Samsung 1998 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

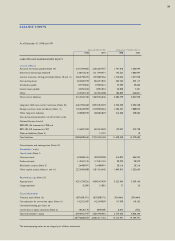

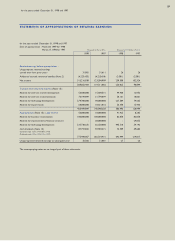

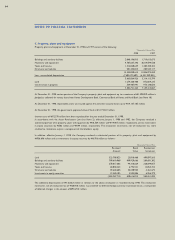

As of December 31, 1998 and 1997

Thousands of Korean Won Thousands of US Dollars (Note 3)

1998 1997 1998 1997

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities

Accounts and notes payable (Note 19) 2,101,399,002 2,036,207,957 1,741,010 1,686,999

Short-term borrowings (Note 9) 238,413,236 1,311,944,971 197,525 1,086,947

Current maturities of long-termdebt (Notes 10 and 11) 2,064,758,293 1,293,807,566 1,710,653 1,071,920

Accrued expenses 655,682,599 836,591,876 543,233 693,117

Dividends payable 87,759,832 59,969,415 72,709 49,685

Income taxes payable 42,052,010 8,981,053 34,840 7,441

Other 225,502,128 322,053,208 186,829 266,821

Total current liabilities 5,415,567,100 5,869,556,046 4,486,799 4,862,930

Long-term debt, less current maturities (Note 10) 6,461,904,368 8,094,453,539 5,353,690 6,706,258

Foreign currency notes and bonds (Note 11) 1,453,628,909 2,278,904,464 1,204,332 1,888,073

Other long-term liabilities 258,900,949 300,065,839 214,500 248,605

Accrued severance benefits, net of transfer to the

National Pension Fund of

₩39,495,146 thousand in 1998 and

₩72,107,419 thousand in 1997 216,097,320 692,574,539 179,037 573,798

Deferred liabilities (Note 2) - 21,757 - 18

Total liabilities 13,806,098,646 17,235,576,184 11,438,358 14,279,682

Commitments and contingencies (Note 12)

Shareholders’ equity

Capital stock (Note 1)

Common stock 623,868,165 490,350,200 516,875 406,255

Preferred stock 119,467,135 119,467,135 98,979 98,979

Revaluation surplus (Note 7) 24,400,991 24,400,991 20,216 20,216

Other capital surplus (Notes 1 and 11) 2,225,484,888 1,451,541,645 1,843,815 1,202,603

Retained earnings (Note 13)

Appropriated 4,251,578,256 4,030,347,930 3,522,434 3,339,145

Unappropriated 32,306 31,881 27 26

Capital adjustments

Treasury stock (Note 15) (427,838,371) (427,838,371) (354,464) (354,464)

Consideration for conversion rights (Note 11) 142,352,407 142,549,059 117,939 118,102

Unrealized holding gain (loss) on

investments in equity securities (Note 2) 10,636,170 (909,489) 8,812 (753)

Total shareholders’ equity 6,969,981,947 5,829,940,981 5,774,633 4,830,109

20,776,080,593 23,065,517,165 17,212,991 19,109,791

The accompanying notes are an integral part of these statements.

BALANCE SHEETS

35