Qantas 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

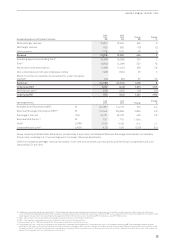

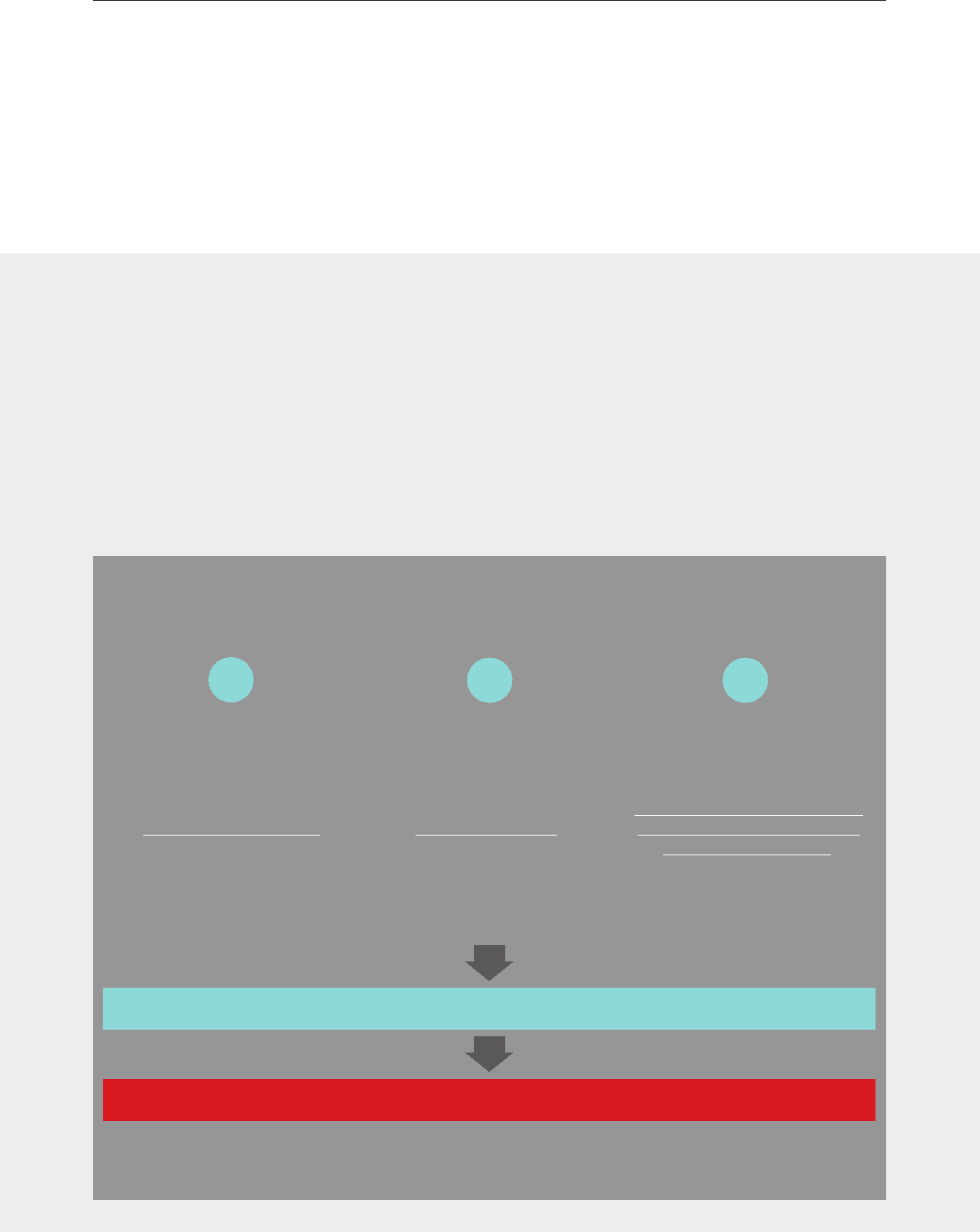

The Financial Framework for a Stronger Qantas Group

At the 2015 Qantas Investor Day,

we outlined the financial framework

that guides the Group’s thinking

on shareholder value creation,

our optimal capital structure, and

capital allocation.

The three pillars of the financial

framework are supported by

measureable targets, aligned

with those of our shareholders.

Our overarching objective is

maintainable earnings per share

growth over the cycle, to deliver

total shareholder returns (TSR) in

the top quartile of the ASX100 and a

peer group of global listed airlines3.

Maintaining an optimal capital

structure, consistent with

investment grade-level leverage

metrics, will minimise Qantas’ cost

of capital. Delivering return on

invested capital above our weighted

average cost of capital will ensure

we can continue to reinvest in our

business for sustainable returns.

And by growing the Group’s invested

capital over time, and returning

surplus capital to shareholders, we

will continue to create long-term

value for our shareholders.

MAINTAINING AN

OPTIMAL CAPITAL

STRUCTURE

ROIC > WACC

THROUGH THE CYCLE

DISCIPLINED

ALLOCATION OF CAPITAL

Target: minimise WACC Target: ROIC > 10%1

Target: grow Invested Capital

with disciplined investment,

return surplus capital

2014/2015: >$1 billion debt

reduction, return to optimal

capital structure

2014/2015: ROIC of 16% 2014/2015: Proposed

$505 million capital return

MAINTAINABLE EPS2 GROWTH OVER THE CYCLE

TOTAL SHAREHOLER RETURNS IN THE TOP QUARTILE3

Financial Framework Aligned with Shareholder Objectives

Enhancing long-term shareholder value

12 3

1 Target of 10% ROIC allows ROIC to be greater than pre-tax WACC through the cycle.

2 Earnings Per Share.

3

Target Total Shareholder Returns with the top quartile of the ASX100 and global listed airline peer group as stated in the 2014/2015 Remuneration Report in reference

to the 2015–2017 LTIP.

07

QANTAS ANNUAL REPORT 2015