Qantas 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

QANTAS ANNUAL REPORT 2015

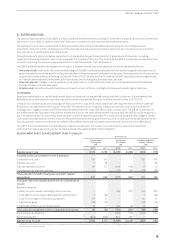

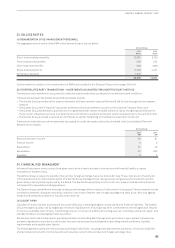

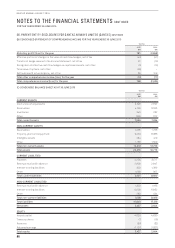

(D) CAPITAL EXPENDITURE COMMITMENTS

Qantas’ capital expenditure commitments as at 30 June 2015 are $10,051 million (2014: $8,622 million). Qantas has certain rights

within its aircraft purchase contracts which can reduce or defer the above capital expenditure.

Qantas’ capital expenditure commitments are predominantly denominated in US dollars. Disclosures outlined above are translated

to Australian dollar presentational currency at the 30 June 2015 closing exchange rate of $0.77 (30 June 2014: $0.94).

(E) FINANCING FACILITIES

The financing facilities held by the parent entity are the same as those held by the Group as disclosed in Note 27(B).

(F) CONTINGENT LIABILITIES

The contingent liabilities held by the parent entity are the same as those held by the Group as disclosed in Note 30.

(G) PARENT ENTITY GUARANTEES IN RESPECT OF DEBTS OF ITS SUBSIDIARIES

The parent entity has entered into a Deed of Cross Guarantee with the effect that the Company guarantees debts in respect of its

subsidiaries. Further details of the Deed of Cross Guarantee and the subsidiaries subject to the Deed are disclosed in Note 32.

(H) INTEREST-BEARING LIABILITIES

The parent entity has total interest-bearing liabilities of $6,979 million (2014: $8,241 million), of which $3,185 million (2014: $3,532million)

represent lease and hire purchase liabilities payable to controlled entities. Of the $3,794 million (2014: $4,709 million) payable to

other parties, $2,128 million (2014: $2,314 million) represents secured bank loans and lease liabilities with the remaining balance

representing unsecured loans and deferred lease benefits.

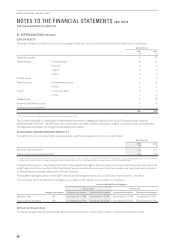

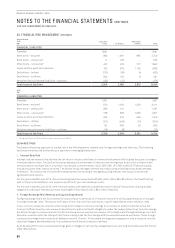

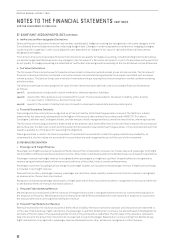

37. SIGNIFICANT ACCOUNTING POLICIES

Except for the changes explained in Note 38, the Group has consistently applied the following accounting policies to all periods

presented in these consolidated financial statements.

(A) PRINCIPLES OF CONSOLIDATION

i. Business Combinations

All business combinations are accounted for by applying the acquisition method. Goodwill represents the difference between

the cost of the acquisition and the fair value of the net identifiable assets acquired. Negative goodwill arising on an acquisition

is recognised directly in the Consolidated Income Statement. Transaction costs are expensed as incurred. Any contingent

consideration is measured at fair value at the date of acquisition.

ii. Controlled Entities

Controlled entities are entities controlled by the Group. Control exists when the Group is exposed to or has rights to, variable returns

from its involvement with the entity and has the ability to affect those returns through its power over the entity.

The Financial Statements of controlled entities are included in the Consolidated Financial Statements from the date that control

commences until the date that control ceases.

iii. Non-controlling Interests

Non-controlling interests in the results and equity of controlled entities are shown separately in the Consolidated Income Statement,

Consolidated Statement of Comprehensive Income, Consolidated Statement of Changes in Equity and Consolidated Balance Sheet.

iv. Loss of Control

When the Group loses control over a controlled entity, it derecognises the assets and liabilities of the controlled entity and any

related non-controlling interest and other components of equity. Any resulting gain or loss on sale is recognised in the Consolidated

Income Statement. Any interest retained in the former controlled entity is measured at fair value when control is lost and depending

on the nature of the retained interest, is recognised as either an investment accounted for under the equity method where the Group

retains significant influence or as a financial asset.

v. Equity Accounted Investments

Associates are those entities in which the Group has significant influence, but not control or joint control, over the financial and

operating policies. Investments in associates are accounted for under the equity accounting method. The investments are carried

atthe lower of the equity accounted amount and the recoverable amount.