Redbox 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

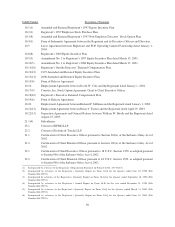

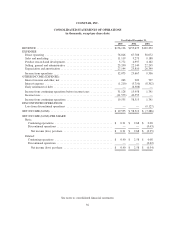

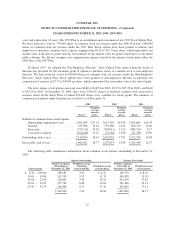

COINSTAR, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands, except share data)

Common Stock Accumulated

Deficit

Treasury

Stock

Accumulated

Other

Comprehensive

Income (Loss) Total

Comprehensive

Income (Loss)Shares Amount

BALANCE, December 31, 2000 ..... 20,388,705 $161,339 $(126,480) $ — $ (17) $ 34,842

Issuance of common stock .......... 3,324 64 64

Issuance of shares under employee

stockpurchaseplan.............. 54,319 760 760

Exercise of stock options, net ........ 867,697 7,701 7,701

Net exercise of common stock

warrants ....................... 36,955 — —

Stock issued in connection with

purchase of minority interest of

subsidiary ..................... 52,656 1,000 1,000

Stock-based compensation expense . . . 195 195

Comprehensive loss:

Netloss ....................... (7,386) (7,386) $ (7,386)

Foreign currency translation

adjustments .................. 51 51 51

Totalcomprehensiveloss: .......... $ (7,335)

BALANCE, December 31, 2001 ..... 21,403,656 171,059 (133,866) 34 37,227

Issuance of shares under employee

stockpurchaseplan.............. 39,325 816 816

Exercise of stock options, net ........ 688,253 7,445 7,445

Stock-based compensation expense . . . 610 893 893

Tax benefit on options and employee

stockpurchaseplan.............. 7,260 7,260

Repurchaseofcommonstock........ (299,500) (7,496) (7,496)

Comprehensive income:

Netincome .................... 58,513 58,513 $58,513

Foreign currency translation

adjustments .................. 741 741 741

Interest rate swap on long-term

debt ........................ (148) (148) (148)

Totalcomprehensiveincome:........ $59,106

BALANCE, December 31, 2002 ..... 21,832,344 187,473 (75,353) (7,496) 627 105,251

Issuance of shares under employee

stockpurchaseplan.............. 70,728 960 960

Exercise of stock options, net ........ 256,304 2,696 2,696

Stock-based compensation expense . . . 2,649 43 43

Non-cash stock-based compensation . . (65) (65)

Tax benefit on options and employee

stockpurchaseplan.............. 263 263

Repurchaseofcommonstock........ (933,714) (15,287) (15,287)

Comprehensive income:

Netincome .................... 19,555 19,555 $19,555

Short-term investments net of tax

expenseof$6 ................ 10 10 10

Foreign currency translation

adjustments net of tax expense of

$722 ....................... 676 676 676

Interest rate swap on long-term debt

net of tax benefit of $36 ........ 88 88 88

Totalcomprehensiveincome:........ $20,329

BALANCE, December 31, 2003 ..... 21,228,311 $191,370 $ (55,798) $(22,783) $1,401 $114,190

See notes to consolidated financial statements

37