Redbox 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

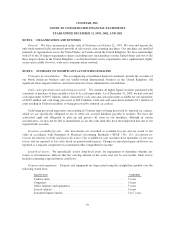

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

EBITDA, a minimum fixed charge coverage ratio, a maximum consolidated leverage ratio and a minimum net

cash balance, all as defined in the agreement.

Quarterly principal payments on the outstanding term loan began September 30, 2002 and are based upon

the repayment terms as specified in the agreement. Our current principal payments are $3.8 million per quarter

and our principal payments will increase to $4.3 million per quarter beginning June 30, 2004, with all remaining

principal and interest due May 20, 2005, the maturity date of the credit facility. Commitment fees on the unused

portion of the facility, initially equal to 40 basis points, may vary and are based on our maintaining certain

consolidated leverage ratios. As of December 31, 2003, commitment fees on the unused portion of the facility

were equal to 20 basis points.

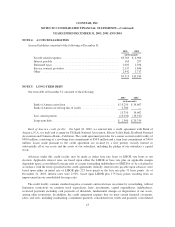

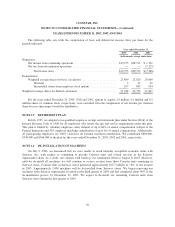

Principal payments: As of December 31, 2003, scheduled principal payments on long-term debt are as

follows:

(in thousands)

2004 ................................................... $13,250

2005 ................................................... 2,500

$15,750

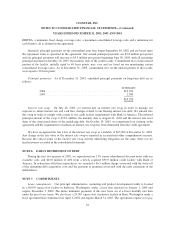

Interest rate swap: On July 26, 2002, we entered into an interest rate swap in order to manage our

exposure to future interest rate and cash flow changes related to our floating interest rate debt. We entered into

this swap in order to comply with certain of our credit facility requirements with Bank of America. The notional

principal amount of the swap is $10.0 million, the maturity date is August 21, 2004 and the interest rate reset

dates of the swap match those of the underlying debt. On October 10, 2003, we renegotiated our existing credit

agreement and the requirement to maintain an interest rate swap has been eliminated from the credit agreement.

We have recognized the fair value of the interest rate swap as a liability of $95,000 at December 31, 2003.

Any change in the fair value of the interest rate swap is reported in accumulated other comprehensive income.

Because the critical terms of the interest rate swap and the underlying obligation are the same, there was no

ineffectiveness recorded in the consolidated statements.

NOTE 6: EARLY RETIREMENT OF DEBT

During the first two quarters of 2002, we repurchased our 13% senior subordinated discount notes with our

available cash, and $43.0 million of debt from a newly acquired $90.0 million credit facility with Bank of

America. In connection with these repurchases, we recorded a $6.3 million charge associated with the write-off

of the remaining debt acquisition costs and the payment of premium associated with the early retirement of the

indebtedness.

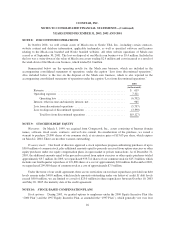

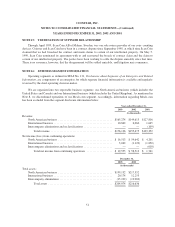

NOTE 7: COMMITMENTS

Lease commitments: Our principal administrative, marketing and product development facility is located

in a 46,070 square foot facility in Bellevue, Washington, under a lease that renewed on January 1, 2004 and

expires December 1, 2009. The future minimum payments of this new lease are at a lower monthly rate than

under the prior lease terms. We also lease a 24,367 square foot warehouse facility in Kent, Washington under a

lease agreement that commenced on April 1, 2002 and expires March 31, 2005. The agreements require us to pay

44