Qantas 2015 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2015 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

QANTAS ANNUAL REPORT 2015

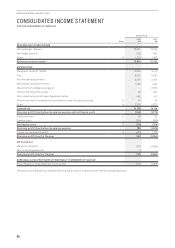

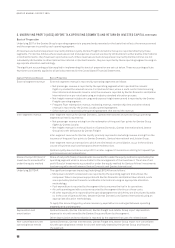

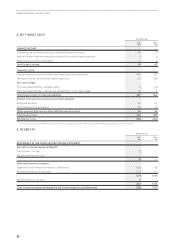

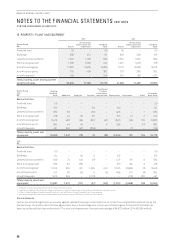

(D) DESCRIPTION OF UNDERLYING PBT AND RECONCILIATION FROM STATUTORY PROFIT/(LOSS) BEFORE TAX

Underlying PBT is a non-statutory measure and is the primary reporting measure used by the Qantas Group’s chief operating

decision-making bodies, being the Chief Executive Officer, Group Management Committee and the Board of Directors. The objective

of measuring and reporting Underlying PBT is to provide a meaningful and consistent representation of the underlying performance

of each operating segment and the Qantas Group.

Underlying PBT was derived by adjusting Statutory Profit/(Loss) Before Tax for the impacts of:

i. Ineffectiveness and Non-designated Derivatives relating to Other Reporting Periods

In prior reporting periods, Underlying PBT was adjusted for the impacts of AASB 139 which relate to other reporting periods. The

AASB 139 adjustments to Statutory Profit/(Loss) Before Tax ensured derivative mark-to-market movements that relate to underlying

exposures in other reporting periods were recognised in Underlying PBT in those reporting periods.

In the current reporting period, as a result of the early adoption of AASB 9 (2013), there is now better alignment between Underlying

PBT and Statutory Profit/(Loss) Before Tax. However, there will continue to be a difference between Statutory Profit/(Loss) Before Tax

and Underlying PBT resulting from derivative mark-to-market movements being recognised in the Consolidated Income Statement in

a different period to the underlying exposure.

ii. Other Items not Included in Underlying PBT

Items which are identified by Management and reported to the chief operating decision-making bodies as not representing the

underlying performance of the business are not included in Underlying PBT. The determination of these items is made after

consideration of their nature and materiality and is applied consistently from period to period.

Items not included in Underlying PBT primarily result from revenues or expenses relating to business activities in other reporting

periods, major transformational/restructuring initiatives, transactions involving investments and impairments of assets and other

transactions outside the ordinary course of business.

The reconciliation of Underlying PBT from Statutory Profit/(Loss) Before Tax is detailed in the table below.

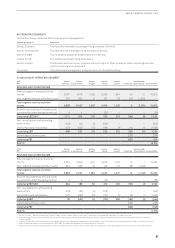

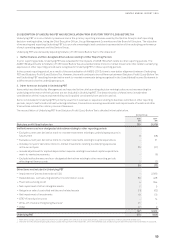

Qantas Group

2015

$M

2014

$M

Statutory profit/(loss) before tax 789 (3,976)

Ineffectiveness and non-designated derivatives relating to other reporting periods

–Exclude current year derivative mark-to-market movements relating to underlying exposures in

future years 3(58)

–Exclude current year derivative mark-to-market movements relating to capital expenditure –21

–Include prior years’ derivative mark-to-market movements relating to underlying exposures

in the current year 35 (27)

–Include adjustment for implied depreciation expense relating to excluded capital expenditure

mark-to-market movements –(6)

–Exclude ineffectiveness and non-designated derivatives relating to other reporting periods

affecting net finance costs 1(2)

39 (72)

Other items not included in Underlying PBT

–Impairment of Qantas International CGU –2,560

–Redundancies, restructuring and other transformation costs 80 428

–Fleet restructuring costs14394

–Net impairment of other intangible assets 7 9

–Net gain on sale of controlled entities and related assets (11) (62)

–Net impairment of investments 19 50

–B787-8 introduction costs –14

–Write-off of Jetstar Hong Kong Business221 –

–Other 27 9

147 3,402

Underlying PBT 975 (646)

1 Fleet restructuring costs includes impairment of aircraft together with other aircraft associated property, plant and equipment, inventory and other related costs.

2 The write-off of the Jetstar Hong Kong Business includes the impairment of the investment, write-off of deferred costs and the Group’s share of net losses for the year ended 30 June 2015.