Samsung 1998 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 1998 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

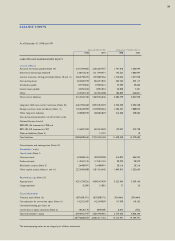

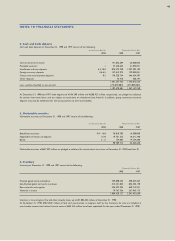

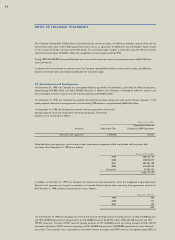

Discounts and Premiums on Debentures and Adjustment

Account for Conversion Rights -

Discounts and premiums on debentures represent the difference

between the issue price and par value of debentures. Discounts

and premiums on debentures are amortized over the redemp-

tion period of the related debentures using the straight-line

method. The amortized amounts from discount on debentures

are recorded as interest expenses and the amortized amounts

from premiums on debentures are deducted from interest

expenses.

The Company records a consideration for conversion rights and

an adjustment account for conversion rights which represents the

difference between the nominal value and the discounted present

value at market return rate or guaranteed return rate, if any, of con-

vertible debentures. These amounts are reported as an adjustment

account to debentures, and credited to shareholders’ equity.

The adjustment account for conversion rights is amortized using

the effective interest rate method and is recognized as interest

expense. When convertible debentures are converted, the con-

sideration for conversion rights is offset against the related

adjustment account for conversion rights and the remainder is

presented as other capital surplus.

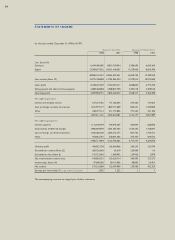

Foreign Currency Translation -

Monetary assets and liabilities denominated in foreign currencies

are translated into Korean Won at the basic rates in effect at the

balance sheet date (in case of U.S. Dollars, US$1 to 1,207.80),

and resulting translation gains and losses are recognized currently.

However, translation gains or losses on long-term monetary

assets and liabilities denominated in foreign currencies, which result-

ed from significant changes in the exchange rate in 1997 were

deferred. Subsequent gains or losses incurred for the same mon-

etary assets and liabilities in 1998 were offset against the deferred

amount carried forward from 1997 and the net amount remain-

ing is to be amortized over the maturities of the corresponding

assets and liabilities using the straight-line method.

Foreign currency convertible debentures are translated at a

fixed exchange rate for conversion in accordance with account-

ing practices prevailing in the Republic of Korea.

Income Taxes -

The provision for income taxes is comprised of corporate tax,

resident tax and agriculture and fishery development special tax

surcharges, payable in the current year. In conformity with

accounting practices prevailing in the Republic of Korea, the

Company does not recognize deferred income taxes arising

from temporary differences between amounts reported for

financial accounting and income tax reporting purposes.

Investment tax credits are recognized as a reduction of income

tax expense in the year in which they are utilized.

Earnings Per Share -

Earnings per share are computed, after deduction of dividends

declared non-voting preferred stock, using the weighted average

number of common shares outstanding during the period.

Product Warranties and Performance Guarantees -

In conformity with accounting practices prevailing in the Republic

of Korea, costs related to repairs, service and other work

required in accordance with product warranties and perfor-

mance guarantees are charged to expense when incurred.

Prior Period Error Corrections -

Pursuant to the revised generally accepted financial accounting

standards effective January 1, 1997, the Company recorded pri-

or period error corrections as extraordinary income or loss. Prior

period error corrections include refinements of estimates used

in prior years and the resolution of matters outstanding from pri-

or years.

Significant Changes in Financial Accounting Standards -

In December 1998, significant changes to the financial account-

ing standards in Korea were announced which will change

accounting principles generally accepted in Korea to be more con-

sistent with International Accounting Standards. These changes,

including accounting for investment securities, foreign currency

translation, impairment of long-lived assets,

deferred assets, goodwill, and prior period adjustments are

effective for years beginning on or after January 1, 1999. The cumu-

lative effect on prior years of these changes in accounting poli-

cies will be charged or credited to retained earnings, with dis-

closure on the effect of the change on prior years’ net income.

In addition, recognition of income tax expenses and deferred income

taxes will be applied in accordance with the provision of the

Addendum of the Financial Accounting Standards of the Republic

of Korea.

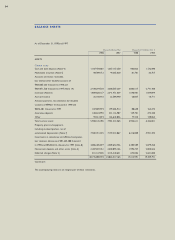

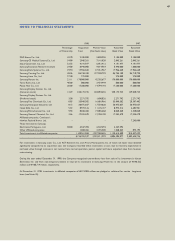

3. Amounts Stated in U.S. Dollars

The Company operates primarily in Korean Won and its official

accounting records are maintained in Korean Won. The US

Dollar amounts are provided herein as supplementary informa-

tion solely for the convenience of the reader. For both 1998 and

1997, Won amounts are expressed in US Dollars at the rate of

₩1,207:US$1, the rate in effect on December 31, 1998. This pre-

sentation is not in accordance with accounting principles gener-

ally accepted in either Korea or the United States, and should not

be construed as a representation that the Won amounts shown

could be converted, realized or settled in US Dollars at these rates.

The 1997 U.S.Dollar amounts, which were previously expressed

at ₩1,415:US$1, the rate prevailing on December 31, 1997,

have been restated to reflect the exchange rate in effect on

December 31, 1998.

NOTES TO FINANCIAL STATEMENTS

42