Qantas 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

QANTAS ANNUAL REPORT 2015

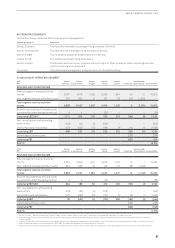

Qantas Group

2015

$M

2014

$M

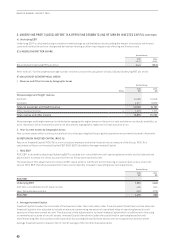

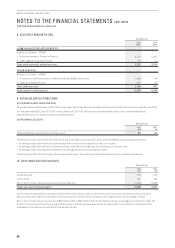

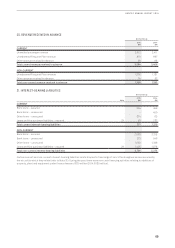

INVESTED CAPITAL

Receivables (current and non-current) 1,093 1,354

Inventories 322 317

Other assets (current and non-current) 424 374

Investments accounted for using the equity method 134 143

Property, plant and equipment 10,715 10,500

Intangible assets 803 741

Assets classified as held for sale 136 134

Payables (1,881) (1,851)

Provisions (current and non-current) (1,213) (1,281)

Revenue received in advance (current and non-current) (4,943) (4,589)

Capitalised operating leased assets13,100 3,553

Invested Capital as at 30 June 8,690 9,395

Average Invested Capital for the year ended 30 June29,091 13,004

1 Capitalised operating lease assets are initially measured at fair value at lease commencement date (translated to Australian dollars) and subsequently depreciated in accordance with

the Group’s accounting policies for owned aircraft. The calculated depreciation is reported as ‘Notional Depreciation’ in the determination of ROIC EBIT.

2 The impairment of the Qantas International CGU was recognised as at 30 June 2014.

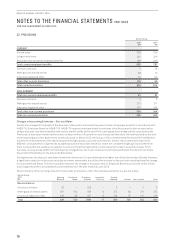

iii. ROIC %

Qantas Group

2015

%

2014

%

ROIC %116.2 (1.5)

1 ROIC % is calculated as Return on Invested Capital EBIT (ROIC EBIT) divided by Average Invested Capital.

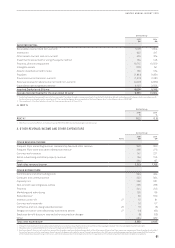

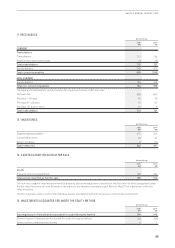

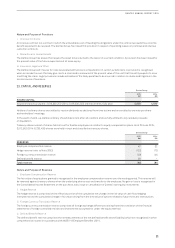

4. OTHER REVENUE/INCOME AND OTHER EXPENDITURE

Qantas Group

Notes

2015

$M

2014

$M

OTHER REVENUE/INCOME

Frequent Flyer marketing revenue, membership fees and other revenue 348 300

Frequent Flyer store and other redemption revenue1286 275

Contract work revenue 141 227

Retail, advertising and other property revenue 154 156

Other 284 197

Total other revenue/income 1,213 1,155

OTHER EXPENDITURE

Commissions and other selling costs 544 494

Computer and communication 400 394

Capacity hire 292 331

Non-aircraft operating lease rentals 235 238

Property 244 245

Marketing and advertising 103 86

Redundancies260 370

Inventory write-off 27 10 61

Contract work materials 16 57

Ineffective and non-designated derivatives 26 13 (8)

Net gain on sale of controlled entity and related assets 27 (11) (62)

Employee benefit discount rate and other assumption changes (8) (53)

Other 464 482

Total other expenditure32,362 2,635

1 Frequent Flyer redemption revenue excludes redemptions on Qantas Group flights which are reported as net passenger revenue in the Consolidated Income Statement.

2 Redundancies include defined benefit curtailment expenses of $5 million (2014: $36 million).

3 Employee benefit discount rate and other assumption changes have been disclosed separately within other expenditure rather than manpower expenses as these changes do not reflect

the current service costs for employees. Airport security charges are included in aircraft operating variable costs. Selling and marketing expenses have been separately disclosed as

either marketing and advertising, commissions and other selling costs or other expenditure. The comparative for 30 June 2014 has been restated to enable comparability.