Qantas 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

QANTAS ANNUAL REPORT 2015

Qantas Group

2015

$M

2014

$M

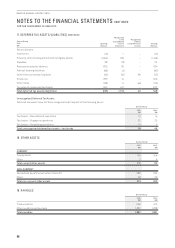

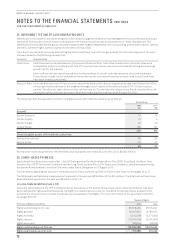

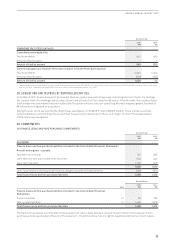

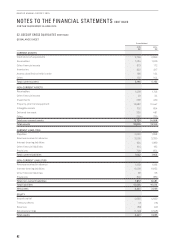

FINANCING FACILITIES CONTINUED

Committed revolving facility1

Facility available 940 630

Amount of facility used – –

Amount of facility unused 940 630

Commercial paper and medium-term notes (subject to Dealer Panel participation)

Facility available 2,000 1,000

Amount of facility used (950) (950)

Amount of facility unused 1,050 50

1 The revolving facility includes $425 million with a term of three years from 24 April 2015, $425 million with a term of four years from 24 April 2015 and $90 million with a term of five years

from 31 July 2014. There is an additional $100 million with a term of five years effective from 7 July 2015.

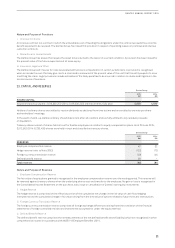

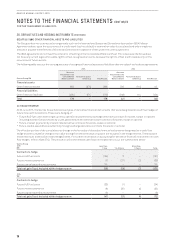

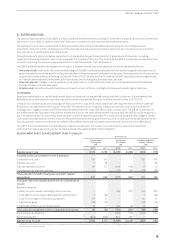

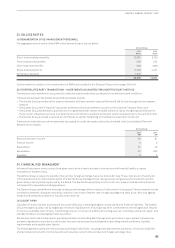

28. ACQUISITION AND DISPOSAL OF CONTROLLED ENTITIES

On 24 March 2015, Qantas Frequent Flyer Limited (Qantas Loyalty) acquired a 51 per cent controlling interest in Taylor Fry Holdings

Pty Limited (Taylor Fry Holdings), which owns 100 per cent of Taylor Fry Pty Limited for $9 million. From this date, the results of Taylor

Fry Holdings are consolidated into the results of the Group with a 49 per cent non-controlling interest being recognised. Goodwill of

$8 million was recognised on acquisition.

During the year, the Group sold the Tour East Group subsidiaries for SGD$18.3 million (A$16.3 million). These entities are wholly

owned subsidiaries of the Holiday Tours and Travel Group of which Qantas owns 75 per cent. A gain on sale of these subsidiaries

of$13 million was recognised.

