SkyWest Airlines 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.aircraft ownership costs. In accordance with Emerging Issues Task Force No. 01-08, "Determining Whether an Arrangement

Contains a Lease" ("EITF 01-08"), the Company has concluded that a component of its revenue under the agreement discussed

above is rental income, inasmuch as the United agreement identifies the "right of use" of a specific type and number of aircraft

over a stated period of time. The amount deemed to be rental income during the year since the date of inception of the new

agreement was $44.2 million and has been included in passenger revenue on the Company’s statements of income.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Aircraft Fuel

In the past, the Company has not experienced difficulties with fuel availability and expects to be able to obtain fuel at prevailing

prices in quantities sufficient to meet its future needs. Effective January 1, 2002, the Company’s contracts with its major partners

obligate its major partners to bear the majority of the economic risk of fuel price fluctuations. As such, during the terms of those

contracts the Company anticipates that its results from operations will not be directly affected by fuel price volatility.

Interest Rates

The Company's financial condition and results of operations are affected by changes in interest rates due to the amounts of

variable rate long-term debt and the amount of cash and securities held. The interest rates applicable to variable rate notes may

rise and increase the amount of interest expense. However, the Company would also receive higher amounts of interest income on

its cash and securities held at the time. At December 31, 2003, the Company had variable rate notes representing 77.4% of its

total long-term debt compared with 10.7% of its total long-term debt at December 31, 2002. For illustrative purposes only, the

impact of market risk is estimated using a hypothetical increase in interest rates of one percentage point for both the Company's

variable rate long-term debt and cash and securities. Based on this hypothetical assumption, the Company would have incurred an

additional $2,500,000 in interest expense and received $4,410,000 in additional interest income for the year ended December 31,

2003, and an additional $160,000 in interest expense and received $3,565,000 in additional interest income for the year ended

December 31, 2002.

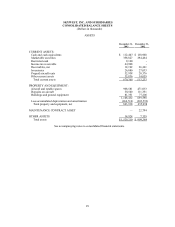

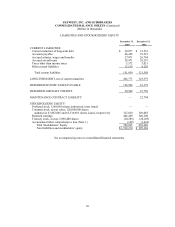

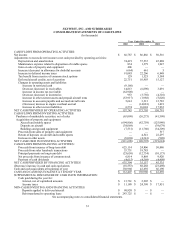

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information set forth below should be read together with the “Management’s Discussion and Analysis of Financial Condition

and Results of Operations,” appearing elsewhere herein.

26