Redbox 2003 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

accordance with the terms specified in the credit agreement). Initially, interest rates payable upon advances were based

upon either an initial rate of LIBOR plus 225 basis points or the base rate plus 75 basis points. Since January 15, 2003,

we qualify for an interest rate of LIBOR plus 175 basis points or the base rate plus 25 basis points.

The credit facility contains standard negative covenants and restrictions on actions by us including, without

limitation, activity relating to our common stock repurchases, liens, investments, capital expenditures, indebtedness,

restricted payments including cash payments of dividends, and fundamental changes or dispositions of our assets,

among other restrictions. In addition, the credit agreement requires that we meet certain financial covenants, ratios and

tests, including maintaining a minimum quarterly consolidated net worth, a minimum fixed charge coverage ratio,

minimum quarterly EBITDA, a maximum consolidated leverage ratio and a minimum net cash balance, all as defined

in the agreement. As of December 31, 2003, we were in compliance with all covenants under the credit facility.

Quarterly principal payments on the outstanding term loan began on September 30, 2002 and are based upon the

repayment terms as specified in the agreement. To date we have made payments on principal balances of $26.8 million

which includes our scheduled quarterly payments as well as additional payment totaling $5.0 million. Our principal

payments are currently $3.8 million per quarter and ultimately will increase to $4.3 million per quarter beginning

June 30, 2004, with all remaining principal and interest due May 20, 2005. Commitment fees on the unused portion of

the facility, initially equal to 40 basis points, may vary and are based on our maintaining certain consolidated leverage

ratios. Our commitment fee on the unused portion of the facility is currently equal to 20 basis points.

As of December 31, 2003, our deferred income tax assets totaled $38.8 million. In the year ended December 31,

2003, we recorded $11.6 million in income tax expense, which, as a result of our NOL carryforwards, will not result in

cash payments for income taxes other than those required by some states and alternative minimum taxes.

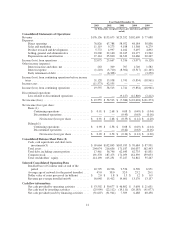

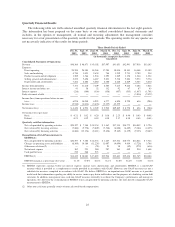

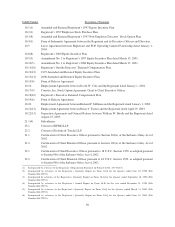

The tables below summarize our contractual obligations and other commercial commitments as of

December 31, 2003:

Payments Due by Period

Contractual Obligations

As of December 31, 2003 Total

Less than 1

year

1-3

years

4-5

years

After 5

years

(in thousands)

Long-term debt ................................ $15,750 $13,250 $2,500 $ — $ —

Capital lease obligations ........................ 1,840 1,005 835 — —

Operating leases ............................... 2,773 568 847 890 468

Purchaseobligations* .......................... 10,149 10,149 — — —

Total contractual cash obligations ................. $30,512 $24,972 $4,182 $890 $468

* Purchase obligations consist of outstanding purchase orders issued in the ordinary course of our business.

Amount of Commitment Expiration Per Period

Other Commercial Commitments

As of December 31, 2003 Total

Less than 1

year

1-3

years

4-5

years

After 5

years

(in thousands)

Letters of credit ................................. $11,246 $11,056 $190 $— $—

Total commercial commitments .................... $11,246 $11,056 $190 $— $—

We believe existing cash, cash equivalents, short-term investments and amounts available to us under our

credit facility will be sufficient to fund our cash requirements and capital expenditure needs for at least the next

12 months. After that time, the extent of additional financing needed, if any, will depend on the success of our

business. If we significantly increase installations beyond planned levels, or if unit coin processing volumes

generated are lower than historical levels, our cash needs may increase. Furthermore, our future capital requirements

will depend on a number of factors, including customer usage, the timing and number of installations, the number of

available Coinstar units held in inventory, the type and scope of service enhancements, the cost of developing

potential new product and service offerings and enhancements and potential future acquisitions.

24