Qantas 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

QANTAS ANNUAL REPORT 2015

REMUNERATION REPORT (AUDITED) CONTINUED

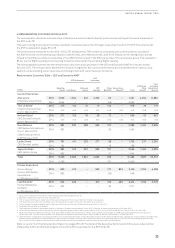

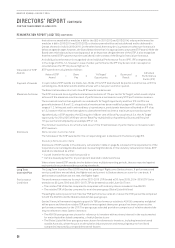

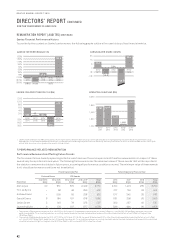

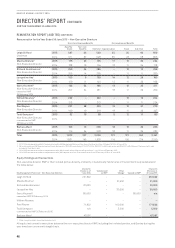

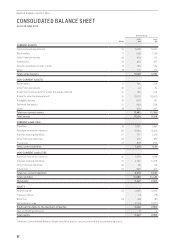

Qantas Financial Performance History

To provide further context on Qantas’ performance, the following graphs outline a five-year history of key financial metrics.

1 Underlying Profit Before Tax (PBT) is the primary reporting measure used by the Qantas Group’s chief operating decision-making bodies, being the Chief Executive Officer, Group

Management Committee and the Board of Directors, for the purpose of assessing the performance of the Group. Statutory Profit After Tax for 2014/2015 was $560 million (2014: ($2.8)

billion, 2013: $2 million, 2012: ($244) million and 2011: $249 million).

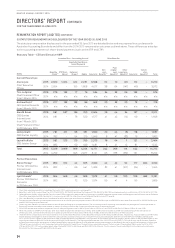

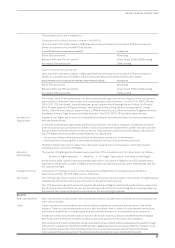

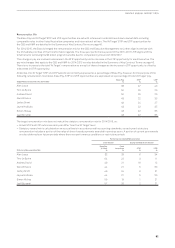

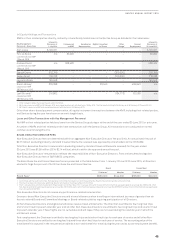

7) PERFORMANCE-RELATED REMUNERATION

Performance Remuneration Affecting Future Periods

The fair value of share-based payments granted is amortised over the service period and therefore remuneration in respect of these

awards may be reported in future years. The following table summarises the maximum value of these awards that will be reported in

the statutory remuneration tables in future years, assuming all performance conditions are met. The minimum value of these awards

is nil, should performance conditions not be satisfied.

Future Expense by Plan Future Expense by Financial Year

Deferred Shares LTIP Awards

Executives

2012/2013

$’000

2014/2015

$’000

2014–20161

$’000

2015–20172

$’000

Total

$’000

2016

$’000

2017

$’000

2018

$’000

Total

$’000

Alan Joyce 20 651 670 2,409 3,750 2,102 1,413 235 3,750

Tino La Spina –98 48 256 402 217 159 26 402

Andrew David –599 55 298 952 577 345 30 952

Gareth Evans 6184 197 678 1,065 601 398 66 1,065

Lesley Grant 5140 79 373 597 320 237 40 597

Jayne Hrdlicka 6176 197 677 1,056 596 394 66 1,056

1 The number of Rights granted under the 2014–2016 LTIP on 18 October 2013 were determined using the fair value of a Right on 1 July 2013 ($0.790 per Right), being the start of the

performance period. For accounting purposes, accounting standards require the share-based payment expense to be calculated using the fair value of a Right on the grant date

($0.830per Right).

2 The number of Rights granted under the 2015–2017 LTIP (on 24 October 2014 for Mr Joyce and 15 September 2015 for other Executives) were determined using the fair value of a Right

on 1 July 2014 ($0.785 per Right), being the start of the performance period. For accounting purposes, accounting standards require the share-based payment expense to be calculated

using the fair value of a Right on the grant date ($0.970 per Right for Mr Joyce and $0.972 for other Executives).

DIRECTORS’ REPORT CONTINUED

FOR THE YEAR ENDED 30 JUNE 2015

QANTAS TSR PERFORMANCE (%)

150%

130%

110%

90%

70%

50%

30%

10%

(10%)

(30%)

(50%) (6.7)

150.8

(16.4) (41.6)

25.6

2010/

2011

2011/

2012

2012/

2013

2013/

2014

2014/

2015

600

(600)

400

(400)

200

(200)

800

1,000

1,200

02010/

2011

2011/

2012

UNDERLYING PROFIT BEFORE TAX ($M)

552 95 186

(646)

975

2012/

2013

2013/

2014

2014/

2015 1,300

1,600

1,900

2,200

1,000 2010/

2011

2011/

2012

OPERATING CASHFLOW ($M)

1,782 1,810

1,417

1,069

2,048

2012/

2013

2013/

2014

2014/

2015

0

(5)

5

(15)

15

25

(128.5)

25.4

11.0

(10.8)

0.04

2010/

2011

2011/

2012

2012/

2013

2013/

2014

2014/

2015

EARNINGS PER SHARE (CENTS)