Redbox 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Selling, General and Administrative

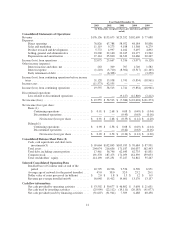

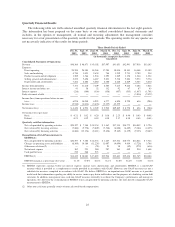

Selling, general and administrative expenses decreased to $22.1 million in 2002 from $22.2 million in 2001.

Selling, general and administrative expenses decreased primarily as a result of decreased consulting expense and

professional fees, including consulting expense and professional fees incurred during 2001 associated with our

analysis of strategic business alternatives performed by JP Morgan, and other infrequent or non-recurring

expenses incurred during 2001. These decreased expenses were partially offset by increased expenses associated

with non-cash stock option compensation for retiring executives and board members, as well as increased

insurance expense. Selling, general and administrative expenses as a percentage of revenue decreased to 14.2%

in 2002 from 17.2% in 2001.

Depreciation and Amortization

Depreciation and amortization expense decreased to $25.8 million in 2002 from $26.3 million in 2001.

Depreciation expense declined primarily due to the net decrease in the number of Coinstar units being

depreciated. A greater number of Coinstar units became fully depreciated between December 31, 2001 and

December 31, 2002 than were newly installed in the same period. Depreciation and amortization as a percentage

of revenue decreased to 16.6% in 2002 from 20.4% in 2001.

Other Income and Expense

Interest income and other, net, decreased to $309,000 in 2002 from $707,000 in 2001. The decrease,

primarily in interest income, was attributed to lower interest rates earned on investments in the year ended

December 31, 2002 than in the prior year.

Interest expense decreased to $3.7 million in 2002 from $8.3 million in 2001. The decrease was attributed to

the repurchase of $61.0 million of our 13% senior subordinated discount notes during the first half of 2002. The

long term debt was retired using cash and $43.0 million of term and revolving debt from a new $90.0 million

credit facility provided by a syndicate of financial institutions led by Bank of America. The combination of

greatly reduced interest rates and the decreased amount of outstanding debt during 2002 resulted in the $4.6

million decrease of interest expense in 2002. As of December 31, 2002, we had $34.7 million of long-term debt

outstanding under our credit facility.

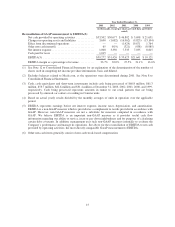

We had accounted for the loss from early retirement of debt as an extraordinary item in 2002. However, in

accordance with SFAS No. 145, Rescission of FASB Statements No. 4, 44, 64, Amendment of FASB Statement

No. 13, and Technical Corrections, we have reclassified the losses associated with our early retirement of debt

within the other income and expense section of our consolidated statements of operations. These 2002 expenses

are related to premiums paid and the write-off of deferred financing fees to retire our 13% senior subordinated

discount notes prior to the October 2006 maturity date.

Income Tax Benefit

During the fourth quarter of 2002, we recognized deferred tax assets resulting in an income tax benefit $42.6

million. The deferred tax assets primarily represent the income tax benefit of net operating losses we have

incurred since inception. As required by SFAS No. 109, Accounting for Income Taxes, we did not recognize any

tax assets on our balance sheet until it was “more likely than not” that the tax assets would be realized on future

tax returns. Based upon a review of historical operating performance and our expectation that we will generate

sustainable consolidated net income for the foreseeable future, we accordingly recognized an income tax benefit

of $42.6 million in the fourth quarter of 2002.

Liquidity and Capital Resources

As of December 31, 2003, we had cash, cash equivalents and cash being processed totaling $99.7 million,

which consisted of cash and cash equivalents available to fund our operations of $38.9 million and cash being

22