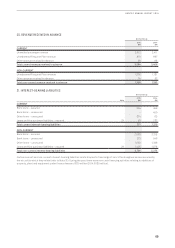

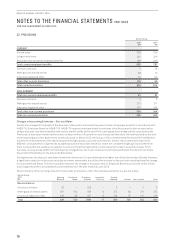

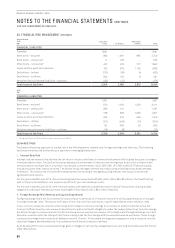

29. COMMITMENTS

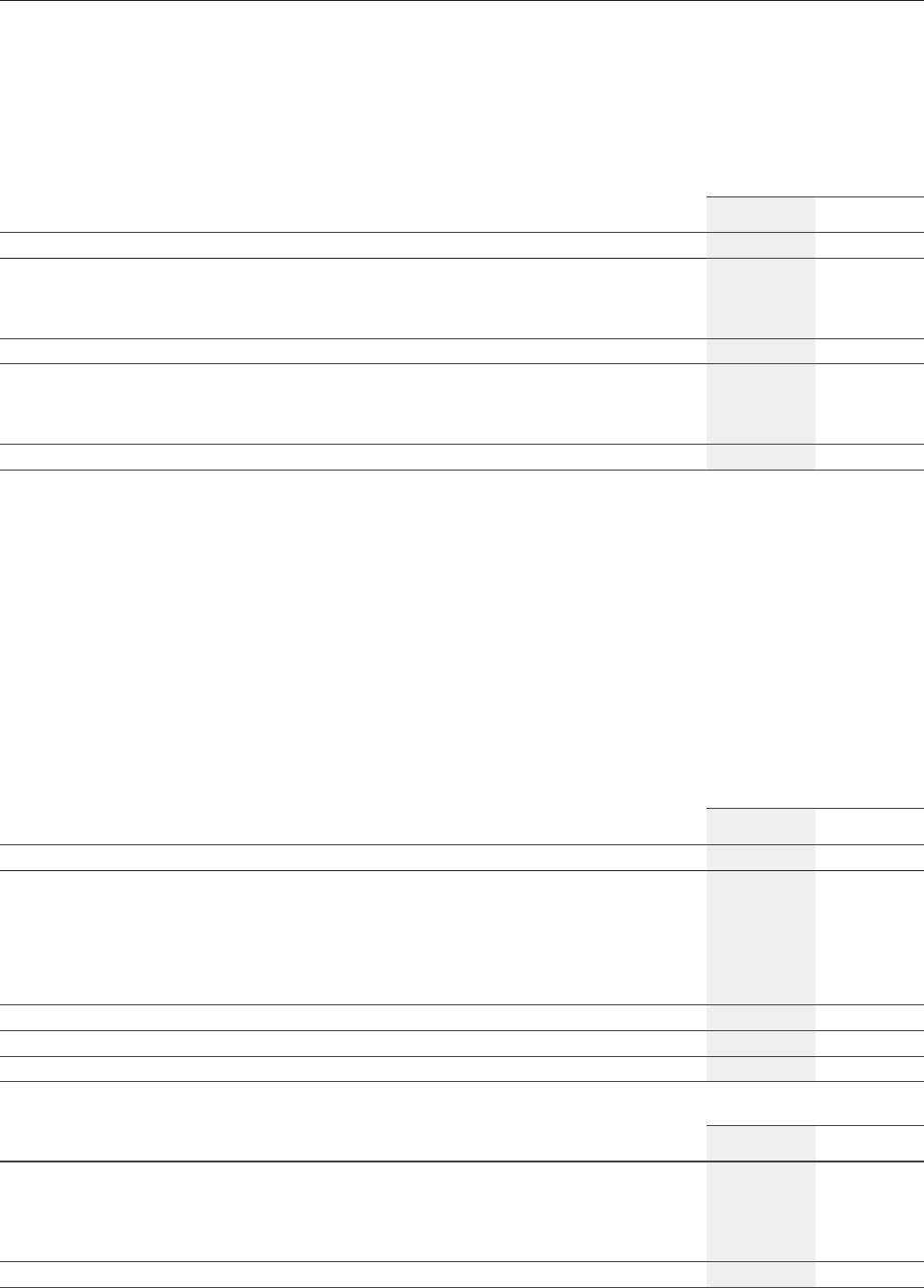

(A) FINANCE LEASE AND HIRE PURCHASE COMMITMENTS

Qantas Group

2015

$M

2014

$M

AS LESSEE

Finance lease and hire purchase liabilities included in the Consolidated Financial Statements

Aircraft and engines – payable:

Not later than one year 135 262

Later than one year but not later than five years 553 402

Later than five years 1,150 946

1,838 1,610

Less: future lease and hire purchase finance charges and deferred lease benefits (340) (300)

Total finance lease and hire purchase liabilities 1,498 1,310

Qantas Group

Note

2015

$M

2014

$M

Finance lease and hire purchase liabilities included in the Consolidated Financial

Statements

Current liabilities 21 93 232

Non-current liabilities 21 1,405 1,078

Total finance lease and hire purchase liabilities 1,498 1,310

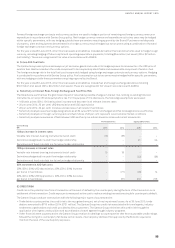

The Qantas Group leases aircraft under finance leases with expiry dates between one and 10 years. Most finance leases contain

purchase options exercisable at the end of the lease term. The Qantas Group has the right to negotiate extensions on most leases.