Samsung 1998 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

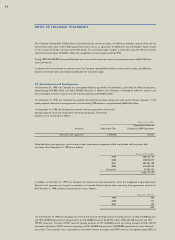

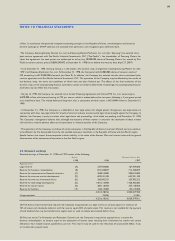

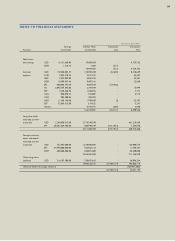

million. In accordance with generally accepted accounting principles in the Republic of Korea, unrealized gains and losses on

forward exchange or SWAP contracts are excluded from operations and recognized upon settlement date.

•The Company, Samsung Display Devices Co., Ltd. and Samsung Electro-Mechanics Co., Ltd. (the “Samsung”) has entered into a

joint-venture agreement with Pan-Pacific Industrial Investments, PLC (“Pan-Pacific”), the shareholder of Samsung Motors Inc.

Upon this agreement, the each parties are authorized to sell or buy 50,000,000 shares of Samsung Motors Inc. owned by Pan-

Pacific at certain exercise price (US$348,290,072 at December 31, 1998) on or before the maturity date (April 27, 2007).

• As of December 31, 1998, Samsung Group is in the process of a business swap arrangement involving Samsung Motors Inc. (the

“SMI”) and Daewoo Electronics Co., Ltd. At December 31, 1998, the Company holds 34,000,000 shares of common stock of

SMI amounting to ₩170,000,000 thousand (see Note 8). In addition, the Company has entered into the above-mentioned joint-

venture agreement with Pan-Pacific Industrial Investment, PLC. The operation of the Company may be affected by the results of

the business swap, the terms and conditions of which have not been finalized yet. The effects of the final resolution of this

business swap on the accompanying financial statements cannot currently be determined. Accordingly, the accompanying financial

statements do not reflect this transaction.

• On July 16, 1998, the Company has entered into a Vendor Financing Agreement with Hansol PCS Co., Ltd., amounting to

₩470,000 million with interest bearing at 22% per annum, which is redeemable within two years following a 3 year grace period

at an installment basis. The related balance of long-term loan, a component of other assets, is ₩324,089 million at December 31,

1998.

• At December 31, 1998, the Company is a defendant in four legal actions for alleged patent infringement, one legal actions in

connection with sales, two legal action for breach of contract and one environmental legal action brought against the Company. In

addition, the Company is party to various other legal claims and proceedings, all of which are pending as of December 31, 1998.

The Company’s management believes that, although the outcome of these matters is uncertain, the resolution of these matters

will not have a material adverse effect on the operations or financial position of the Company.

• The operations of the Company, and those of similar companies in the Republic of Korea, have been affected, and may continue

to be affected, for the foreseeable future by the unstable economic conditions in the Republic of Korea and Asia Pacific region.

Specific factors that impact these companies include volatility in the value of the Korean Won and interest rates and the general

deterioration of the economies of countries in the Asia Pacific region.

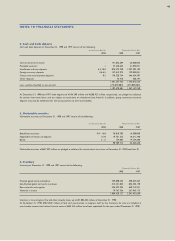

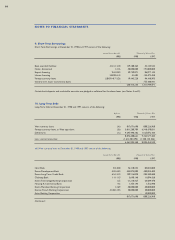

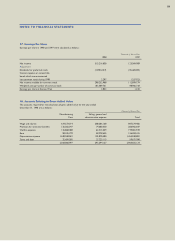

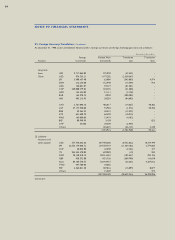

13. Retained earnings

Retained earnings at December 31, 1998 and 1997 consist of the following:

Reference Thousands of Korean Won

1998 1998 1997

Appropriated

Legal reserve (A) 237,789,000 187,789,000

Reserve for business rationalization (B) 812,100,829 712,100,829

Reserve for improvement of financial structure (C) 204,815,000 204,815,000

Reserve for overseas market development (D) 602,341,108 655,941,108

Reserve for overseas investment losses (D) 283,582,353 353,782,252

Reserve for technology development (D) 1,691,216,908 1,428,186,683

Reserve for export losses (D) 285,118,058 353,118,058

Reserve for facilities ( E ) 134,615,000 134,615,000

4,251,578,256 4,030,347,930

Unappropriated: 32,306 31,881

4,251,610,562 4,030,379,811

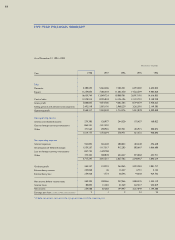

(A) The Korean Commercial Code requires the Company to appropriate as a legal reserve an amount equal to a minimum of

10% of annual cash dividends declared, until the reserve equals 50% of capital stock. This reserve is not available for the payment

of cash dividends but may be transferred to capital stock or used to reduce accumulated deficit, if any.

(B) Pursuant to the Tax Exemption and Reduction Control Law, the Company is required to appropriate as a reserve for

business rationalization, an amount equal to the exemption of income taxes resulting from investment tax credits and certain

deductions from taxable income specified by such law. This reserve may be used for the reduction of accumulated deficit, if any,

or transferred to capital stock.

NOTES TO FINANCIAL STATEMENTS

53