Redbox 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

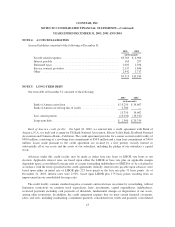

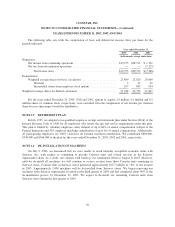

The following table sets forth the computation of basic and diluted net income (loss) per share for the

periods indicated:

Year ended December 31,

2003 2002 2001

(in thousands, except share data)

Numerator:

Net income from continuing operations .............................. $19,555 $58,513 $ 1,741

Net loss from discontinued operations ............................... — — (9,127)

Netincome(loss) ........................................... $19,555 $58,513 $ (7,386)

Denominator:

Weighted average shares for basic calculation ........................ 21,489 21,820 20,869

Warrants .................................................. 2 11 22

Incremental shares from employee stock options .................. 297 892 954

Weighted average shares for diluted calculation ........................... 21,788 22,723 21,845

For the years ended December 31, 2003, 2002 and 2001, options to acquire 2.0 million, 0.1 million and 0.2

million shares of common stock, respectively, were excluded from the computation of net income per common

share because their impact would be antidilutive.

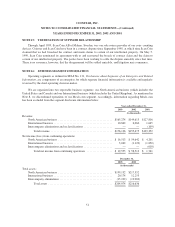

NOTE 13: RETIREMENT PLAN

In July 1995, we adopted a tax-qualified employee savings and retirement plan under Section 401(k) of the

Internal Revenue Code of 1986 for all employees who satisfy the age and service requirements under this plan.

This plan is funded by voluntary employee salary deferral of up to 60% of annual compensation (subject to the

Federal limitation) and 50% employer matching contributions of up to 6% of annual compensation. Additionally,

all participating employees are 100% vested for all Coinstar matched contributions. We contributed $898,000,

$740,000 and $566,000 to the plan for the years ended December 31, 2003, 2002 and 2001, respectively.

NOTE 14: DE-INSTALLATION OF MACHINES

On July 9, 2003, we announced that we were unable to reach mutually acceptable economic terms with

Safeway, Inc. with respect to continuing to provide Coinstar units and related services in the Safeway

supermarket chain. As a result, our contract with Safeway was terminated effective August 6, 2003. However,

until we de-install all machines, we will continue to receive revenue from those Coinstar units remaining in

Safeway stores. Coinstar units in Safeway stores generated approximately $13.7 million or 7.8% of our revenue

in 2003. Approximately 1,000 machines will be de-installed from Safeway stores. We began removing our

machines from Safeway supermarket locations in the third quarter of 2003 and had completed about 90% of the

de-installation process by December 31, 2003. We expect to de-install our remaining Coinstar units from

Safeway stores during the first quarter of 2004.

50