Samsung 1998 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

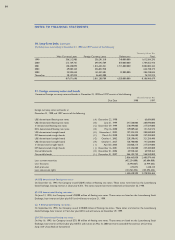

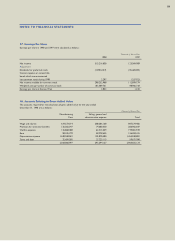

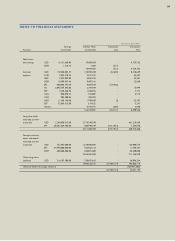

The Company recorded ₩115,678 million of consideration for conversion rights, the difference between nominal value and the

discounted present value at the 5.558% guaranteed return rate, as an adjustment to debentures and shareholders’ equity related

to the issuance of foreign currency convertible bonds. The conversion rights account is amortized using the effective interest

method and amortization of ₩8,607 million was recognized as interest expense during 1998.

During 1998, US$ 500,000 of convertible bonds were converted to common stocks at the conversion price of ₩123,635 per

share (see Note 1).

In relation with the conversion to common stock, the Company recorded ₩10 million as other capital surplus, the difference

between conversion rights and related consideration for conversion rights.

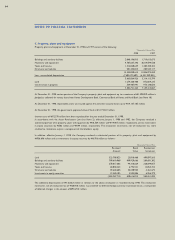

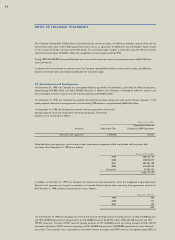

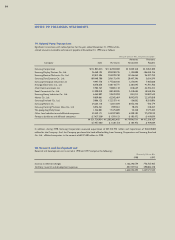

12. Commitments and Contingencies

•At December 31, 1998, the Company was contingently liable for guarantees of indebtedness, principally for affiliated companies,

approximating ₩74,800 million and US$ 2,578,905 thousand. In addition, the Company is contingently liable for accounts and

notes receivable sold with recourse, but not matured, approximating ₩9,846 million.

•At December 31, 1998, the Company has entered into technical assistance agreements with certain foreign companies. Total

royalty expense related to these agreements incurred during 1998 amounts to approximately ₩684,640 million.

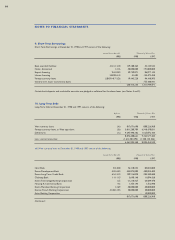

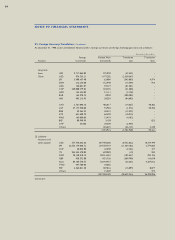

•At December 31, 1998, the Company has entered into lease agreements with several

leasing companies which are recognized as direct financing leases. These lease

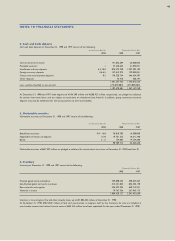

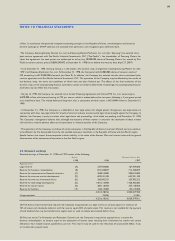

agreements are summarized as follows:

Millions of Korean Won

Depreciation Expense

Accounts Acquisition Cost Charged to 1998 Operations

Machinery and equipment 1,919,018 172,421

Scheduled future lease payments, net of interest, under these lease arrangements which are included with long-term debt

(see Note 10) at December 31, 1998 are as follows:

Thousands of Korean Won

1999 380,327,142

2000 418,023,819

2001 383,387,108

2002 218,500,549

Thereafter 37,934,752

1,438,173,370

In addition, at December 31, 1998, the Company has entered into lease agreements which are recognized as operating leases.

Related rental payments are charged to operations as incurred. Rental expense under operating lease agreements amounts to

₩1,334 million in 1998, and future rental payments are as follows :

Thousands of US Dollar

1999 465

2000 323

2001 107

895

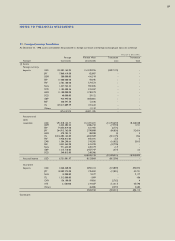

•As of December 31, 1998, the Company has entered into forward exchange contracts (buying amounts of US$ 271,900thousand

and HKD 469,040 thousand and selling amounts of US$ 60,000 thousand, ₩133,974 million, HKD 642,160 thousand and CNY

799,935 thousand), Currency SWAP contracts (buying amounts of DM 434,840thousand and selling amounts of US$ 265,279

thousand) and Interest SWAP contracts amounting to US$1,400,000 thousand and ¥20,000,000 thousand with certain financial

institutions. The unrealized losses expected from the above forward exchange and SWAP contracts are approximately ₩37,513

NOTES TO FINANCIAL STATEMENTS

52