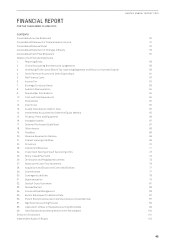

Qantas 2015 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

QANTAS ANNUAL REPORT 2015

1. REPORTING ENTITY

Qantas Airways Limited (Qantas) is a for-profit company limited by shares, incorporated in Australia whose shares are publicly traded

on the Australian Securities Exchange (ASX) and which is subject to the operation of the Qantas Sale Act 1992.

The Consolidated Financial Statements for the year ended 30 June 2015 comprise Qantas and its controlled entities (together

referred to as the Qantas Group) and the Qantas Group’s interest in investments accounted for under the equity method.

Qantas has five subsidiaries that are material to the Qantas Group in 2015 and 2014. The Parent has majority voting rights in

respectof each of the material subsidiaries. Materiality has been assessed based on the contribution of statutory profit/(loss)

totheQantas Group.

The Consolidated Financial Statements of Qantas for the year ended 30 June 2015 were authorised for issue in accordance with a

resolution of the Directors on 28 August 2015.

(A) STATEMENT OF COMPLIANCE

The Consolidated Financial Statements are general purpose financial statements which have been prepared in accordance with

Australian Accounting Standards (AASBs) adopted by the Australian Accounting Standards Board (AASB) and with the Corporations

Act 2001. The Consolidated Financial Statements also comply with International Financial Reporting Standards and interpretations

(IFRICs) adopted by the International Accounting Standards Board (IASB).

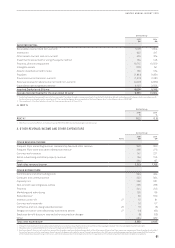

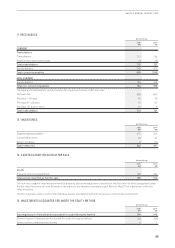

(B) BASIS OF PREPARATION

The Consolidated Financial Statements are presented in Australian dollars, which is the functional currency of the Qantas Group,

and have been prepared on the basis of historical cost except for the following material items in the Consolidated Balance Sheet:

–Derivatives at fair value through profit and loss are measured at fair value

–Assets classified as held for sale are measured at lower of cost and fair value less costs to sell

–Net defined benefit asset/(liability) are measured at fair value of plan assets less the present value of the defined benefit

obligation

Qantas is a company of the kind referred to in Australian Securities and Investments Commission (ASIC) Class Order 98/100 dated

10July 1998. In accordance with that Class Order, all financial information presented has been rounded to the nearest million dollars,

unless otherwise stated.

Details of the Qantas Group’s accounting policies, including changes during the year are included in Notes 37 and 38.

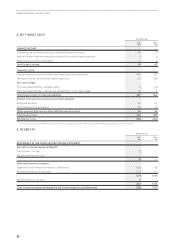

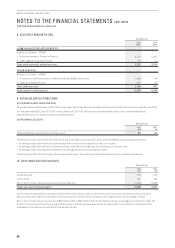

2. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of the Consolidated Financial Statements requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and reported amounts of assets, liabilities, income and expenses. The estimates

and associated assumptions are based on historical experience and various other factors that are believed to be reasonable under

the circumstances, the results of which form the basis for making the judgements about carrying values of assets and liabilities that

are not readily apparent from other sources. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised and in any future periods affected. Judgements made by management in the application

of AASBs that have a significant effect on the Consolidated Financial Statements and estimates with a significant risk of material

adjustment in future periods are included in the following notes:

–Note 22 – Provisions

–Note 24 – Impairment Testing of Cash Generating Units

–Note 31 – Superannuation

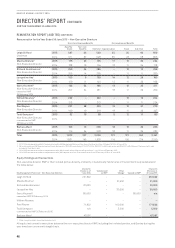

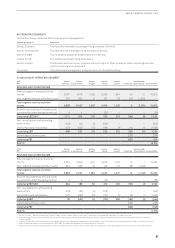

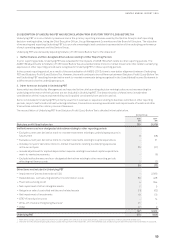

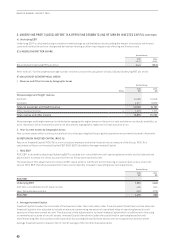

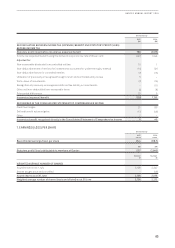

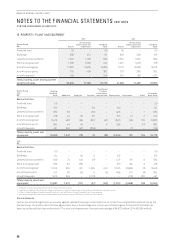

3. UNDERLYING PROFIT/(LOSS) BEFORE TAX,OPERATING SEGMENTS AND RETURN ON INVESTED CAPITAL

(A) UNDERLYING PROFIT/(LOSS) BEFORE TAX (UNDERLYING PBT)

Underlying PBT is the primary reporting measure used by the Qantas Group’s chief operating decision-making bodies, being the Chief

Executive Officer, Group Management Committee and the Board of Directors, for the purpose of assessing the performance of the Group.

The primary reporting measure of the Qantas Domestic, Qantas International, Qantas Freight, Jetstar Group and Qantas Loyalty

operating segments is Underlying EBIT. The primary reporting measure of the Corporate segment is Underlying PBT as net finance

costs are managed centrally and are not allocated to Qantas Domestic, Qantas International, Qantas Freight, Jetstar Group and

Qantas Loyalty operating segments.

Refer to Note 3(D) for a description of Underlying PBT and reconciliation from Statutory profit/(loss) before tax.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 30 JUNE 2015