Qantas 2015 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

QANTAS ANNUAL REPORT 2015

that either no award will be made (as it did for the CEO in 2011/2012 and 2013/2014), only a partial award be

made (as it did in 2010/2011 and 2012/2013), or that any award will be entirely deferred and/or delivered in

Qantas shares (as it did in 2010/2011). On the other hand, there may be circumstances where performance is

below an agreed target; however, the Board determines that it is appropriate to pay some STIP award. While the

Board sees this balanced scorecard approach as an important design element of the STIP, it also recognises

that the overall STIP outcome must be considered in the context of the Group’s financial performance.

An individual’s performance is recognised via an Individual Performance Factor (IPF). IPFs are generally

in the range of 0.8 to 1.2, however in case of under-performance the IPF may be zero and in exceptional

circumstances the IPF may be as high as 1.5.

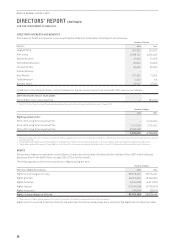

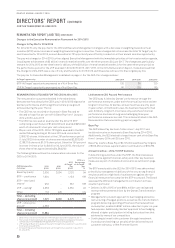

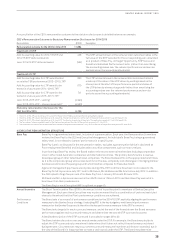

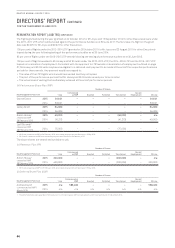

Calculation of STIP

Awards

STIP awards are calculated as follows:

Value of STIP

Award =Base

Pay X‘At Target’

Opportunity XScorecard

Result X

Individual

Performance

Factor (IPF)

Payment of Awards In a year where STIP awards are made, two-thirds of the STIP award would be paid as a cash bonus, with the

remaining one-third deferred into Qantas shares with a two year restriction period.

The Board retains discretion as to how STIP awards are delivered.

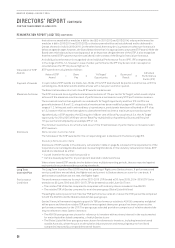

Maximum Outcome The STIP scorecard has a hypothetical maximum outcome of 175 per cent of ‘At Target’, which could only be

achieved if the maximum overdrive level of performance is achieved on every STIP performance measure.

The scorecard result is then applied to an individual’s ‘At Target’ opportunity and their IPF. As IPFs are

generally between 0.8 and 1.2, a hypothetical maximum has been modelled using an IPF at the top of this

range of 1.2. In the past and in extraordinary circumstances, participants have been allocated an IPF of up

to1.5, however this has never been given to date where there has been a maximum scorecard outcome.

Hypothetically, a STIP award to the CEO equal to 168 per cent of Base Pay could result (i.e. the ‘At Target’

opportunity for 2014/2015 of 80 per cent of Base Pay multiplied by a hypothetical Scorecard Result of

175percent and multiplied by an example IPF of 1.2).

The minimum outcome is nil, which would occur if the threshold level of performance is missed on each

STIP measure.

Disclosure

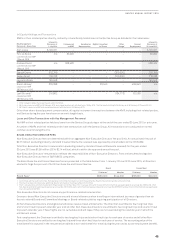

Remuneration Outcomes Table

The full value of the STIP awarded for the corresponding year is disclosed in the table on page 33.

Statutory Remuneration Table

Disclosure of STIP awards in the statutory remuneration table on page 34 is based on the requirements of the

Corporations Act and applicable Australian Accounting Standards. In the statutory remuneration table, STIP

awards are disclosed as either:

–A cash incentive for any cash bonus paid or

–A share-based payment for any component awarded in deferred shares

Where share-based STIP awards involve deferral over multiple reporting periods, they are reported against

each period in accordance with accounting standards.

Long Term

IncentivePlan

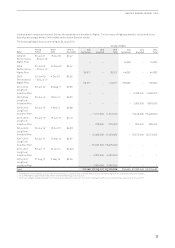

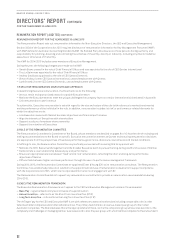

The Long Term Incentive Plan (LTIP) involves the granting of Rights over Qantas shares. If performance and

service conditions are satisfied, the Rights vest and convert to Qantas shares on a one-for-one basis. If

performance conditions are not met, the Rights lapse.

Performance

Conditions

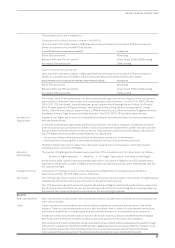

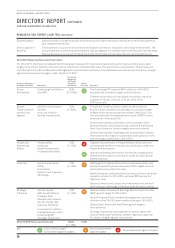

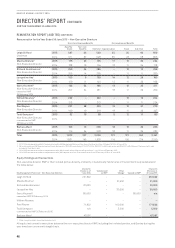

The performance measures for each of the 2013–2015 LTIP (tested at 30 June 2015), 2014–2016 LTIP (to be

tested as at 30 June 2016) and 2015–2017 LTIP (to be tested as at 30 June 2017) are:

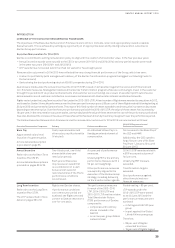

–The relative TSR of Qantas compared to companies with ordinary shares included in the ASX100

–The relative TSR of Qantas compared to an airline peer group (Global Listed Airlines)

These Rights will only vest in full if Qantas’ TSR performance ranks at or above the 75th percentile compared

to both the ASX100 and the Global Listed Airlines peer groups.

Qantas’ financial framework targets top quartile TSR performance relative to ASX100 companies and global

airline peers and therefore relative TSR performance against these peer groups has been chosen as the

performance measures for the LTIP. The peer groups selected provides a comparison of relative shareholder

returns relevant to most Qantas investors:

–The ASX100 peer group was chosen for relevance to investors with a primary interest in the equity market

for major Australian listed companies, of which Qantas is one

–The Global Listed Airlines peer group was chosen for relevance to investors, including investors based

outside Australia, whose focus is on the aviation industry sector and measuring returns from listed

companies impacted by comparable external factors

DIRECTORS’ REPORT CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015

REMUNERATION REPORT (AUDITED) CONTINUED