Qantas 2014 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2014 Qantas annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

QANTAS ANNUAL REPORT 2014

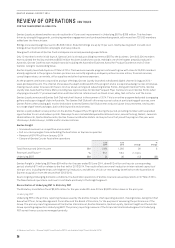

REVIEW OF OPERATIONS CONTINUED

FOR THE YEAR ENDED 30 JUNE 2014

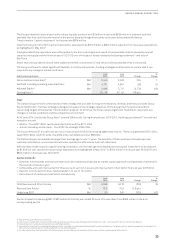

The reduction in Underlying EBIT was driven largely by continued domestic market capacity growth ahead of demand growth and

i

ncreased fuel cost of $68million. Business and leisure demand remained weak throughout the year, with corporate account

revenue impacted by softening resources sector demand, particularly in the Western Australian and Queensland markets and

reduced Government spending. This challenging competitive environment resulted in reduced revenue seat factor and weaker yields.

However, Qantas continues to be the clear choice for business travellers and has maintained over 80 per cent share of corporate

account revenue.

Qantas Domestic’s comparable unit cost6 improved three per cent on the prior corresponding period, as cost savings were realised

from the accelerated Qantas Transformation program. Benefits realised stemmed from initiatives including the consolidation of

Qantas heavy maintenance bases, continued fleet renewal, and the ongoing management and non-operational restructure.

Qantas Domestic achieved record customer satisfaction levels over the year, with a number of industry awards recognising our

product offering and service standards:

–‘Best Domestic Airline’32 five years running

–‘Best Economy’33 noting that Qantas Domestic was the world’s best by a wide margin

–‘Best Lounges’33

–‘Australia’s Favourite Airline’34

Qantas Domestic has achieved superior on-time performance for the fifth year running, including beating its main competitor for an

unprecedented 18 consecutive months to June 2014.

Qantas Domestic continued to strengthen its customer proposition through improved lounge experiences, investing in new and

expanded lounges in Melbourne, Tamworth and Broome airports, and continued investment in front-line team training. Network

growth continues with commencement of new East Coast premium leisure routes: Brisbane to Port Macquarie, Sydney to Hervey Bay,

Melbourne to Coffs Harbour, and Sydney to Hamilton Island.

Qantas Domestic continues to support the regional market position through QantasLink and Network Aviation services. QantasLink

launched two-class B717-200 services on Canberra and Tasmania routes and took delivery of two Bombardier Q400 aircraft and two

B717-200 aircraft during the period. Network Aviation commenced regular passenger transport operations during June. QantasLink

relocated into the Qantas Sydney terminal, creating a more seamless travel experience for Qantas customers through smoother

connections and reduced check-in times.

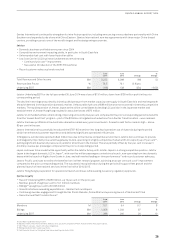

Qantas International

–Market capacity oversupply adversely impacted International market yields and revenue seat factors

–Adverse currency movement increased AUD fuel price

–Comparable unit cost6 improvement of four per cent

–Strengthening alliances through Emirates partnership and new codeshare agreements

–Ongoing product investment to build on recent customer advocacy gains

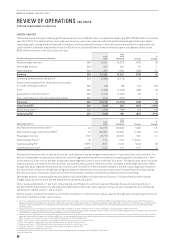

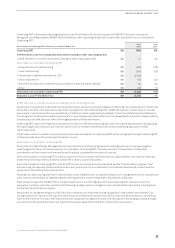

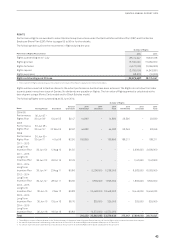

June

2014

June

2013 Change

%

Change

Total Revenue and Other Income $M 5,297 5,496 (199) (4)

Revenue Seat Factor %79.6 81.6 (2.0) pts

Underlying EBIT $M (497) (246) (251) >(100)

Qantas International Underlying EBIT loss of $497million represents a $251million deterioration on the prior financial year.

Significant benefits from the Qantas Transformation program have been materially offset by lower revenue and the unfavourable

foreign exchange impact on fuel of $42million.

Yields were reduced due to market capacity oversupply, with International capacity in and out of Australia increasing by 9.5 per cent

(or 3.7million additional seats), resulting in an intensely competitive pricing environment. Capacity growth was largely led by Middle

Eastern, Asian network and low-cost carriers. The strength of our alliance with Emirates has provided a partial offset, with a strong

‘one stop’ European proposition and additional frequencies into Asia.

Comparable unit cost improved four per cent. Improved asset utilisation of six per cent, combined with the ongoing restructure of the

legacy cost base through the Qantas Transformation program, has delivered this strong unit cost result. The B747-400 retirement

program (an additional three units in financial year 2013/2014), reduction in heavy maintenance footprint, and improved fleet

economics following the A380-800 and B747-400 reconfiguration program have all made a significant contribution to cost reduction.

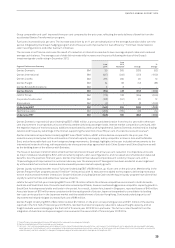

Ongoing optimisation of the network remains a key focus area. Recent examples include the exit of Perth-Singapore and down-gauge

of Brisbane-Singapore and Sydney-Singapore to A330 aircraft.

Qantas International continues to invest in what our customers value most, including lounges, with significant improvements to

the Los Angeles and Hong Kong lounges, and onboard product enhancement including menu design and a sleeper service. These,

combined with the broader network proposition through the Emirates alliance, have seen Net Promoter Scores improve a significant

10 points over two years. The launch of the A330 flat bed in late 2014 continues this commitment.

32 Australian Federation of Travel Agents National Industry Awards 2010 – 2014.

33 AirlineRatings.com’s Airline Excellence Awards, January 2014.

34 TripAdvisor Traveller’s Choice Awards.