Samsung 1998 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

REPORT OF INDEPENDENT ACCOUNTANTS

To the Shareholders and Board of Directors

Samsung Electronics Co., Ltd.

We have audited the accompanying balance sheets of Samsung Electronics Co., Ltd. as of December 31, 1998 and 1997, and the

related statements of income, appropriations of retained earnings and cash flows for the years then ended, expressed in Korean

Won. These financial statements are the responsibility of the management of Samsung Electronics Co., Ltd. Our responsibility is

to express an opinion, as independent accountants, on these financial statements, as to whether they have been prepared in

conformity with financial accounting standards generally accepted in the Republic of Korea. For this purpose, we conducted our

audits in accordance with auditing standards generally accepted in the Republic of Korea.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial positions of Samsung

Electronics Co., Ltd. as of December 31, 1998 and 1997, and the results of its operations, the changes in its retained earnings and

its cash flows for the years then ended, in conformity with financial accounting standards generally accepted in the Republic of

Korea.

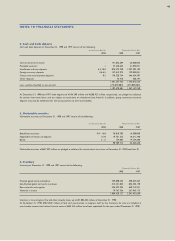

As more fully discussed in Note 7 to the financial statements, effective January 1, 1998, the Company revalued a substantial

portion of its property, plant and equipment and investments in equity securities by ₩963,652 million in accordance with the

Asset Revaluation Law of the Republic of Korea. As a result, the Company recognized revaluation surplus of ₩934,742 million,

net of revaluation tax in the amount of ₩28,910 million, and recorded an offsetting entry of ₩934,732 million to deferred foreign

exchange losses.

As discussed in Notes 8 and 22 to the financial statements, during the year ended December 31, 1998, the Company recognized

(1) extraordinary losses in the amount of ₩299,236 million from sale of its investment in Icheon Electronics Inc. and from non-

temporary decline in value of its investment in Samsung Watch Inc. and (2) extraordinary gain of ₩277,619 million from

divestiture of the Power Device Business located in Bucheon plant. As part of the Company’s restructuring plans, 22 functional

divisions of the Company were spun off to 18 separate companies including Samsung Electronics Services Co., Ltd.

As more fully discussed in Note 19 to the financial statements, the Company had sales of ₩351,735 million and US$7,457,380

thousand to subsidiaries and affiliated companies within the Samsung Group, during the year ended December 31, 1998, and the

related amounts receivable as of December 31, 1998 was ₩79,997 million and US$183,472 thousand. In addition, the Company

purchased the head office building from Samsung Corporation and Samsung Everland Co., Ltd. in the amount of ₩227,400 million.

As more fully discussed in Note 12 to the financial statements, as of December 31, 1998, Samsung Group is in the process of a

business swap arrangement involving Samsung Motors Inc. and Daewoo Electronics Co. The operation of the Company may be

affected by the results of the business swap, the terms and conditions of which have not been finalized yet.

As discussed in Note 27 to the financial statements, 9,580,000 shares of common stock of the Company will be issued on

February 12, 1999 per resolution of the Company’s board of directors’ meeting on December 14, 1998. On February 1, 1999, the

Company issued foreign currency convertible bonds of US$100 million at face value to Intel Corporation in the United States.

As discussed in Note 12 to the financial statements, the operation of the Company, and those of similar companies in the

Republic of Korea, have been significantly affected, and will continue to be affected for the foreseeable future, by the country’s

unstable economy caused in party by the currency volatility in the Asia Pacific region.

The amounts expressed in U.S. dollars, provided solely for the convenience of the reader, have been translated on the basis set

forth in Note 3 to the accompanying financial statements.

The accompanying financial statements are not intended to present the financial positions, results of operations and cash flows in

accordance with accounting principles and practices generally accepted in countries and jurisdictions other than the Republic of

Korea. The standards, procedures and practices utilized to audit such financial statements are those generally accepted and

applied in the Republic of Korea.

33

Samil Accounting Corporation

Seoul, Korea

February 9, 1999

Samil Accounting Corporation is the Korean member firm of the worldwide

PricewaterhouseCoopers organization.