Samsung 1998 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

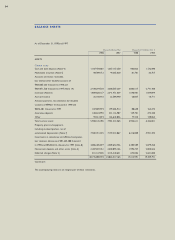

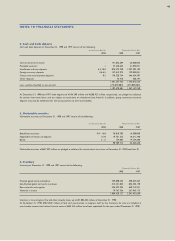

1. The Company

Samsung Electronics Co., Ltd. (the“Company”) is incorporated

under the laws of the Republic of Korea to manufacture and sell

electronic goods, communication facilities, semi-conductors,

telecommunication equipment and other similar products.

The Company’s stock is publicly traded, and all issued and out-

standing shares are listed on the Korean Stock Exchange.

Under the Articles of Incorporation, the Company is autho-

rized to issue 500,000,000 shares of capital stock (par value:₩5,000),

of which 100,000,000 shares are cumulative, participating preferred

stock, which are non-voting and entitled to a minimum cash

dividend (9% of par value).

The non-cumulative, non-voting preferred stock issued on or before

February 28, 1997 is entitled to an additional cash dividend (1%

of par value) over common stock. At December 31, 1998,

124,773,633 shares of common stock and 23,893,427 shares of

such preferred stock were issued and outstanding.

In addition, the Company is authorized to issue convertible

debentures and debentures with stock purchase options up to

₩4,000,000 million and ₩2,000,000 million, respectively. The

Company is authorized to issue depository receipts free from any

preemptive rights by shareholders. Also, in case of issuing capi-

tal stocks through the exercise of stock option or general pub-

lic subscription and issuing capital stocks to domestic and foreign

financial institutions for urgent fund raising or co-operating com-

panies for technical assistance, the Company is authorized to issue

capital stocks free from any preemptive rights by shareholders.

No debenture with stock purchase options have been issued as

of December 31, 1998.

The Company has a stock option plan under which options to

purchase shares of common stock may be granted to key employ-

ees up to maximum 1% of issued shares per employee by the

approval of shareholders meeting. No stock option has been

endowed as of December 31, 1998.

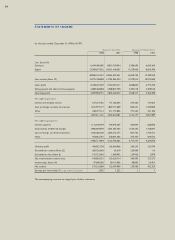

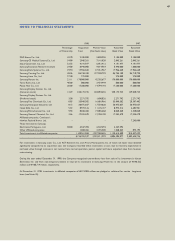

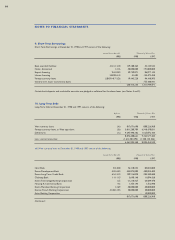

The Company issued 11,700,000 shares of common stock for cash

at ₩38,900 per share on June 5, 1998 and 15,000,000 shares of

common stock for cash at ₩29,300 per shares on September 25,

1998. In addition, the Company issued 3,593 shares of common

stock through the conversion of foreign currency convertible bonds

in the amount of US$ 500,000 in 1998 (see Note 11). The cash

received in excess of par value of ₩761,130 million and the con-

version price in excess of par value of ₩426 million were cred-

ited to other capital surplus.

As of December 31, 1998, ₩330,046,214 thousand (face value of

US$377,060,000) of convertible bonds are outstanding (see Note 11).

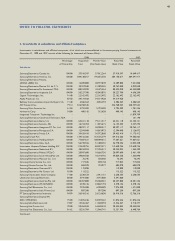

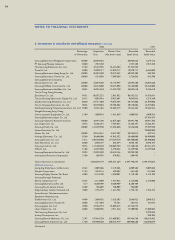

2. Summary of Significant Accounting Policies

The significant accounting policies followed by the Company in

the preparation of its financial statements are summarized below.

Basis of Financial Statement Presentation -

The official accounting records of the Company, on which the

Korean language financial statements are based, are maintained

in Korean Won in accordance with the laws and regulations of

the Republic of Korea.

For the convenience of the reader, the accompanying financial state-

ments have been condensed, restructured and translated into English

from the Korean language financial statements. Certain supple-

mentary information included in the Korean language financial state-

ments not required for a fair presentation of the Company’s finan-

cial position or results of operations and cash flows is not pre-

sented in the accompanying financial statements.

Such financial statements are not intended to present the finan-

cial position and results of operations and cash flows in accor-

dance with accounting principles and practices generally accept-

ed in countries and jurisdictions other than the Republic of

Korea.

The preparation of financial statements requires management to

make estimates and assumptions that effect amounts reported

therein. Due to the inherent uncertainty involved in making esti-

mates, actual results reported in future periods may differ from

those estimates.

Marketable Securities -

Marketable securities are stated at cost, which approximates mar-

ket value.

Allowance for Doubtful Accounts -

The Company provides an allowance for doubtful accounts and

notes receivable based on the aggregate estimated collectibility

of the amountsreceivable.

Inventory Valuation -

Inventory are stated at the lower of cost or market, cost being

determined by the average cost method, except for materials in

transit which are stated at actual cost as determined by the spe-

cific identification method.

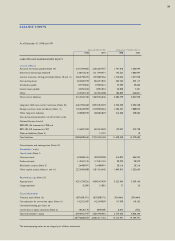

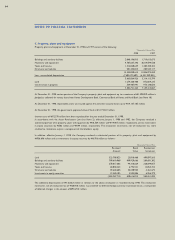

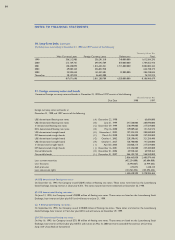

Property, Plant and Equipment and Related Depreciation -

Property, plant and equipment are stated at cost, except for cer-

tain assets subject to upward revaluation in accordance with the

Asset Revaluation Law. The revaluation presents production

facilities and other buildings at their depreciated replacement cost,

and land at the prevailing market price, as of the effective date

of revaluation. The revaluation increment, net of revaluation

tax, is first applied to offset accumulated deficit, if any, and the

remainder may either be credited to capital surplus which are trans-

ferred to common stock or may be credited to deferred foreign

currency translation losses.

A new basis for calculating depreciation is established for reval-

NOTES TO FINANCIAL STATEMENTS

40

December 31, 1998 and 1997