Qantas 2015 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

QANTAS ANNUAL REPORT 2015

REMUNERATION REPORT (AUDITED) CONTINUED

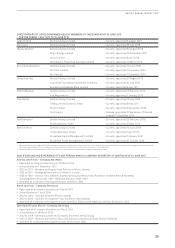

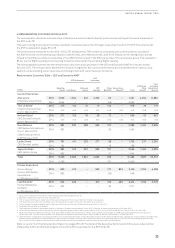

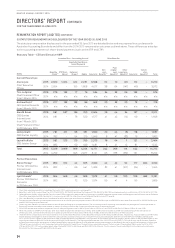

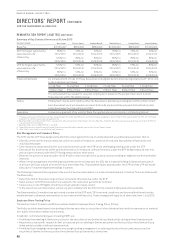

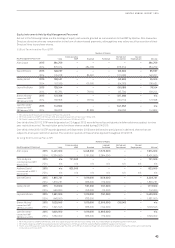

5) STATUTORY REMUNERATION DISCLOSURES FOR THE YEAR ENDED 30 JUNE 2015

The statutory remuneration disclosures for the year ended 30 June 2015 are detailed below and are prepared in accordance with

Australian Accounting Standards and differ from the 2014/2015 remuneration outcomes outlined above. These differences arise due

to the accounting treatment of share-based payments (such as the STIP and LTIP).

Statutory Table – CEO and Executive KMP

Incentive Plan – Accounting Accrual Other Benefits

Equity Settled Share-

based Payments

$’000s

Base Pay

(Cash)1,2

STIP Cash

Bonus1

Deferred

Shares3Rights Sub-total

Non-

cash

Benefits1,4

Post-

employ-

ment

Benefits5

Other

Long-term

Benefits6Sub-total

Termin-

ation

Benefits9Total

Current Executives

Alan Joyce

Chief Executive

Officer

2015

2014

2,000

2,054

1,904

–

423

155

2,261

1,808

6,588

4,017

63

38

70

64

(21)

(147)

112

(45)

–

–

6,700

3,972

Tino La Spina7

Chief Financial Officer

from 1 March 2015

2015

2014

279

n/a

152

n/a

17

n/a

76

n/a

524

n/a

24

n/a

32

n/a

96

n/a

152

n/a

–

n/a

676

n/a

Andrew David7

CEO Qantas Domestic

from 1 March 2015

2015

2014

277

n/a

152

n/a

128

n/a

86

n/a

643

n/a

20

n/a

32

n/a

20

n/a

72

n/a

–

n/a

715

n/a

Gareth Evans

CEO Qantas

International

from 1 March 2015

Chief Financial Officer

to 28 February 2015

2015

2014

981

981

537

–

126

76

760

520

2,404

1,577

39

41

44

42

24

(14)

107

69

–

–

2,511

1,646

Lesley Grant

CEO Qantas Loyalty

2015

2014

781

782

411

–

96

54

351

210

1,639

1,046

20

8

44

41

(6)

(33)

58

16

–

–

1,697

1,062

Jayne Hrdlicka

CEO Jetstar Group

2015

2014

981

982

513

–

119

60

760

439

2,373

1,481

76

8

44

41

1

12

121

61

–

–

2,494

1,542

Total

2015

2014

5,299

4,799

3,669

–

909

345

4,294

2,977

14,171

8,121

242

95

266

188

114

(182)

622

101

–

–

14,793

8,222

Former Executives

Simon Hickey8

Former CEO Qantas

International

to 28 February 2015

2015

2014

860

982

612

–

43

66

665

441

2,180

1,489

43

32

42

41

92

(107)

177

(34)

833

–

3,19 0

1,455

Lyell Strambi8

Former CEO Qantas

Domestic

to 28 February 2015

2015

2014

654

982

466

–

46

72

506

520

1,672

1,574

41

50

55

41

100

4

196

95

483

–

2,351

1,669

1 Short-term employee benefits include Base Pay (cash), STIP cash bonus and non-cash benefits.

2 Base Pay (cash) for Mr Joyce is Base Pay of $2,125,000 (2014: $2,125,000) less Base Pay forgone of $106,250 (2014: $53,125) less superannuation contributions of $18,783 (2014: $17,775).

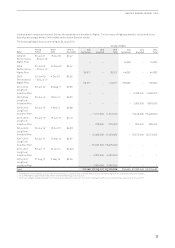

3 Deferred Shares for Mr La Spina and Mr David includes STIP awards which were made since commencing as KMP and share awards under the Manager Incentive Plan as well as Deferred

Share Plan award granted to Mr David prior to commencing as KMP. For other Executives, Deferred Shares include STIP awards.

4 Non-cash Benefits include the value of travel benefits whilst employed and other minor benefits.

5 Post-employment Benefits include superannuation and an accrual for post-employment travel of $51,000 for Mr Joyce and $25,000 for each other Executive (2014: $47,000 for Mr Joyce

and $22,000 for each other Executive).

6 Other Long-term Benefits include movement in annual leave and long service leave balances. The accounting value of other long-term benefits may be negative, for example where an

Executive’s annual leave balance decreases as a result of taking more than the 20 days annual leave they accrue during the year.

7 2014/2015 remuneration reflects the period of time in a key management role for Mr La Spina (1 March 2015 to 30 June 2015) and Mr David (1 March 2015 to 30 June 2015).

8 Mr Hickey ceased as a KMP on 28 February 2015 and ceased employment with Qantas on 15 May 2015 and Mr Strambi ceased as a KMP and ceased employment with Qantas on

28February 2015. 2014/2015 remuneration is included up until the termination date of Mr Hickey of 15 May 2015 and for Mr Strambi of 28 February 2015.

9 Under the terms of separation, termination benefits of 10 months’ Base Pay and 6 months’ Base Pay were paid to Mr Hickey and Mr Strambi, respectively. As good leavers, both Mr Hickey

and Mr Strambi were eligible to receive deferred cash payments prorated for the portion of the performance period employed under the 2014/15 STIP and the Rights granted under

2013–2015 LTIP which lapsed on the termination date and were replaced by the deferred cash payments as disclosed in the table on page 33 (the fair values of the prorated Rights on the

original grant date was $542,000 for Mr Hickey and $503,000 for Mr Strambi). The Rights granted under the 2014–2016 LTIP and 2015–2017 LTIP to Mr Hickey and Mr Strambi lapsed on

the termination date and in replacement of these lapsed Rights, they are eligible to receive deferred cash payments subject to the Board’s discretion and the achievement of the original

LTIP performance conditions, with the payment amount pro-rated for the portion of the performance period employed. The fair values of the prorated Rights under the 2014–2016

LTIP and 2015–2017 LTIP on the original grant dates totalled $617,000 for Mr Hickey and $512,000 for Mr Strambi. The fair values of the prorated Rights on the termination date were

$2,492,000 for Mr Hickey and $1,669,000 for Mr Strambi.

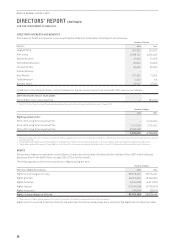

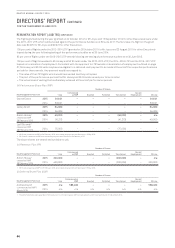

DIRECTORS’ REPORT CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015