Samsung 1998 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

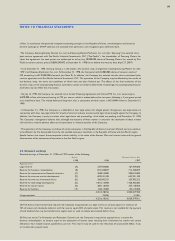

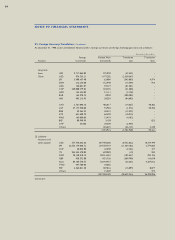

(C) The Financial Control Regulations for listed companies require the Company to appropriate as a reserve for improvement of

financial structure an amount equal to at least 50% of the net extraordinary gain on disposal of property, plant and equipment and

10% of net earnings for each year until the Company’s net worth equals 30% of total assets. This reserve is not available for

payment of cash dividends, but may be transferred to capital stock or used to reduce accumulated deficit, if any.

(D) Pursuant to Korean tax laws, the Company is allowed to claim the amounts of retained earnings appropriated for reserves

for overseas market development, overseas investment losses, technology development and export losses as deductions in

determining taxable income. These amounts are not available for dividends until used for the specified purposes or reversed.

(E) The reserve for facilities represents amounts appropriated by the Company for capital expenditures and may be used for any

purpose through shareholders’ resolution.

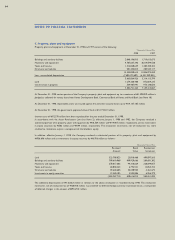

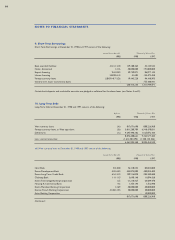

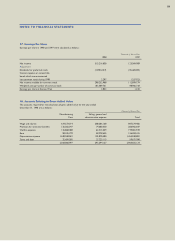

14. Dividends

At December 31, 1998, the Company’s income available for dividends under the Commercial Code in the Republic of Korea

amounts to ₩2,785,556 million and dividend propensity is approximately 28.02%.

For the year ended December 31, 1998, a cash dividend of ₩87,760 million (Common stock : 12%, Preferred stock : 13%) is

proposed for the general stockholders’ meeting to be held on March 20, 1999.

15. Treasury stock

At December 31, 1998, the Company acquired 3,449,625 shares of common stock and 869,693 shares of non-voting preferred

stock under the authorization of the Board of Directors. This treasury stock is recorded as a capital adjustment and will be sold

subject to stock market conditions.

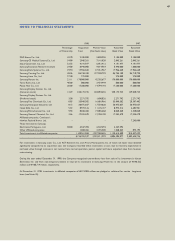

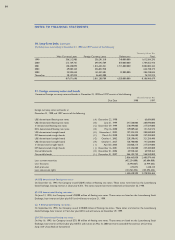

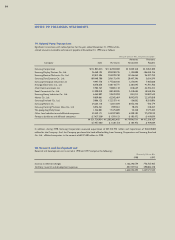

16. Income Taxes

The statutory income tax rate, including resident tax surcharges, applicable to the Company in 1998 is approximately 30.8%.

However, the actual income tax expense reported by the Company differs from the expected income tax computed at the

statutory income tax rate as follows:

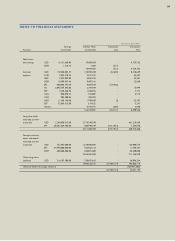

Tax Rates (%) Thousands of Korean Won

1998 1997 1998 1997

Income tax expense computed

at the statutory rate 30.8 30.8 126,543,747 47,315,180

Reversal of special reserves

appropriated for tax purposes (see Note 13) 35.0 29.3 143,681,969 44,980,391

Investment tax credits (19.2) (21.5) (79,115,643) (33,056,154)

Capitalized interest expense (6.1) (11.4) (25,289,979) (17,570,762)

Foreign exchange losses (22.6) (13.9) (92,852,879) (21,340,190)

Timing differences from revenue recognition (1.9) (0.1) (7,946,305) (279,448)

Invested stock reduction loss 8.4 - 34,689,080 -

Non-deductible donations - 12.0 - 18,490,365

Others, net (0.6) (5.6) (2,069,707) (8,423,577)

Income tax, as reported 23.8 19.6 97,640,283 30,115,805

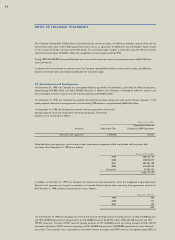

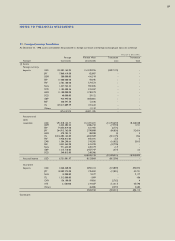

The accumulated temporary differences between amounts reported for financial accounting and for tax purposes at December

31, 1998 are approximately ₩1,191,845 million, and their effect will be to increase future taxable income. These differences arise

primarily in connection with foreign exchange losses and the appropriation of various reserves for tax purposes (see Note 13)

NOTES TO FINANCIAL STATEMENTS

54