Redbox 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

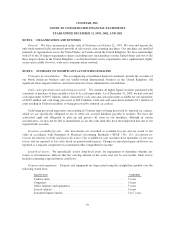

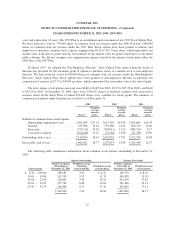

Deferred income tax assets and liabilities reflect the net tax effects of temporary differences between the

carrying amounts of assets and liabilities for financial reporting purposes and the carrying amounts used for

income tax purposes. Future tax benefits for net operating loss and tax credit carryforwards are also recognized to

the extent that realization of such benefits is more likely than not. Significant components of our deferred tax

assets and liabilities at December 31, 2003 and 2002 are as follows:

December 31,

2003 2002

(in thousands)

Depreciation and amortization ................................................. $(4,029) $ (5,093)

Net unrealized gains on investments ............................................. (692) —

Total deferred tax liabilities ................................................... (4,721) (5,093)

Tax loss and credit carry forwards .............................................. 42,989 55,501

Other ..................................................................... 1,138 806

Total deferred tax assets ...................................................... 44,127 56,307

Net deferred tax asset ........................................................ 39,406 51,214

Valuation allowance ......................................................... (580) (1,399)

$38,826 $49,815

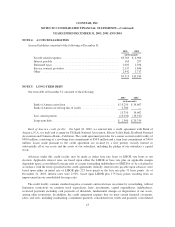

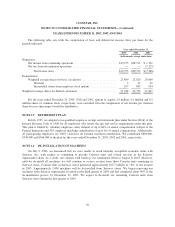

At December 31, 2003, we had approximately $111.5 million of net operating loss and credit carryforwards

that expire from the years 2006 to 2021. Changes in ownership, as defined by Section 382 of the Internal

Revenue Code, may limit the amount of net operating loss carryforwards used in any one year. The company also

has minimum and state tax credit carryforwards of approximately $1.0 million which are available to reduce

future federal and state regular income taxes, if any, over an indefinite period.

The valuation allowance on the U.S. deferred tax assets was eliminated in 2002 because current operations

indicate that realization of the related deferred tax asset is now more likely than not to occur. We maintained a

valuation allowance for net operating loss carryovers related to foreign operations. The net change in the

valuation allowance during the years ended December 31, 2003, 2002 and 2001 was $(0.8) million, $(52.2)

million and $9.4 million, respectively.

For tax purposes, the income tax benefit from stock compensation expense in excess of the amounts

recognized for financial reporting purposes at December 31, 2003 and 2002 credited to common stock was

approximately $0.3 million and $7.3 million, respectively. Of the 2002 benefit, approximately $3.9 million

related to stock option activity in 2002 and the remaining $3.4 million related to stock option activity which

occurred during the year ended December 31, 2001.

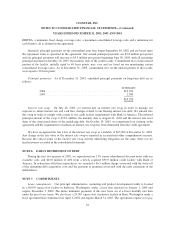

NOTE 12: INCOME (LOSS) PER SHARE

Basic net income (loss) per share is computed by dividing the net income (loss) available to common

stockholders for the period by the weighted average number of common shares outstanding during the period.

Diluted net income (loss) per share is computed by dividing the net income (loss) for the period by the weighted

average number of common and potential common shares outstanding (if dilutive) during the period. Potential

common shares, composed of incremental common shares issuable upon the exercise of stock options and

warrants, are included in the calculation of diluted net income (loss) per share to the extent such shares are

dilutive.

49