Redbox 2003 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

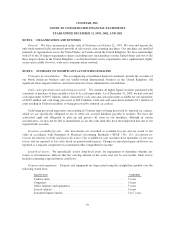

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

a portion of operating costs and minimum monthly payments, which escalate annually, based on a stated

schedule. Each agreement allows us to renew each lease for one consecutive period of five years and three years,

respectively.

We have entered into capital lease agreements to finance the acquisition of certain automobiles. We retain

title to such assets. These capital leases have terms of 36 months at imputed interest rates that range from 4.1% to

11.7%. Assets under capital lease obligations aggregated $4.0 million and $4.3 million, net of $1.8 million and

$1.6 million of accumulated amortization, at December 31, 2003 and 2002, respectively.

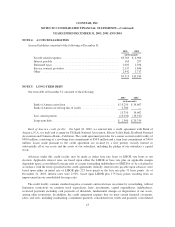

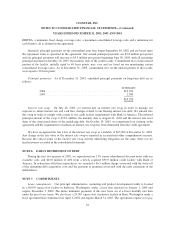

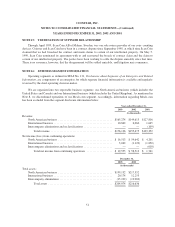

A summary of our minimum lease obligations at December 31, 2003 is as follows:

Capital

Leases

Operating

Leases

(in thousands)

2004 ...................................................... $1,005 $ 568

2005 ...................................................... 735 425

2006 ...................................................... 100 422

2007 ...................................................... — 422

2008 ...................................................... — 468

Thereafter .................................................. — 468

Total minimum lease commitments .............................. 1,840 $2,773

Less amounts representing interest .............................. (129)

Present value of lease obligation ................................ 1,711

Less current portion .......................................... (938)

Long-term portion ........................................... $ 773

Rental expense was $1.4 million for each of the years ended December 31, 2003, 2002 and 2001,

respectively.

Purchase commitments: We have entered into certain purchase agreements with suppliers of Coinstar

units, which in aggregate total purchase commitments of $10.1 million in 2004.

Concentration of suppliers: We currently buy a significant component of the Coinstar unit from two

suppliers. Although there are a limited number of suppliers for the component, we believe that other suppliers

could provide similar equipment, which may require certain modifications. Accordingly, a change in suppliers

could cause a delay in manufacturing and a possible slow-down of growth, which could have a materially

adverse affect on future operating results.

Letter of credit: As of December 31, 2003, we had five irrevocable letters of credit that totaled $11.2

million. These letters of credit, which expire at various times through May 31, 2005, are available to collateralize

certain obligations to third parties. We expect to renew these letters of credit and have an agreement with Bank of

America to automatically renew one of the letters of credit, in three-month increments, through December 31,

2004. As of December 31, 2003, no amounts were outstanding under these letters of credit agreements.

45