Redbox 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2003, 2002 AND 2001

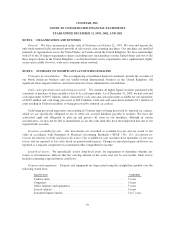

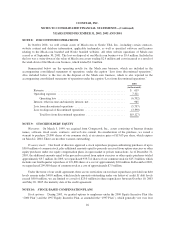

years and expire after 10 years. The 1997 Plan is an amendment and restatement of our 1992 Stock Option Plan.

We have reserved a total of 770,000 shares of common stock for issuance under the 2000 Plan and 4,380,000

shares of common stock for issuance under the 1997 Plan. Stock options have been granted to officers and

employees to purchase common stock at prices ranging from $0.25 to $32.79 per share, which represented fair

market value at the date of grants and our best estimate of fair market value for grants issued prior to our initial

public offering. We did not recognize any compensation expense related to the options issued under either the

2000 Plan or the 1997 Plan.

In March 1997, we adopted the Non-Employee Directors’ Stock Option Plan, under which the board of

directors has provided for the automatic grant of options to purchase shares of common stock to non-employee

directors. We have reserved a total of 400,000 shares of common stock for issuance under the Non-Employee

Directors’ Stock Option Plan. Stock options have been granted to non-employee directors to purchase our

common stock at prices of $7.75 to $30.00 per share, which represented the fair market value at the date of grant.

The price ranges of all options exercised were $0.40 to $18.93 in 2003, $0.25 to $25.78 in 2002, and $0.40

to $19.25 in 2001. At December 31, 2003, there were 3,204,132 shares of unissued common stock reserved for

issuance under all the Stock Plans of which 893,642 shares were available for future grants. The numbers of

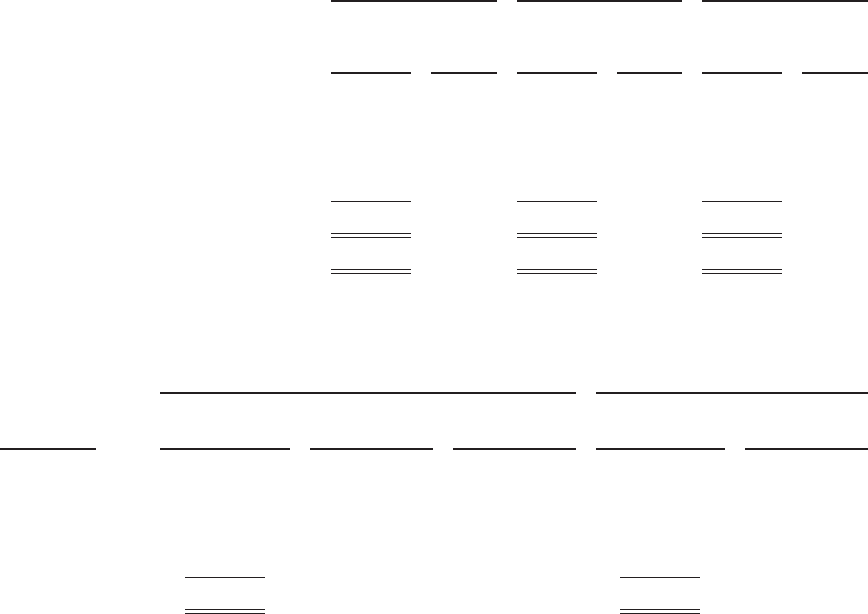

common stock options under the plans are as follows as of December 31:

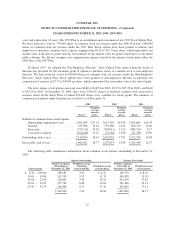

2003 2002 2001

Shares

Weighted

average

exercise

price Shares

Weighted

average

exercise

price Shares

Weighted

average

exercise

price

Number of common shares under option:

Outstanding, beginning of year ...... 2,692,054 $17.91 2,912,350 $14.98 3,025,664 $11.03

Granted......................... 187,038 19.16 559,280 24.31 856,749 22.66

Exercised ....................... (272,114) 10.92 (705,012) 11.25 (888,724) 9.17

Canceled or expired ............... (296,488) 21.12 (74,564) 13.58 (81,339) 12.39

Outstanding, end of year ............... 2,310,490 18.43 2,692,054 17.91 2,912,350 14.98

Exercisable, end of year ................ 1,465,062 16.77 1,247,653 14.89 1,201,548 11.57

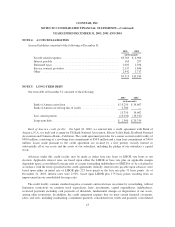

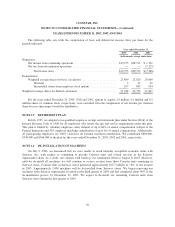

The following table summarizes information about common stock options outstanding at December 31,

2003:

Options Outstanding Options Exercisable

Exercise price

Number of options

outstanding at

December 31, 2003

Weighted average

remaining

contractual life

Weighted average

exercise price

Number of options

exercisable at

December 31, 2003

Weighted average

exercise price

$ 0.70 – $10.00 138,287 3.95 $ 8.47 136,770 $ 8.45

10.01 – 14.00 511,333 5.55 11.35 486,305 11.34

14.01 – 22.00 726,603 7.49 18.23 414,239 17.89

22.01 – 23.50 737,769 8.46 23.04 282,146 23.13

23.50 – 32.79 196,498 8.27 27.26 145,602 27.21

2,310,490 7.23 18.43 1,465,062 16.77

47