Redbox 2003 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Seasonality

Our coin processing volumes appear to be affected by seasonality. In particular, coin processing volumes

generally have been lowest in the first quarter of the year and volumes generally have been highest in the third

quarter, followed by the fourth quarter of the year. There can be no assurance, however, that the seasonal trends

we have historically experienced will continue. Any projections of future seasonality are inherently uncertain due

to the lack of comparable companies engaged in the coin processing business.

In addition to fluctuations in revenue resulting from factors affecting customer usage, the timing of unit

installations or de-installations may result in significant fluctuations in quarterly results. The rate of installations

does not follow a regular pattern, as it depends principally on installation schedules determined by agreements

between us and our retail partners, variable length of partner trial periods and the planned coordination of

multiple partner installations in a given geographic region.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

We are subject to the risk of fluctuating interest rates in the normal course of business, primarily as a result

of our credit agreement with Bank of America and investment activities that generally bear interest at variable

rates. Because our investments have maturities of three months or less, and our credit facility interest rates are

based upon either the LIBOR or base rate plus an applicable margin, we believe that the risk of material loss is

low and that the carrying amount approximates fair value.

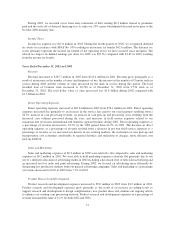

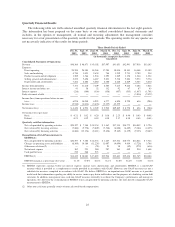

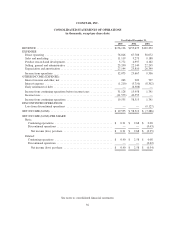

The table below presents principal amounts, at book value, by year of maturity and related weighted average

interest rates.

Liabilities* Expected Maturity Date December 31, 2003

(in thousands) 2004 2005 2006 2007 2008 Total Fair Value

Long-term debt:

Variable rate ........................... $13,250 $2,500 — — — $15,750 $15,750

Average interest rate ..................... 3.19% 4.00% — — — 3.43%

Interest rate derivatives:

Interest rate swaps:

Variable to fixed ........................ $10,000 — — — — $10,000 $ 95

Average pay rate ...................... 2.50% — — — — 2.50%

Average receive rate ................... 1.26% — — — — 1.26%

* Interest rates may increase or decrease based on the fluctuations in the LIBOR rate as well as Coinstar’s

consolidated leverage ratio. Currently our interest rates are based on LIBOR plus 175 basis points. We have

entered into an interest rate swap covering $10.0 million of our long-term debt. Please refer to the following

discussion about the interest rate swap.

We have entered into variable-rate debt and a variable to fixed interest rate swap that, at December 31,

2003, had outstanding balances of $15.8 million and $10.0 million respectively. Based on our variable-rate

obligations outstanding at December 31, 2003, an increase or decrease of 1.0% in interest rates would,

respectively, increase or decrease our annual interest expense and related cash payments by approximately

$26,000. Such potential increases or decreases are based on certain simplifying assumptions, including minimum

quarterly principal repayments made on variable-rate debt for all maturities and an immediate, across-the-board

increase or decrease in the level of interest rates with no other subsequent changes for the remainder of the

periods.

26