Redbox 2003 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

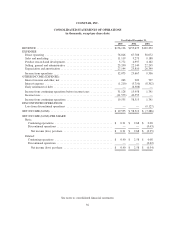

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

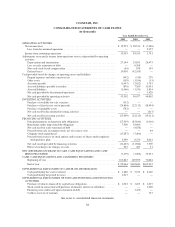

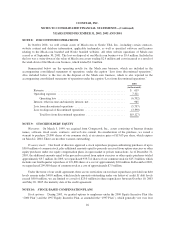

Year ended December 31,

2003 2002 2001

(in thousands, except per share data)

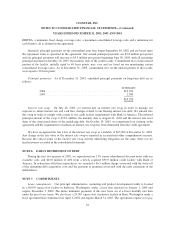

Net income (loss) as reported: ........................................ $19,555 $58,513 $ (7,386)

Add:

Total stock-based employee compensation expense included in the

determination of net income as reported, net of related tax effect ....... 17 558 195

Prior year’s tax effect recognized in 2002 ........................... — (263) —

17 295 195

Deduct:

Total stock-based employee compensation determined under fair value

based method for all awards, net of related tax effect ................ (5,053) (5,406) (4,867)

Prior year’s tax effect recognized in 2002 ........................... — 5,562 —

(5,053) 156 (4,867)

Pro forma net income (loss): .......................................... $14,519 $58,964 $(12,058)

Net income (loss) per share:

Basic:

As reported ............................................... $ 0.91 $ 2.68 $ (0.35)

Proforma ................................................ $ 0.68 $ 2.70 $ (0.58)

Diluted:

As reported ............................................... $ 0.90 $ 2.58 $ (0.34)

Proforma ................................................ $ 0.68 $ 2.59 $ (0.55)

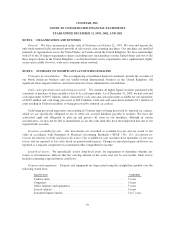

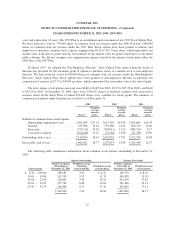

The fair value of stock options is estimated on the date of grant using the Black-Scholes option-pricing

model with the following assumptions: four to five year expected life from date of grant; annualized stock

volatility of 72%, 74% and 78% for 2003, 2002, and 2001, respectively; risk-free interest rates ranging from

2.1% to 4.9%; and no dividends during the expected term.

As required by SFAS No. 123, we determined that the weighted average fair value of options granted during

2003, 2002 and 2001 was $11.10, $15.07 and $14.52, respectively.

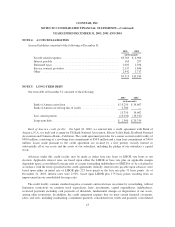

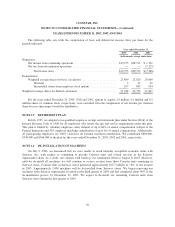

Income taxes: The Company accounts for income taxes under the asset and liability method as set forth in

SFAS No. 109, Accounting for Income Taxes, under which deferred income taxes are provided for the temporary

differences between the financial reporting basis and the tax basis of the Company’s assets and liabilities and

operating loss and tax credit carryforwards. A valuation allowance is established when necessary to reduce

deferred tax assets to the amount expected to be realized. Deferred tax assets and liabilities and operating loss

and tax credit carryforwards are measured using enacted tax rates expected to apply to taxable income in the

years in which those temporary differences and operating loss and tax credit carryforwards are expected to be

recovered or settled.

Use of estimates: The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date

of the financial statements and the reported amounts of revenues and expenses during the reporting period.

Actual results could differ from those estimates.

41