Samsung 1998 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

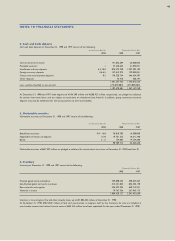

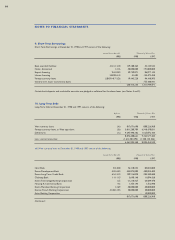

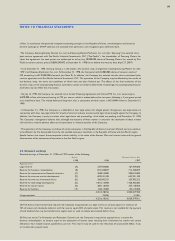

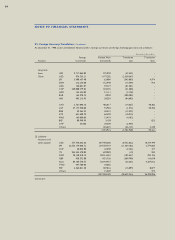

(E) US$ denominated straight bonds -

On November 1, 1992, the Company issued US dollar denominated bonds of US$200 million at 99.5% of face value for the

expansion of semiconductor product manufacturing facilities. The bonds bear interest at 8.5% per annum and mature on

November 1, 2002. The Company redeemed US$ 36,625 thousand of these bonds during 1998.

(F) DM denominated straight bonds -

On March 24, 1995, the Company issued straight bonds of DM300 million at 101.75%of face value. The bonds bear interest at

7.5% and mature on March 24, 2000.

(G) US$ denominated straight bonds -

On October 2, 1997, the Company issued straight bonds of US$227 million at 93.11% of face value. The bonds bear interest at

7.45% per annum and mature on October 1, 2002. The Company redeemed US$ 44,610 thousand of these bonds during 1998.

(H) US$ denominated straight bonds -

On October 2, 1997, the Company issued straight bonds of US$ 100 million at 99.85% of face value. The bonds bear interest at

7.7% per annum and mature on October, 1, 2027.

(I)¥denominated straight bonds -

On April 23, 1996, the Company issued straight bonds of ¥20,000 million at face value. The bonds bear interest at 3.3% per

annum and mature on April 23, 2003. The Company redeemed ¥5,210 million of these bonds during 1998.

(J) DM denominated straight bonds -

On December 16, 1996, the Company issued straight bonds of DM300 million at face value. The bonds bear interest at 5.375%

per annum and mature on December 16, 2001.

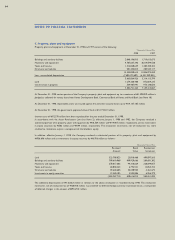

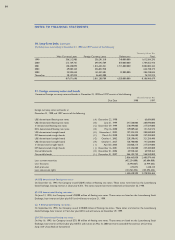

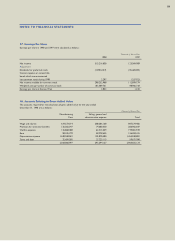

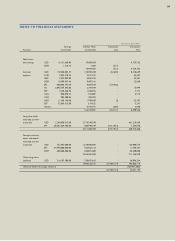

(K) Convertible bonds -

On September 24, 1996, the Company issued foreign currency convertible bonds of US$150 million for the expansion of

manufacturing facilities. The bonds are listed on the London Stock Exchange and will mature on December 31, 2006. A summary

of the terms of bonds is as follows :

•Interest: 0.25% per annum payable annually in arrears on December 31 of each year.

•Conversion period: On and after November 24, 1996 through December 15, 2006.

•Conversion Price: Subject to adjustment based on certain events, ₩67,905 per share, with a fixed exchange rate applicable to

the conversion of ₩827.3 : US$1.00.

•Redemption: Redeemable at the option of the bondholders on September 24, 2001 at 131.1% of the principal amount, and at the

option of the Company at any time on or after October 24, 1996 at a declining redemption price. However, no such redemption

may be made prior to September 24, 2001 unless the closing price of the Company’s common shares has reached 135% of the

conversion price for a stipulated period.

The Company recorded ₩51,969 million of consideration for conversion rights, the difference between nominal value and the

discounted present value at the 5.796% guaranteed return rate, as an adjustment to debentures and shareholders’ equity related

to the issuance of foreign currency convertible bonds. The conversion rights account is amortized using the effective interest

method, and amortization of ₩2,137 million was recognized as interest expense during 1998.

During 1997, US$ 72,440 thousand of convertible bonds were converted into 823,352 shares of common stocks at the

conversion price of ₩72,784 per share.

(L) Convertible bonds -

On June 26, 1997, the Company issued foreign currency convertible bonds of US$300 million for the expansion of manufacturing

facilities. The bonds are listed on the London Stock Exchange and will mature on December 31, 2007. A summary of the term of

bonds is as follows:

• Interest: 0%

• Conversion period: On and after July 26, 1997 through December 15, 2007.

• Conversion Price: Subject to adjustment based on certain events, ₩116,763 per share with a fixed exchange rate applicable

to the conversion of ₩888.5 : US$1.00

• Redemption: Redeemable at the option of the bondholders on June 26, 2002 at 131.1% of the principal amount, and at the

option of the Company at any time on or after June 26, 1999 at a declining redemption price. However, no such redemption

may be made prior to June 26, 2002 unless the closing price of the Company’s common shares has reached 135% of the

conversion price for a stipulated period.

NOTES TO FINANCIAL STATEMENTS

51