Redbox 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On July 26, 2002, we entered into an interest rate swap in order to manage our exposure to future interest

rate and cash flow changes related to our floating interest rate debt. We entered into this swap in order to comply

with certain of our credit facility requirements with Bank of America. The notional principal amount of the swap

is $10.0 million, the maturity date is August 21, 2004 and the interest rate reset dates of the swap match those of

the underlying debt. On October 10, 2003, we renegotiated our existing credit agreement and the requirement to

maintain an interest rate swap has been eliminated from the credit agreement.

The fair value of the interest rate swap at December 31, 2003 resulted in a liability of approximately

$95,000. Any change in the fair value of the interest rate swap is reported in accumulated other comprehensive

income. Because the critical terms of the interest rate swap and the underlying obligation are the same, there was

no ineffectiveness recorded in the consolidated statements.

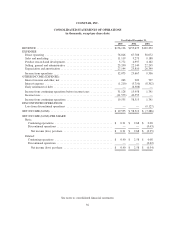

Item 8. Financial Statements and Supplementary Data.

See Item 15 for an index to the financial statements and supplementary data required by this item.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

On September 8, 2003, the Audit Committee of Coinstar dismissed Deloitte & Touche LLP and engaged

KPMG LLP as our independent auditors for 2003. Additional information regarding our change in auditors can

be found in our current report on Form 8-K filed with the SEC on September 9, 2003. There have been no

disagreements between Coinstar and our accountants on any matter of accounting principles or practices or

financial statement disclosure.

Item 9A. Controls and Procedures.

We maintain a set of disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e)) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), designed to ensure that information required

to be disclosed in our filings under the Exchange Act is recorded, processed, summarized and reported within the

time periods specified in the Securities and Exchange Commission’s rules and forms. Management, with the

participation of our chief executive officer and chief financial officer, has evaluated the effectiveness of the

design and operation of our disclosure controls and procedures as of the end of the period covered by this report

and has determined that such disclosure controls and procedures are effective.

We also maintain a system of internal control over financial reporting (as defined in Rules 13a-15(f) and

15d-15(f) of the Exchange Act). No changes in our internal control over financial reporting occurred during the

fiscal quarter ended December 31, 2003 that have materially affected, or are reasonably likely to materially

affect, our internal control over financial reporting.

27