SkyWest Airlines 2003 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.any aircraft accident or incident, even if fully insured, could cause a public perception that the Company is less safe or reliable

than other airlines.

ITEM 2. PROPERTIES

Flight Equipment

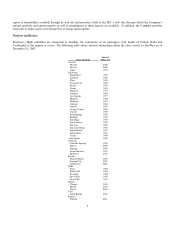

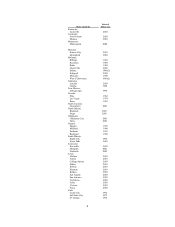

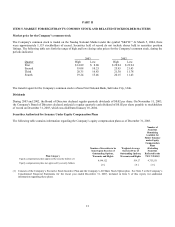

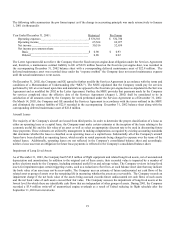

As of December 31, 2003, SkyWest owned or leased the following types of aircraft:

Number of Scheduled Average

Aircraft Flight Cruising Average

Passenger Range Speed Age

Type of Aircraft Owned Leased Capacity (Miles) (MPH) (Years)

------------------ ---------------- ----------------- ------------------ ------------------ ------------------

EMB120s 21 55 30 300 300 8.3

CRJ200s 30 79 50 850 530 2.2

SkyWest's aircraft are turboprop and jet aircraft designed to operate more economically over short-haul routes with lower

passenger load factors than larger jet aircraft. These factors make it economically feasible for SkyWest to provide high frequency

service in markets with relatively low volumes of passenger traffic. Passenger comfort features of these aircraft include stand-up

headroom, a lavatory, overhead baggage compartments and flight attendant service. Fiscal year 1995 marked the introduction of

the CRJ200s. As of December 31, 2003, SkyWest operated 109 of these aircraft on stage lengths up to 850 miles.

During 2003, SkyWest took delivery of 39 CRJ200s in connection with the Delta Connection and United Express expansion. On

September 15, 2003, the Company announced the completion of a firm order for 30, 70-seat CRJ700s for the United Express

operations. The Company began, taking delivery of these aircraft in January 2004, and will continue through May 2005. The

Company’s firm aircraft orders, as of December 31, 2003, consisted of orders for 30, 70-seat CRJ700s scheduled for delivery

through May 2005. Gross committed expenditures for these aircraft and related equipment, including estimated amounts for

contractual price escalations will be approximately $375 million through December 31, 2004 and $375 million through May 31,

2005. The contract also includes options for another 80 aircraft that can be delivered in either 70 or 90 seat configurations. The

Company presently anticipates that delivery dates for these aircraft could start in June 2005 and continue through September

2008; however, actual delivery dates remain subject to final determination as agreed upon by the Company and United. On

February 10, 2004, the Company announced it had agreed to take another 12 Canadair Regional Jets in its United Express

operations during 2004. The Company presently anticipates that two of these aircraft will be CRJ700s and ten will be CRJ200s.

The Company’s total long-term debt at December 31, 2003 was $493.7 million, of which $485.4 million related to the acquisition

of EMB120 and CRJ200 aircraft and $8.3 million related to the acquisition of the Company’s corporate office building. Certain

amounts related to the EMB120s are supported by continuing subsidy payments through the export support program of the

Federative Republic of Brazil. The subsidy payments reduced the stated interest rates to an average effective rate of

approximately 4.0% on $9.5 million of the Company’s long-term debt at December 31, 2003. The continuing subsidy payments

are at risk to the Company if the Federative Republic of Brazil does not meet its obligations under the export support program.

While the Company has no reason to believe, based on information currently available, that the Company will not continue to

receive these subsidy payments from the Federative Republic of Brazil in the future, there can be no assurance that such a default

will not occur. On the remaining long-term debt related to the EMB120 aircraft of $18.2 million, the lender has assumed the risk

of the subsidy payments and the average effective rate on this debt was approximately 3.8% at December 31, 2003. The average

effective rate on the debt related to the CRJ200 aircraft of $457.7 million was 3.8% at December 31, 2003, and is not subject to

subsidy payments.

As part of the Company’s leveraged lease agreements, the Company typically indemnifies the equity/owner participant against

liabilities that may arise due to changes in benefits from tax ownership of the respective leased aircraft.

11