Qantas 2014 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

QANTAS ANNUAL REPORT 2014

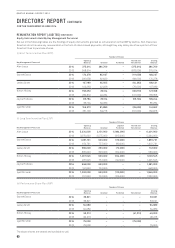

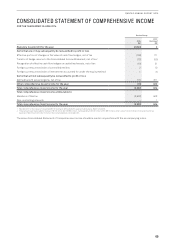

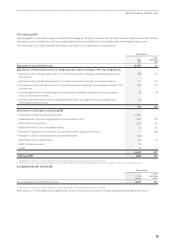

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED 30 JUNE 2014

Qantas Group

2014

$M

2013

Restated1

$M

Statutory (loss)/profit for the year (2,843) 2

Items that are or may subsequently be reclassified to profit or loss

Effective portion of changes in fair value of cash flow hedges, net of tax (106) 111

Transfer of hedge reserve to the Consolidated Income Statement, net of tax2(70) (50)

Recognition of effective cash flow hedges on capitalised assets, net of tax (19) 21

Foreign currency translation of controlled entities 210

Foreign currency translation of investments accounted for under the equity method 1(1)

Items that will not subsequently be reclassified to profit or loss

Defined benefit actuarial gains, net of tax 113 311

Other comprehensive (loss)/income for the year (79) 402

Total comprehensive (loss)/income for the year (2,922) 404

Total comprehensive (loss)/income attributable to:

Members of Qantas (2,922) 403

Non-controlling interests – 1

Total comprehensive (loss)/income for the year (2,922) 404

1 Restatement for the impact of revised AASB 119 relating to defined benefit superannuation plans. Refer to Note 38.

2 These amounts were allocated to revenue of $(110)million (2013:$(59)million), fuel expenditure of $10million (2013: $(8)million), other costs of nil (2013: $(4)million) and income tax

expense of $30million (2013: $21million) in the Consolidated Income Statement.

The above Consolidated Statement of Comprehensive Income should be read in conjunction with the accompanying notes.