Qantas 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

QANTAS ANNUAL REPORT 2015

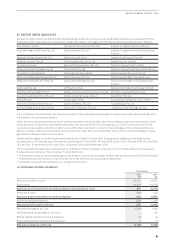

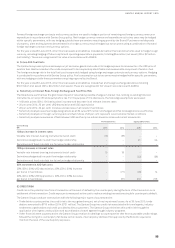

The Qantas Group takes a disciplined approach to continually reviewing its capital structure against the optimal capital structure.

Where there is surplus capital, the Group seeks to enhance shareholder value with the appropriate mix of growth and shareholder

returns. Where surplus capital enables returns to be made to shareholders, the Board will have regard to a range of factors (including

the level of franking credits available) to determine the ideal method to return capital, be it through dividends, buybacks (off or on

market), capital returns or a combination of each.

The Qantas Group maintains access to a broad range of debt markets, both secured and unsecured. The Qantas Group maintains a

prudent liquidity policy that ensures adequate coverage of liquidity requirements under a range of adverse scenarios.

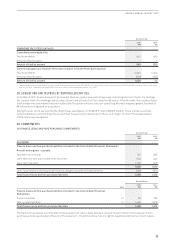

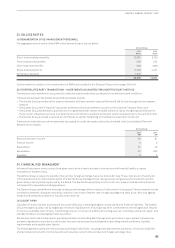

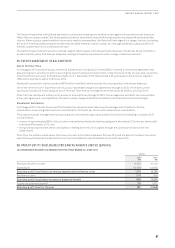

35. EVENTS SUBSEQUENT TO BALANCE DATE

Sale of Terminal Three

On 18 August 2015, Qantas Airways Limited and Sydney Airport Corporation Limited (SACL) reached a commercial agreement that

delivers long-term certainty to both concerning the airport’s domestic third terminal. Under the terms of the 10-year deal, ownership

of Terminal Three will revert from Qantas to SACL as of 1 September 2015. Qantas held a 30-year lease on the terminal, signed in

1989, which was due to expire on 30 June 2019.

Qantas will receive total cash proceeds of $535 million from SACL which exceeds the carrying value of the assets disposed.

Use of the terminal from 1 September will incur a per-passenger charge at an agreed rate through to 2025. In line with current

operations, Qantas will retain exclusive use of Terminal Three and will manage the terminal on behalf of SACL until July 2019.

After that time, Qantas will retain priority access to Terminal Three through to 2025. The arrangement with SACL also incorporates

afive-year agreement covering Qantas’ domestic runway charge and Qantas and Jetstar international aeronautical charges.

Shareholder Distribution

On 20 August 2015, Qantas announced that the Board proposed to undertake a capital management initiative for Qantas

shareholders, comprising a distribution to shareholders of 23 cents per share and a related share consolidation.

The proposed capital management initiative (subject to shareholder approval at Qantas’ Annual General Meeting in October 2015)

iscomprised of:

–a return of approximately $505 million of share capital (to be effected by Qantas paying each shareholder 23 cents per share held),

to be paid in November 2015; and

–an equal and proportionate share consolidation, relating to the return of capital, through the conversion of each share into

0.939shares.

Other than the matters noted above, there has not arisen in the interval between 30 June 2015 and the date of this Report any other

event that would have had a material effect on the Consolidated Financial Statements as at 30 June 2015.

