Samsung 1998 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

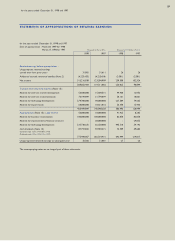

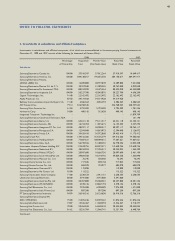

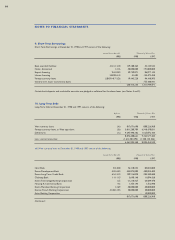

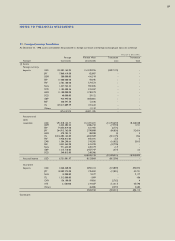

1998 1997

Percentage Acquisition Market Value Recorded Recorded

of Ownership Cost (Net book value) Book Value Book Value

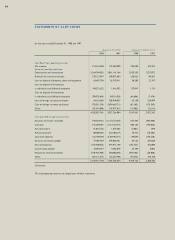

DNS Korea Co., Ltd. 43.70 2,185,000 5,840,296 2,185,000 2,185,000

Samsung-GE Medical SystemsCo., Ltd. 34.00 2,045,261 7,141,020 2,045,261 2,045,261

Seoul Commtech. Co., Ltd. 33.33 4,191,977 6,951,412 4,191,977 4,191,977

Samsung Economic Research Institute 29.80 8,940,000 9,014,964 8,940,000 1,800,000

Samsung Data Systems Co., Ltd. 29.94 17,966,660 27,761,967 17,966,660 17,966,660

Samsung Corning Co., Ltd. 48.36 86,744,180 127,238,729 86,744,180 86,710,798

Samsung Lions Co., Ltd. 27.50 275,000 - 275,000 275,000

Samsung Motors Inc. 21.11 170,000,000 42,765,677 170,000,000 170,000,000

Towa Korea Co., Ltd. 40.00 800,000 3,419,444 800,000 800,000

Posco Huls Co., Ltd. 20.00 17,200,000 14,799,193 17,200,000 17,200,000

Samsung Display Devices Co., Ltd.

(Common stock) 13.29 230,173,725 318,094,455 230,173,725 129,040,723

Samsung Display Devices Co., Ltd.

(Preferred stock) 3.38 2,271,792 1,690,826 2,271,792 2,271,792

Samsung Fine Chemicals Co., Ltd. 8.83 33,040,382 16,681,966 33,040,382 28,307,402

Samsung Aerospace Industries Ltd. 8.13 30,975,037 17,539,620 30,975,037 30,975,037

Hotel Shilla Co., Ltd. 5.32 8,973,516 11,125,137 8,973,516 6,682,901

Samsung Petrochemical Co., Ltd. 9.93 8,040,460 19,085,460 8,040,460 2,530,860

Samsung General Chemical Co., Ltd. 3.66 17,555,670 12,760,190 17,555,670 17,555,670

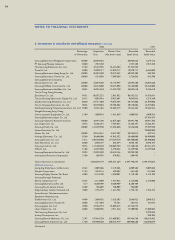

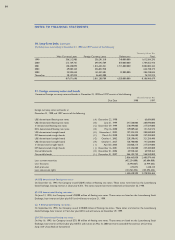

Affiliated companies, Continued :

Hewlett Packard Korea Ltd. - - - - 7,245,000

Texas Instruments Samsung

Electronics Porluguesa., Ltd. 38.00 6,347,494 6,347,494 6,347,494 -

Other affiliated companies 1,068,465 3,735,300 1,068,465 873,195

Total investments in affiliated companies 1,140,261,068 1,237,960,665 1,138,615,580 815,457,692

4,196,765,247 3,233,311,929 4,086,405,877 2,509,654,756

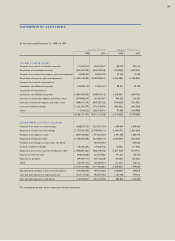

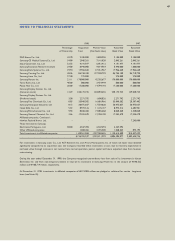

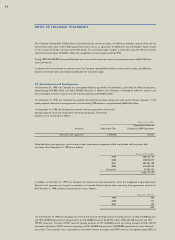

For investments in Samsung Lions Co., Ltd, AST Research Inc. and Arrary Microsystems Inc. of which net book value declined

significantly compared to its acquisition cost, the Company recorded these investments at cost, due to recovery expectation in

net book value through increase in net income from normal operation, paid-in capital and future expected value from business

restructuring.

During the year ended December 31, 1998, the Company recognized extraordinary loss from sale of its investment in Icheon

Electronics Inc. and from non-temporary decline in value of its investment in Samsung Watch Inc. in the amount of ₩190,522

million and ₩108,714 million, respectively.

At December 31, 1998, investments in affiliated companies of ₩174,288 million are pledged as collateral for certain long-term

loans (see Note 10).

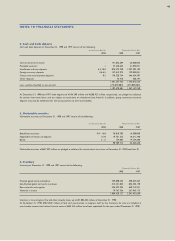

NOTES TO FINANCIAL STATEMENTS

47