Samsung 1998 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

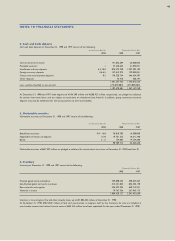

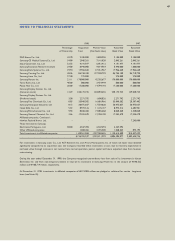

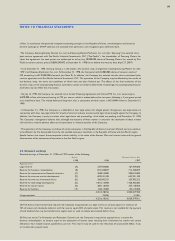

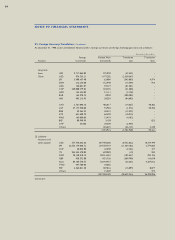

10. Long-Term Debt, Continued :

(C) Debentures outstanding at December 31, 1998 and 1997 consist of the following:

Thousands of Korean Won

Won Currency Loans Foreign Currency Loans Debentures Total

1999 336,212,983 536,291,310 740,000,000 1,612,504,293

2000 215,109,701 699,542,709 870,000,000 1,784,652,410

2001 150,450,893 1,016,633,541 2,715,000,000 3,882,084,434

2002 69,885,445 556,852,928 - 626,738,373

2003 25,905,643 145,332,401 33,000,000 204,238,044

Thereafter 20,107,025 56,635,900 - 76,742,925

817,671,690 3,011,288,789 4,358,000,000 8,186,960,479

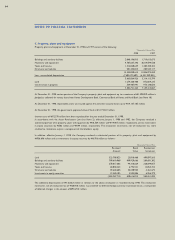

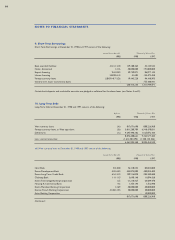

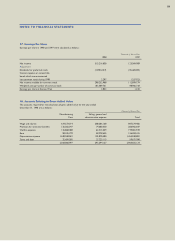

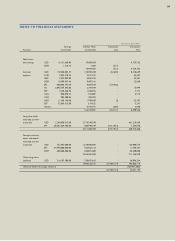

11. Foreign currency notes and bonds

Unsecured Foreign currency notes and bonds at December 31, 1998 and 1997 consist of the following:

Thousands of Korean Won

Due Date 1998 1997

foreign currency notes and bonds at

December 31, 1998 and 1997 consist of the following:

US$ denominated floating rate notes ( A ) December 22, 1998 - 63,684,000

US$ denominated floating rate notes ( B ) June 21, 1999 241,560,000 283,040,000

¥denominated floating rate notes ( C ) December 29, 1999 210,694,000 217,564,000

ECU denominated floating rate notes ( D) May 16, 2000 129,089,664 151,256,576

US$ denominated straight bonds ( E ) November 1, 2002 197,324,325 283,040,000

DM denominated straight bonds ( F ) March 24, 2000 215,436,000 237,285,000

US$ denominated straight bonds ( G ) October 1, 2002 220,290,642 321,250,400

US$ denominated straight bonds ( H ) October 1, 2027 120,780,000 141,520,000

¥denominated straight bonds ( I ) April 23, 2003 155,808,213 217,564,000

DM denominated straight bonds ( J ) December 16, 2001 215,436,000 237,285,000

Convertible bonds ( K ) December 31, 2006 63,940,464 63,940,464

Convertible bonds ( L ) December 31, 2007 266,105,750 266,550,000

2,036,465,058 2,483,979,440

Less: current maturities (452,254,000) (63,684,000)

Less: discounts (6,490,667) (6,944,665)

Add: premiums 672,072 1,248,133

Less: conversion rights (124,763,554) (135,694,444)

1,453,628,909 2,278,904,464

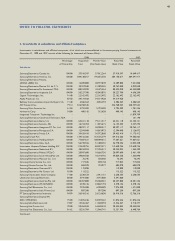

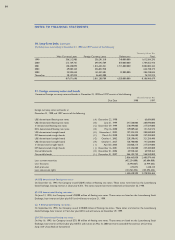

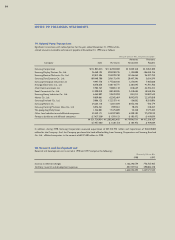

(A) US$ denominated floating rate notes -

On December 22, 1993, the Company issued US$45 million of floating rate notes. These notes were listed on the Luxembourg

Stock Exchange, bearing interest at Libor plus 0.35%. The notes matured and were redeemed on December 22, 1998.

(B) US$ denominated floating rate notes -

On June 21, 1994, the Company issued US$200 million of floating rate notes. These notes are listed on the Luxembourg Stock

Exchange, bear interest at Libor plus 0.3% and will mature on June 21, 1999.

(C) ¥denominated floating rate notes -

On September 26, 1994, the Company issued ¥20,000 million of floating rate notes. These notes are listed on the Luxembourg

Stock Exchange, bear interest at Yen Libor plus 0.35% and will mature on December 29, 1999.

(D) ECU denominated floating rate notes -

On May 16, 1995, the Company issued ECU 80 million of floating rate notes. These notes are listed on the Luxembourg Stock

Exchange, bear interest at ECU Libor plus 0.375% and mature on May 16, 2000 and were concluded the contract of Currency

Swap with Union Bank of Switzerland.

NOTES TO FINANCIAL STATEMENTS

50