Qantas 2015 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

QANTAS ANNUAL REPORT 2015

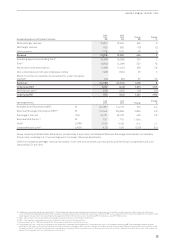

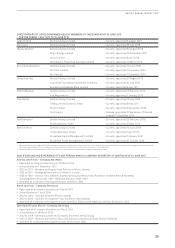

QANTAS TRANSFORMATION – DELIVERING AGAINST A BALANCED SCORECARD

The accelerated Qantas Transformation program is targeting the delivery of $2 billion of gross benefits by the end of financial year

2016/2017, with all milestones to date having been met or exceeded. Within the $2 billion target, the program is sized and structured

to achieve important strategic outcomes.

Strategic outcomes by 2016/2017 include:

–Group ex-fuel expenditure reduced by > 10 per cent23

–Qantas Domestic unit cost gap24 to competitor to close to < five per cent

–Qantas International unit cost comparable to direct competitors

–Jetstar lowest seat cost and yield advantage maintained

–Consistent and improved customer experience

–Embedded culture of transformation for ongoing benefits beyond 2016/2017

The target metrics and achievements to date as at 2014/2015 include:

Achieving Our Targets Target Metric Achievements to Date

Accelerated transformation benefits $2 billion gross benefits

Group ex-fuel expenditure reduced by

> 10 per cent25

5,000 FTE reduction

$1.1 billion cost and revenue benefits

realised

Ex-fuel expenditure26 reduced by

sixpercent

Reduction of 4,00027 full time equivalent

staff out of targeted 5,000 reduction by

2016/2017

De-leverage balance sheet Greater than $1 billion debt reduction $1.1 billion of net debt reduction since

financial year 2012/2013

Debt/EBITDA <4 times Debt / adjusted EBITDA28 of 2.9 times,

meeting leverage target of Debt / adjusted

EBITDA < 4 times two years ahead of

schedule

Cash flow Sustainable positive free cash flow $1.1 billion net free cash flow in FY15

Fleet simplification 11 fleet types to seven Group fleet types (excluding regional

operations) reduced from 11 to nine with the

exit of B734 and B767. In addition, four out of

six non-reconfigured B747 aircraft retired29

Customer and brand Customer satisfaction

(six month rolling average)

Most on-time domestic carrier:

QantasDomestic

Customer satisfaction at record levels

andimproving

Most on-time domestic departures and

arrivals in 2014/201530

With $1.1 billion of benefits having been realised to date, the Group expects to realise Qantas Transformation benefits of $450 million

in 2015/2016.

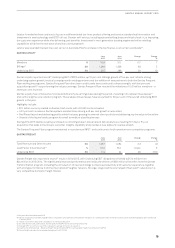

The Group-wide policy of implementing an 18-month wages freeze, whilst not part of the $2 billion Qantas Transformation Program, is

helping to offset inflation and build a more competitive and sustainable wages position. Eighteen agreements have been closed with

the wages freeze, with all of the major unions representing employee groups having signed up to the policy in at least one agreement.

In July 2015, Qantas announced that employees covered by the wages freeze policy will receive a one-off bonus payment worth five

per cent of base annual salary.

23 Target assumes steady foreign exchange rates, capacity and sector length

24 Unit cost is calculated as Underlying EBIT less passenger revenue per ASK. Qantas Domestic unit cost includes QantasLink. Competitor refers to Virgin Australia including mainline

domestic and regional operations. Virgin’s assumed domestic unit cost is based on Qantas’ internal estimates and published competitor data

25 Compared to first-half ended 31 December 2013, annualised and assuming steady foreign exchange rates, capacity and sector length

26 Includes Underlying operating expenses (including fuel), depreciation and amortisation (excluding depreciation reduction from Qantas International non-cash fleet impairment) and

non-cancellable operating lease rentals

27 Exited FTEs as at 30 June 2015

28 Metric calculated based on Moody’s methodology

29 From December 2013 to August 2015

30 Qantas mainline compared with Virgin mainline. Source: BITRE