and freight revenues are recognized when service is provided. Under the Company’s contract and prorate flying

agreements with Delta, United and Continental revenue is considered earned when the flight is completed.

The Company’s flight and related operations conducted under the Delta contract flying relationship are governed by a ten-year

agreement signed with Delta in 1998. During 2003, the Company was compensated on a fee-per-completed-block hour basis plus

true-ups for fuel costs as this is a pass-through cost pursuant to the ten-year agreement. Effective August 1, 2003, all EMB120

flights conducted by the Company under the Delta code were transitioned from contract flying to “prorate flying”. Under prorate

flying arrangement, the Company controls scheduling, ticketing, pricing and seat inventories and receives a prorated portion of

passenger fares.

On September 10, 2003, the Company announced it had completed negotiations, and signed the “United Express Agreement,

which had been previously approved on August 29, 2003 by the U.S. Bankruptcy Court. Subsequently, the United Express

Agreement received all the necessary approvals from the creditors’ committee operating on behalf of United under bankruptcy

protection and United’s pilot union, the Airline Pilot Association. Under the terms of the United Express Agreement, the

Company will be reimbursed primarily on a fee-per-completed-block hour and departure basis plus a margin based on

performance incentives, and true-ups for fuel costs and property taxes as these are pass through costs pursuant to the Agreement

similar in structure to the previous agreement between the parties.

The Company entered into an agreement with United on September 10, 2003 whereby the Company is reimbursed under a fixed

rate per block-hour plus an amount per aircraft designed to reimburse the Company for certain aircraft ownership costs. In

accordance with Emerging Issues Task Force No. 01-08, "Determining Whether an Arrangement Contains a Lease" ("EITF 01-

08"), the Company has concluded that a component of its revenue under the agreement discussed above is rental income,

inasmuch as the agreement identifies the "right of use" of a specific type and number of aircraft over a stated period of time. The

37