Redbox 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

Product research and development: Costs incurred for product research and development activities are

expensed as incurred. Software development costs are required to be capitalized when a product’s technological

feasibility has been established through the date the product is available for release.

Impairment of intangible assets: We assess the impairment of intangibles and long-lived assets whenever

events or changes in circumstances indicate that the carrying value may not be recoverable. Intangible assets are

also reviewed for impairment annually or whenever events or changes in circumstances indicate that the carrying

value may not be recoverable. Factors considered important that could trigger an impairment review include

significant underperformance relative to expected historical or projected future operating results, changes in the

manner of our use of the acquired assets and the strategy for our overall business and negative industry or

economic trends.

Loss from early retirement of debt: We accounted for the loss from early retirement of debt as an

extraordinary item in fiscal year 2002. As of January 1, 2003, we have included losses from early retirement of

debt within the other income and expense section of our consolidated statements of operations. The new method

of accounting for loss on early retirement of debt is the result of adopting SFAS No. 145, Rescission of FASB

Statements No. 4, 44, 64, Amendment of FASB Statement No. 13, and Technical Corrections. Prior year financial

statements have been restated to apply the new method retroactively in accordance with the standard.

Recent accounting pronouncements: In June 2002, the FASB issued SFAS No. 146, Accounting for Costs

Associated with Exit or Disposal Activities. SFAS No. 146 addresses significant issues regarding the recognition,

measurement, and reporting of costs that are associated with exit and disposal activities, including restructuring

activities and employee termination costs. We adopted SFAS No. 146 on January 1, 2003, the date this statement

became effective. On September 3, 2003, we announced a change in our workforce that included eliminating

approximately 50 positions across our organization. This resulted in a charge to operations of approximately

$600,000 for severance costs and termination benefits.

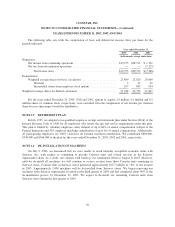

NOTE 3: ACQUISITION

On February 6, 2003, we acquired substantially all of the assets and assumed certain liabilities of Prizm

Technologies, Inc., a privately held corporation. Prizm’s proprietary technology allows consumers to conduct

a range of automated prepaid wireless transactions at its TOP-UP™terminals, such as adding minutes to a

prepaid wireless handset. The purchase was accounted for as a business combination under the provisions of

SFAS No. 141, Business Combinations. The fair value of the assets acquired and liabilities assumed were

included in our financial statements as of February 6, 2003, the acquisition date. The purchase price of this

acquisition does not have a material impact on our consolidated financial position. In June 2003, we entered

into an agreement with the shareholders of Prizm pursuant to which they agreed to relinquish any claims for

additional consideration in connection with the “earn-out” provisions in the asset purchase agreement in

exchange for a maximum payment of $400,000 contingent on meeting certain terms and conditions through

the end of the year. These terms and conditions were met as of December 31, 2003 and we subsequently paid

$400,000 to the shareholders of Prizm. In accordance with SFAS No. 142, Goodwill and Other Intangible

Assets, we have tested the intangible balance for impairment and determined the asset balance is not impaired.

42