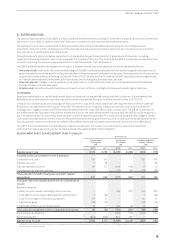

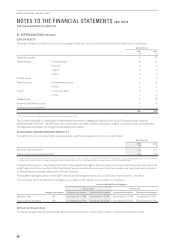

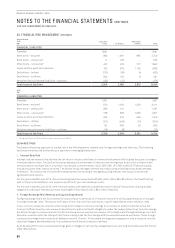

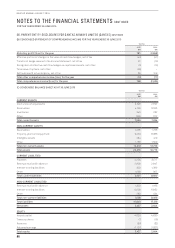

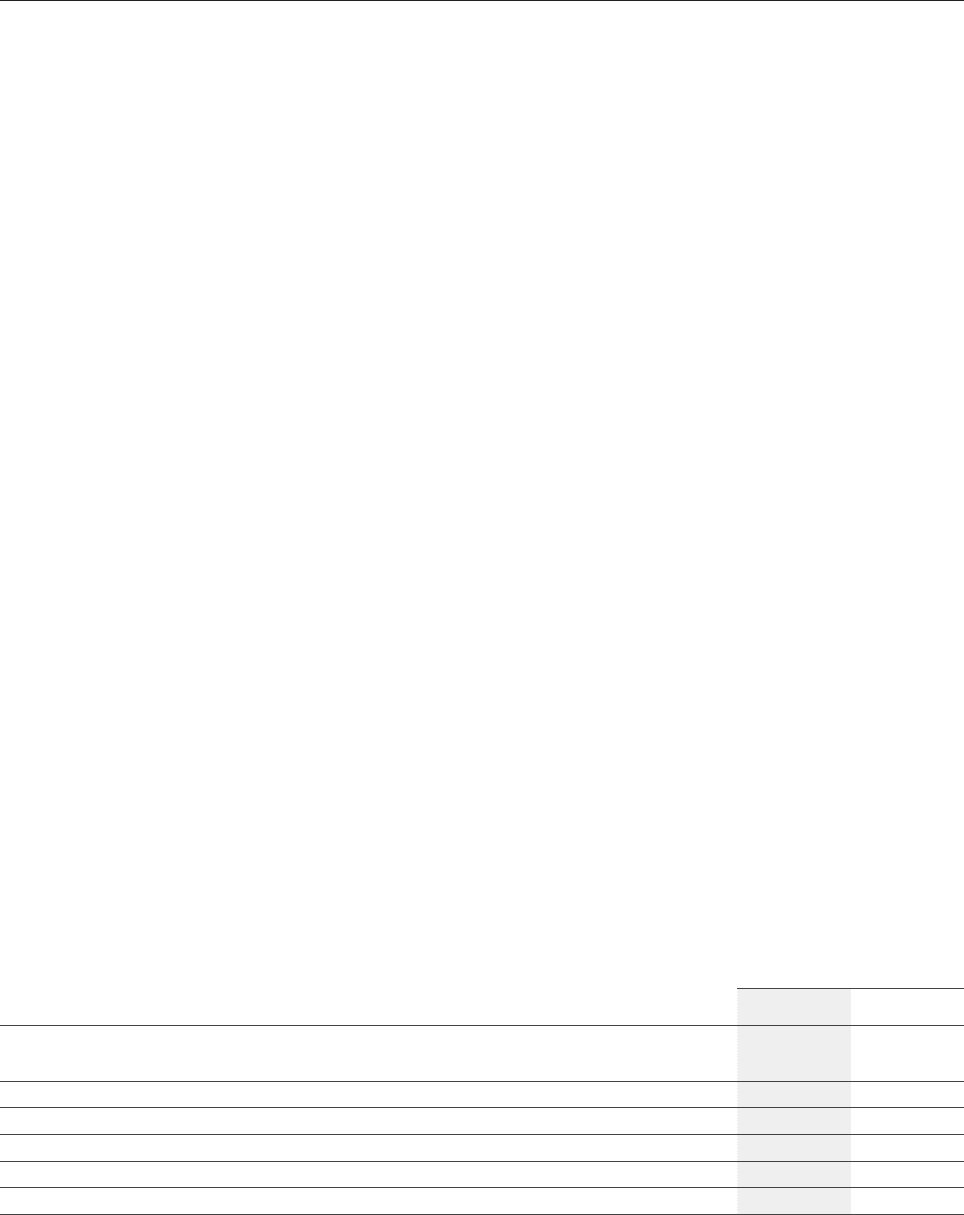

36. PARENT ENTITY DISCLOSURES FOR QANTAS AIRWAYS LIMITED (QANTAS)

(A) CONDENSED INCOME STATEMENT FOR THE YEAR ENDED 30 JUNE 2015

Qantas

2015

$M

2014

$M

Revenue and other income 11,254 10,14 3

Expenditure (10,139) (13,874)

Statutory profit/(loss) before income tax expense and net finance costs 1,115 (3,731)

Net finance costs (246) (190)

Statutory profit/(loss) before income tax (expense)/benefit 869 (3,921)

Income tax (expense)/benefit (88) 1,073

Statutory profit/(loss) for the year 781 (2,848)