Qantas 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

OVERVIEW OF RESULT1

For the 12 months to 30 June 2014, Qantas

announced an Underlying PBT loss of

$646 million and a Statutory Loss After Tax

of $2.8 billion.

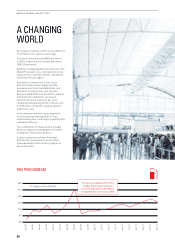

The underlying result was driven by market

record fuel costs of $4.5 billion – up $253 million1

from 2012/2013 – and the impact of capacity

growth running ahead of demand, leading to

a $550 million decline in revenue from weaker

yields and passenger loads.

The $2 billion accelerated Qantas Transformation

program is permanently reducing costs and

laying the foundations for sustainable growth

in earnings. Transformation benefits totalled

$440 million in 2013/2014, including $204 million

in second-half benefits from the accelerated

Qantas Transformation program, while unit costs

were reduced by 3 per cent over the year.

At the same time, Qantas has taken action to

adjust its capacity and network in response

to shifts in demand and the competitive

environment.

The Group has maintained targeted investment

in customer service to sustain yield premiums

for Qantas and Jetstar, while overall capital

investment has been reduced to maximise free

cash flow for debt reduction. At 30 June 2014,

Group liquidity was $3.6 billion – including

$3 billion in cash – and the Group was net free

cash flow neutral after delivering operating cash

flow of $1.1 billion.

FLEET WRITEDOWN

On 28 August 2014, Qantas announced the

outcomes of a structural review of the Group that

commenced in December 2013 – including Board

approval to establish a new corporate entity for

the Qantas International business.

Under accounting standards, this decision

required a change in Qantas’ Cash Generating

Units (CGUs) for impairment testing. The previous

‘Qantas Brands’ CGU has now been split into

separate CGUs for Qantas International, Qantas

Domestic, Qantas Loyalty and Qantas Freight.

While the Qantas Domestic, Qantas Loyalty and

Qantas Freight CGUs are all in surplus, Qantas

Internationanal’s CGU required a non-cash

impairment charge of $2.6 billion, which is

included in the statutory result for 2013/2014.

Following this writedown, the depreciation

expense of Qantas International aircraft will

be approximately $200 million per year lower.

There is no impact on the Group’s or Qantas

International’s cash earnings.

1 For explanations of non-statutory measures, see the Review of Operations section in this report.

06

QANTAS ANNUAL REPORT 2014