Redbox 2003 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

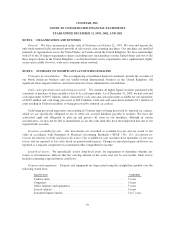

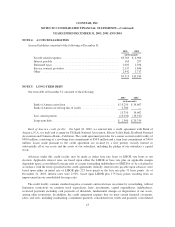

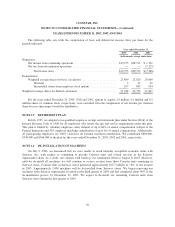

NOTE 4: ACCRUED LIABILITIES

Accrued liabilities consisted of the following at December 31:

2003 2002

(in thousands)

Payroll related expenses ....................................... $3,769 $ 4,964

Interest payable .............................................. 163 297

Estimated taxes .............................................. 1,002 1,356

Service contract providers ...................................... 2,137 1,846

Other ...................................................... 2,442 1,717

$9,513 $10,180

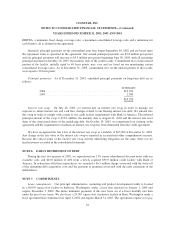

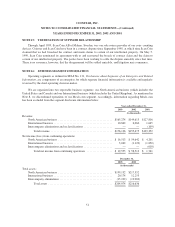

NOTE 5: LONG-TERM DEBT

Our term debt at December 31 consisted of the following:

2003 2002

(in thousands)

Bank of America term loan .................................. $13,250 $34,667

Bank of America revolving line of credit ........................ 2,500 —

15,750 34,667

Less current portion ........................................ (13,250) (13,917)

Long-term debt ............................................ $ 2,500 $20,750

Bank of America credit facility: On April 18, 2002, we entered into a credit agreement with Bank of

America, N.A., for itself and as agent for US Bank National Association, Silicon Valley Bank, KeyBank National

Association and Comerica Bank—California. The credit agreement provides for a senior secured credit facility of

$90.0 million, consisting of a revolving loan commitment of $50.0 million and a term loan commitment of $40.0

million. Loans made pursuant to the credit agreement are secured by a first priority security interest in

substantially all of our assets and the assets of our subsidiary, including the pledge of our subsidiary’s capital

stock.

Advances under this credit facility may be made as either base rate loans or LIBOR rate loans at our

election. Applicable interest rates are based upon either the LIBOR or base rate plus an applicable margin

dependent upon a consolidated leverage ratio of certain outstanding indebtedness to EBITDA (to be calculated in

accordance with the terms specified in the credit agreement). Initially, interest rates payable upon advances were

based upon either an initial rate of LIBOR plus 225 basis points or the base rate plus 75 basis points. As of

December 31, 2003, interest rates were 2.92%, based upon LIBOR plus 175 basis points resulting from an

improvement in our consolidated leverage ratio.

The credit facility contains standard negative covenants and restrictions on actions by us including, without

limitation, restrictions on common stock repurchases, liens, investments, capital expenditures, indebtedness,

restricted payments including cash payments of dividends, fundamental changes or dispositions of our assets,

among other restrictions. In addition, the credit agreement requires that we meet certain financial covenants,

ratios and tests, including maintaining a minimum quarterly consolidated net worth and quarterly consolidated

43