Qantas 2015 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

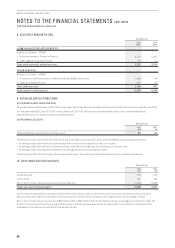

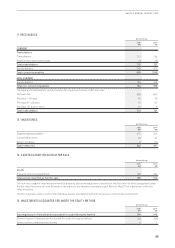

NOTES TO THE FINANCIAL STATEMENTS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015

72

QANTAS ANNUAL REPORT 2015

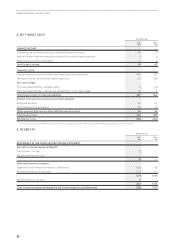

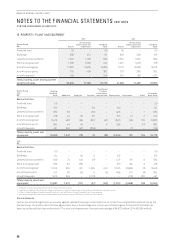

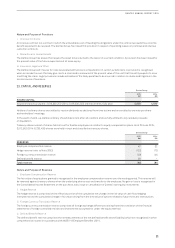

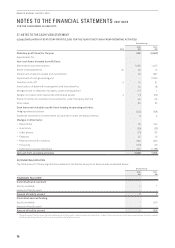

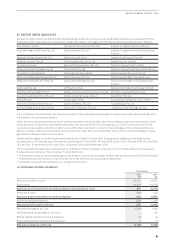

24. IMPAIRMENT TESTING OF CASH GENERATING UNITS

Identification of an asset’s Cash Generating Unit (CGU) involves judgement based on how Management monitors the Qantas Group’s

operations and how decisions to acquire and dispose of the Qantas Group’s assets and operations are made. Management has

identified the lowest identifiable group of assets that generates largely independent cash inflows being Qantas International, Qantas

Domestic, Qantas Freight, Qantas Loyalty and the Jetstar Group CGUs.

The value in use was determined by discounting the future cash flows forecast to be generated from the continuing use of the units

and were based on the following assumptions:

ssumption How determined

Cash Flows Cash flows were projected based on the approved Financial Plan. Cash flows to determine a terminal value were

extrapolated using a constant growth rate of 2.5 per cent per annum, which does not exceed the long-term average

growth rate for the industry.

Cash outflows include capital expenditure for the purchase of aircraft and other property, plant and equipment.

These do not include capital expenditure that enhances the current performance of assets and related cash flows

have been treated consistently.

Discount Rate A pre-tax discount rate of 10 per cent per annum has been used in discounting the projected cash flows of the CGUs,

reflecting a market estimate of the weighted average cost of capital of the Qantas Group (2014: 10.5 per cent per

annum). The discount rate is based on the risk-free rate for 10 year Australian Government Bonds adjusted for a risk

premium to reflect both the increased risk of investing in equities and the risk of the specific CGU.

The following CGUs have goodwill and other intangible assets with indefinite useful lives as follows:

Qantas Group

2015

$M

2014

$M

Goodwill

Qantas Domestic 10 10

Qantas Loyalty 13 5

Qantas Freight 49 49

Jetstar Group 134 131

206 195

Other intangible assets with indefinite useful lives

Qantas International 35 35

Jetstar Group 25 22

60 57

No impairment was recognised for the identified CGUs during the year ended 30 June 2015 (2014: $2,560 million).

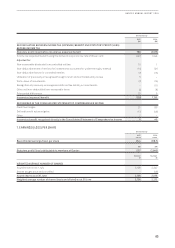

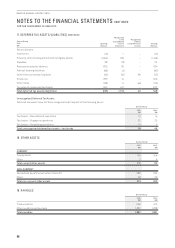

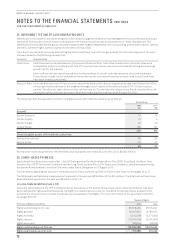

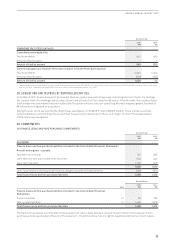

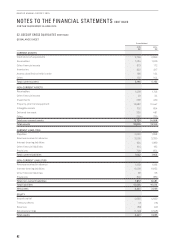

25. SHARE-BASED PAYMENTS

Equity benefits to Executives made after 1 July 2010 are governed by the Employee Share Plan (ESP) Trust Deed, the Short Term

Incentive Plan (STIP) Terms and Conditions and the Long Term Incentive Plan (LTIP) Terms and Conditions, which were approved by

the Qantas Remuneration Committee Chairman under Board Delegation on 12 August 2010.

Further details regarding the operation of equity plans for Executives are outlined in the Directors’ Report from pages 24 to 47.

The total equity settled share-based payment expense for the year was $29 million (2014: $12 million). The total cash settled share-

based payment expense for the year was $6 million (2014: nil).

(A) LONG TERM INCENTIVE PLAN (LTIP)

Generally, participation in the LTIP is limited to Senior Executives of the Qantas Group in key roles or other participants who have

been identified as high potential Executives. All Rights are redeemable on a one-for-one basis for Qantas shares, subject to the

achievement of performance hurdles. Dividends are not payable on the Rights. For more information on the operation of the LTIP,

seepages 36 to 37.

Number of Rights

Performance Rights reconciliation 2015 2014

Rights outstanding as at 1 July 33,579,432 28,174,047

Rights granted 64,317,000 13,790,000

Rights forfeited (1,914,000) (4,571,000)

Rights lapsed (15,614,000) (3,755,000)

Rights exercised (58,844) (58,615)

Rights outstanding as at 30 June 80,309,588 33,579,432

Rights exercisable as at 30 June 157,588 216,432